SURPLUS, INTEREST, DEBT: PERSONAL FINANCE IN A NUTSHELL

What follows here is a basic guide for individuals regarding their personal approach to debt management and wealth creation.

U.S. household consumer debt has reached an all-time high above $14 trillion as of the time of this writing, July 2019 (U.S. consumer debt hit $14 trillion in 2019). This includes student loans, auto loans, credit cards, and mortgages/home equity lines of credit. Many of our friends and neighbors of all socioeconomic classes have not been exposed enough to fundamental financial principles. Feel free to share it with others in your communities who may benefit from a refresher on these basic points.

Surplus, Interest, Debt: Personal Finance in a Nutshell is also available as an easy to share and downloadable PDF version: Personal-Finance-in-a-Nutshell.pdf

Surplus, Interest, Debt: Personal Finance in a Nutshell

Far too many people are living beyond their means. Many of us are spending more money than we make. Many of us are living inflated lifestyles supported by debt. Far too many of us are not prepared for unemployment or economic disruptions. A large group of us are not prepared for even minor financial emergencies. Many workers are not saving enough for retirement. Somewhere along the line, a vast majority of us—including high-income earners—have not been taught how to think properly about money or to transcend the cycle of debt and perpetual want.

There is a better way. It begins by thinking properly about surplus and interest and the dangers of indebtedness. We then can learn how consistent saving over time can take part in the grandeur of investment and compound interest. Albert Einstein called compound interest “the greatest mathematical discovery of all time.”(1) When money is mixed with time, good things can happen. As such, we may benefit from a renewed understanding of the words surplus, interest and debt. We can begin with a very basic socioeconomic classification of people based on these concepts.

Four Economic Classes of People (Which one are you?)

1. The Destitute: The truly forgotten men, women and sometimes children. They are homeless and often helpless. They need our empathy, respect and assistance to secure food, shelter, clothing and fuel.

2. The Dependents: They rely on others including the government or family for the majority of their personal maintenance and support.

3. The Poor: They pay interest.

4. The Rich: They receive interest.

Everyone has income and expenses. When our expenses are higher than income, we have debt. When the income is higher than our expenses, we have a surplus (Income + Expenses = Surplus or Debt). It is a simple concept that even a child can understand. Whatever one’s circumstances, the key concept is to create a surplus and to then build financial security from there forward.

Things to do:

1. Create a surplus. This can happen on any income.

2. Direct surplus for short-term cash reserve ($1000, then 3 months expenses)

3. Use surplus to pay down debt, start with credit cards, cars, education, home.

4. Use surplus to build savings and then investments to start receiving interest.

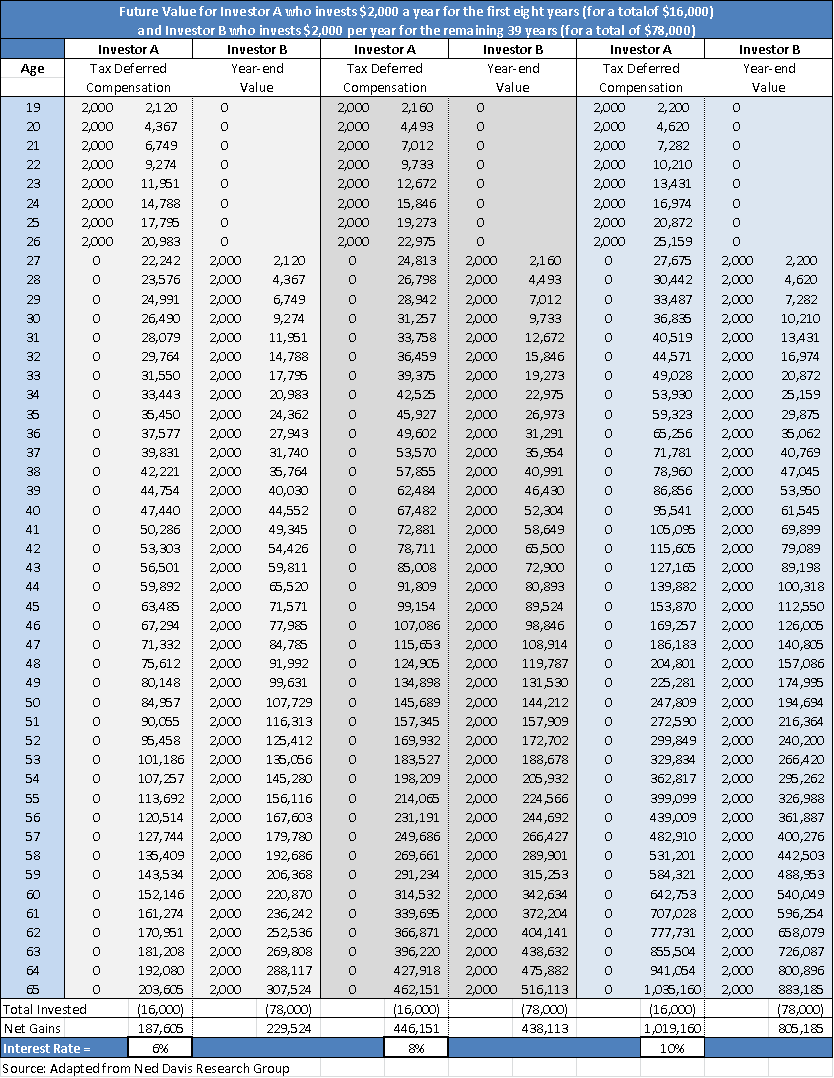

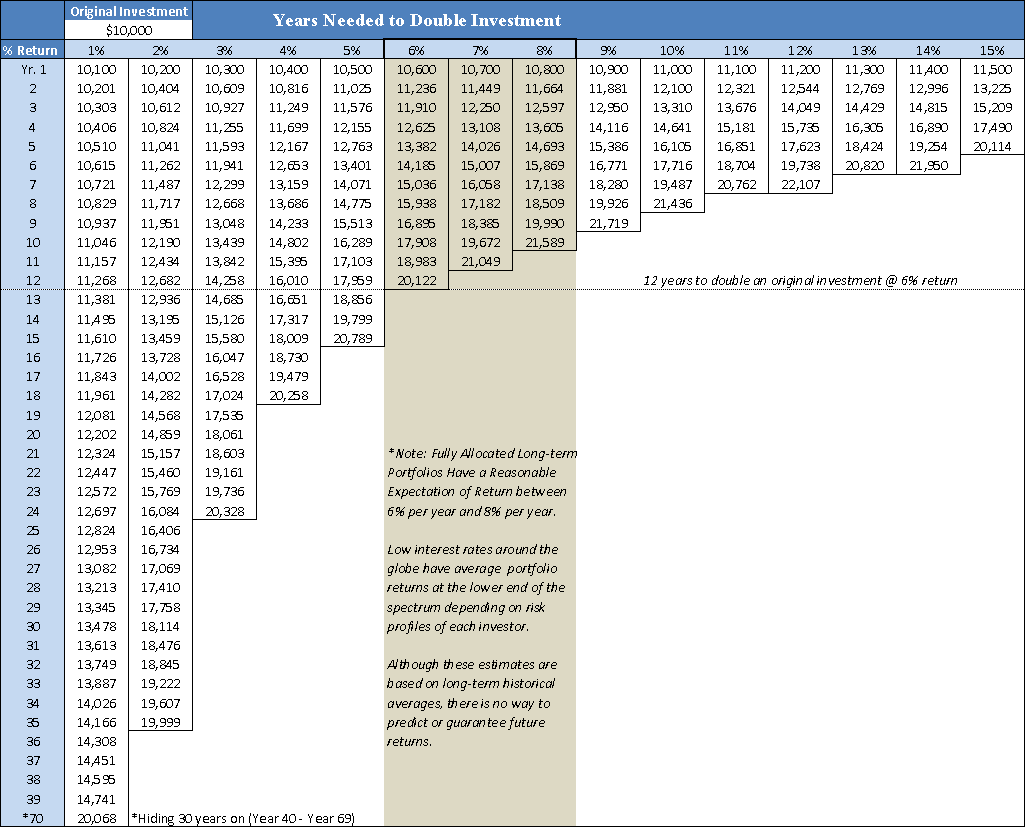

Education Charts: Compounding Interest and Growth Rate Returns

Take a look at Chart 1. Starting at age 19, Investor A contributes $2,000 per year for eight years ($16,000 total) and then invests the money until retirement (39 years more). In contrast, Investor B did not start investing until age 27 at $2,000 per year for the next 39 years (total investment $78,000). The charts show returns for each investor assuming average annual returns of 6%, 8% and even 10%. Receiving interest over time can be rewarding.

Take a look at Chart 2. This chart shows how many years it takes an investment of $10,000 to double given the interest rate/portfolio returns it can achieve. It is clear from the chart that getting to 6% per year or greater returns is important for accelerating investment growth.

The power of compounding interest is one of the finest natural laws, and it does not discriminate. To begin to achieve its benefits, start by generating a surplus. When you increase your lifestyle to consume your present income and even leverage that position through heavy debt loads, then your expenses exceed your earnings and you have no surplus (negative surplus = debt). With no surplus, you forfeit the opportunity to pay down debt and eventually build wealth through receiving interest. Somebody else is getting richer while you are a slave to debt. The future is uncertain if people do not understand nor are taught personal financial management. It is really simple and basic:

If your inflow is less than your outflow, then your upkeep is contributing to your downfall!

Your earning power must be greater than your yearning power!

In a world plagued by debt spirals both personal and governmental, many people have never been taught about the wonderful effects of living with a surplus and the magic of receiving interest rather than paying it. Consistent surplus and effective investment including owning your own home is the most defensible way to build financial security and even wealth over time. The key to becoming more financially healthy and independent is to begin to think differently and to have a plan to get out of debt. This can be done on any income. We can start with a surplus mentality and build our financial future on that solid foundation.

Michael McNiven, Ph.D.

Senior Vice President of Business Development and National Accounts

Email | Bio

(1) “Investing 101: The Concept of Compounding,” Investopedia, found at http://www.investopedia.com/university/beginner/beginner2.asp

Links to other websites or electronic media controlled or offered by Third-Parties (non-affiliates of Cumberland Advisors) are provided only as a reference and courtesy to our users. Cumberland Advisors has no control over such websites, does not recommend or endorse any opinions, ideas, products, information, or content of such sites, and makes no warranties as to the accuracy, completeness, reliability or suitability of their content. Cumberland Advisors hereby disclaims liability for any information, materials, products or services posted or offered at any of the Third-Party websites. The Third-Party may have a privacy and/or security policy different from that of Cumberland Advisors. Therefore, please refer to the specific privacy and security policies of the Third-Party when accessing their websites. Sign up for our FREE Cumberland Market Commentaries Cumberland Advisors Market Commentaries offer insights and analysis on upcoming, important economic issues that potentially impact global financial markets. Our team shares their thinking on global economic developments, market news and other factors that often influence investment opportunities and strategies.