Philippa Dunne and Doug Henwood provide a terrific daily research service, TLR Analytics, that focuses mostly on the component details of the American labor force. They report high-frequency information and offer dissection of details. In times like the present, these “nuggets” are helpful for investment decisions and for economic impact assessment. I read their work daily on receipt. Their service is reasonably priced. Here is how to get that information: https://www.tlranalytics.com/subscriptions/tlr-on-the-economy/.

Every once in a while, they stray from labor/employment/unemployment/state breakdown/sales tax receipts/state forecast misses and hits/job sectors/industry breakdown/ etc. etc. etc.

When they do, they deliver insightful and thought-provoking discussion. Always crisp in reading time. Here is one that I found particularly interesting, so I asked permission to share it with our readers. Hope you enjoy it. -David Kotok

Microscopic atmospheric particles & Pioneer 10

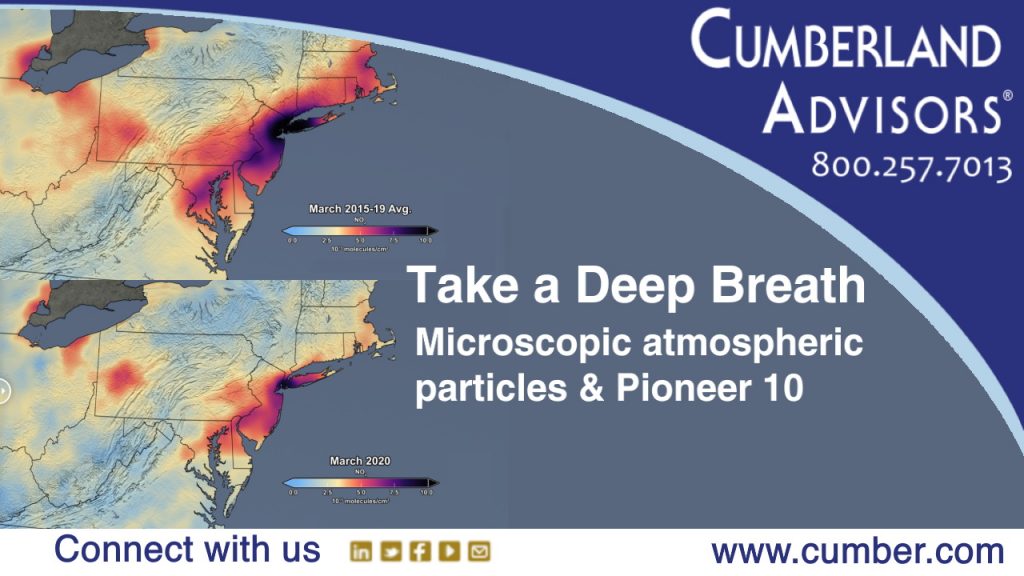

Alexander Morse, researcher at Rockefeller Institute, reports CO₂ emissions will fall 5% this year. CO₂ has fallen by 20% in Wuhan, while microscopic atmospheric debris fell by 71% since March 24th in India.

Neither Morse, nor we, are suggesting this is the solution to our ecological problems, or that we focus on anything outside health and relief right now, but such a dramatic reduction is important knowledge.

For the future, we could try carbon-cost programs. Some estimates of social costs per ton run to $400: The Obama administration estimated between $42 to $62 per ton; the Trump administration between $1 to $7 per ton.

So let’s turn to the states, where initiatives have generated about 50% of growth in renewables. And not a zero sum: Between 1970 and 2017 a witch’s brew of pollutants fell by 73%, while GDP grew by 270%.

If you can see the western sky this evening, look for red giant Alderbaran blazing to the left of Venus.

If all is well, Pioneer 10, launched in 1972 & last heard from across 7.6B miles in 2003, is still heading out. Weighing <600 pounds, carrying pictures of a man & a woman, the solar system, and how to find us relative to 14 pulsars, it should pass Aldebaran in 2 million years.

We know how to do this stuff.

Philippa Dunne & Doug Henwood

Analysis here:

https://rockinst.org/blog/coronavirus-has-improved-air-quality-what-does-that-mean-for-climate-policy/

Cool graphic:

https://www.space.com/nasa-satellite-air-pollution-us-northeast-coronavirus.html

Passing Jupiter, from NASA, where all images are free.

Closing Kotok notes. Many thanks to TLR Analytics for permission to share their piece with readers. Let me add to their list. You may wonder about seeing the Lyrid meteor shower on April 22-23 and how bright it appeared in this new moon period. Clearer air changes what we see as well as what we breathe. Will we go back to our old ways of environmental poisoning? Many say that is likely. Others say the experience of the last two months may, just may, offer verifiable incentives to change. COVID19 fatality rates are higher among people who breathe more heavily polluted air. Have government leaders noticed? Maybe some have. In the US stock market ETF market strategy, we have a sleeve that reaches, solar, wind and water in a combination of three ETFs. In the managed municipal bond separate accounts, we have an ESG approach that stays focused on high grade credits and total return. We agree with TRL Analytics: “We Know how to do this stuff!”

Happy Sunday Morning.

Links to other websites or electronic media controlled or offered by Third-Parties (non-affiliates of Cumberland Advisors) are provided only as a reference and courtesy to our users. Cumberland Advisors has no control over such websites, does not recommend or endorse any opinions, ideas, products, information, or content of such sites, and makes no warranties as to the accuracy, completeness, reliability or suitability of their content. Cumberland Advisors hereby disclaims liability for any information, materials, products or services posted or offered at any of the Third-Party websites. The Third-Party may have a privacy and/or security policy different from that of Cumberland Advisors. Therefore, please refer to the specific privacy and security policies of the Third-Party when accessing their websites.

Sign up for our FREE Cumberland Market Commentaries

Cumberland Advisors Market Commentaries offer insights and analysis on upcoming, important economic issues that potentially impact global financial markets. Our team shares their thinking on global economic developments, market news and other factors that often influence investment opportunities and strategies.