Peter Boockvar, a Camp K fisherman and a super-sharp analyst, sent the note and chart below. We thank him for giving us permission to share his note below.

It is logical that gold would outperform $14 trillion of negative-interest-rate sovereign debt issued by creditworthy governments like Germany and Switzerland. Remember: Gold counts as a monetary reserve. Gold is bought by many central banks. Only desperate nations like Venezuela sell gold and only as a last resort. Gold is measurable and finite. Nearly all the gold ever extracted is known, counted, and hoarded, except for that used in jewelry. Gold has thousands of years of history.

Central banks cannot print gold. And gold lease rates and swaps have positive returns in today’s markets.

Cumberland has a position in the gold miners ETF.

Now here’s Peter.

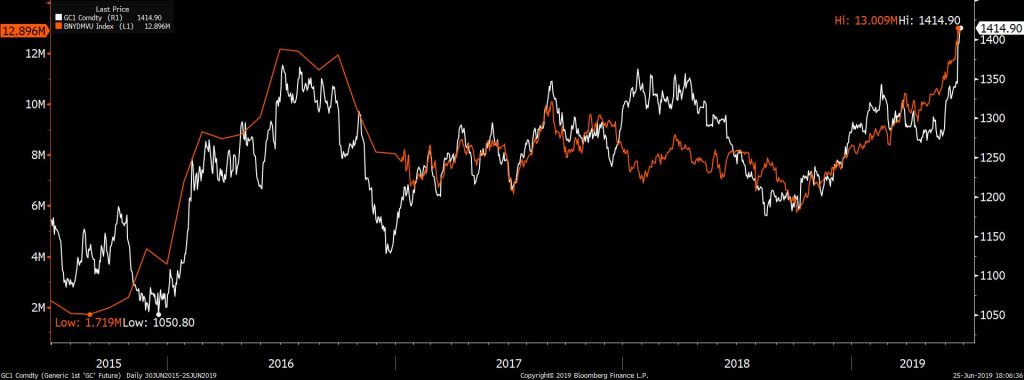

“Subject: Gold and NIRP

“As gold is a positive-yielding asset when compared with those assets that penalize its owners (aka, negative-yielding bonds), here is a visual of gold in white and the dollar amount of negative-yielding bonds in orange.”

Note: Cumberland Advisors has produced the following chart in-house to reflect current conditions as of 4pm June 25, 2019 and to avoid any possible copyright issue. It accurately tracks Peter Boockvar's comments and original visual usage.

Peter Boockvar is the Chief Investment Officer at Bleakly Financial Group Group, a financial planning and wealth management firm, and a CNBC contributor. The Boock Report provides summaries and commentary on macro data and news pertaining to investments. Learn more about Peter, his newsletter, podcasts, and his weekly summary at https://boockreport.com/.

More on NIRP:

-See David R. Kotok’s Nov 25, 2019 commentary on NIRP: https://www.cumber.com/cumberland-advisors-market-commentary-nirp-lagarde-trump-dickens-holidays/

-David R. Kotok talks on Nov 27, 2019 about negative interest rates, NIRP, and says the European Central Bank’s (ECB) Christine Lagarde has a difficult task right now. He also discusses China, the pork shortage, and the impact of viruses on the global food supply. Running time 25:02, David is introduced at the 10:45 mark – Play Episode: https://www.bloomberg.com/news/audio/2019-11-27/surveillance-negative-interest-rates-with-kotok-podcast

Links to other websites or electronic media controlled or offered by Third-Parties (non-affiliates of Cumberland Advisors) are provided only as a reference and courtesy to our users. Cumberland Advisors has no control over such websites, does not recommend or endorse any opinions, ideas, products, information, or content of such sites, and makes no warranties as to the accuracy, completeness, reliability or suitability of their content. Cumberland Advisors hereby disclaims liability for any information, materials, products or services posted or offered at any of the Third-Party websites. The Third-Party may have a privacy and/or security policy different from that of Cumberland Advisors. Therefore, please refer to the specific privacy and security policies of the Third-Party when accessing their websites.

Sign up for our FREE Cumberland Market Commentaries

Cumberland Advisors Market Commentaries offer insights and analysis on upcoming, important economic issues that potentially impact global financial markets. Our team shares their thinking on global economic developments, market news and other factors that often influence investment opportunities and strategies.