Sat Sep 14, 2019

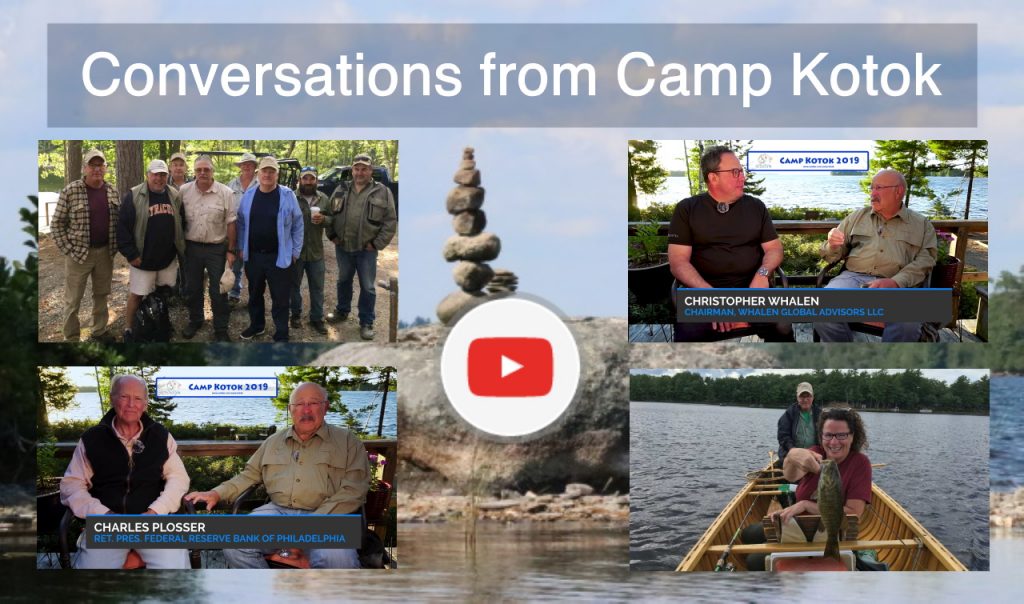

We wrapped up our Labor Day Camp Kotok with a round of excellent on-the-record discussions that we're happy to share with you here.

David Kotok and Charles Plosser at Camp Kotok: The Challenges Facing Central Banks

David Kotok and Christopher Whalen at Camp Kotok: Capital Markets, Debt and Deflation

David Kotok and Doug Duncan at Camp Kotok: Real Income Growth, Interest Rates and Housing

See more interviews and content at Cumberland Advisors' YouTube Channel:

https://www.YouTube.com/CumberlandAdvisors

David Kotok and Charles Plosser at Camp Kotok:

The Challenges Facing Central Banks