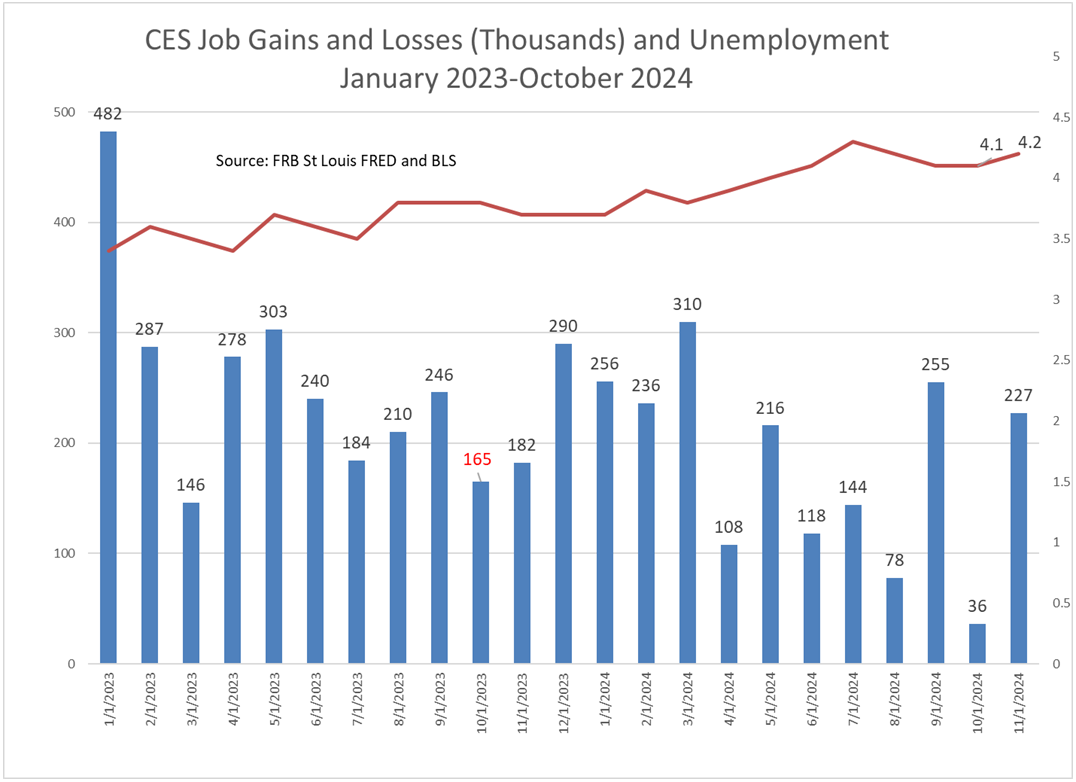

Going into its last meeting of the year, on December 17th and 18th, the FOMC now has a new jobs report, shown below; and the number of jobs created in November is 227,000, which exceeded expectations. On the downside, the data for September and October were revised up slightly as well. The unemployment rate also ticked up from 4.1% in October to 4.2% in November. This means the jobs market has recovered nicely from the hurricanes and now appears to be a bit firmer in the fourth quarter than was previously thought.

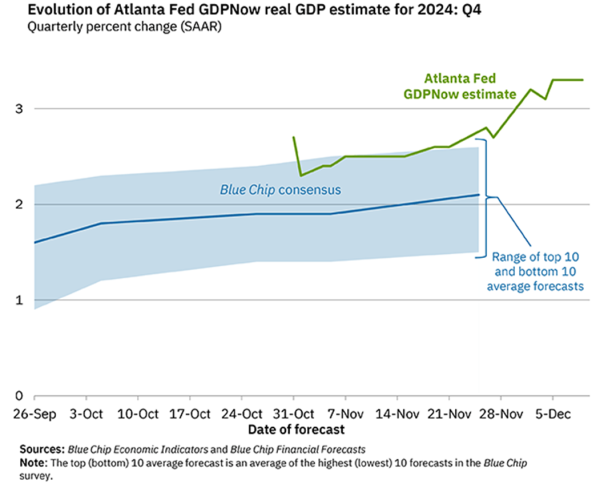

The Committee now has a tough decision to make: whether to pause this meeting or to continue its rate cuts. With a solid jobs =market and GDP now at 2.8% for Q3, but with inflation ticking up from 2.1% in October to 2.3% in November and an even stronger prospect for Q4, the decision becomes harder. We note that the real economy may be stronger than we expected for Q4. For example, the Atlanta Fed’s GDPNow forecast, shown below, currently sees GDP at 3.3%, which is far above the most recent estimates of professional forecasters. The GDPNow forecast is the same as the previous estimate and does not appear to have been impacted by the positive jobs report, which also exceeded expectations.

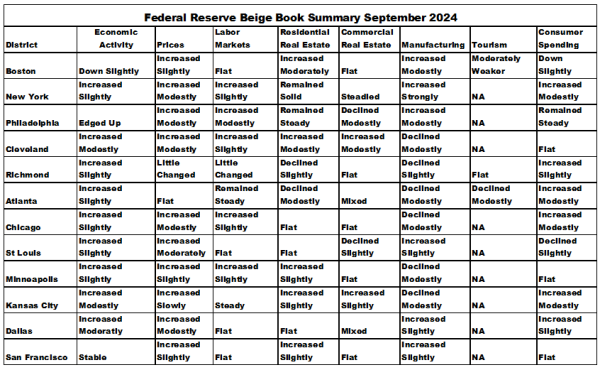

Going into the meeting, the only additional aggregate data on the general state of the economy that the Committee will have are from the Beige Book. As the chart below indicates, the overall economy and key segments are still growing, but likely at a rate more consistent with the expectations of the Blue Chip forecasters than of the Atlanta Fed’s GDPNow.

The key question policy makers are facing is whether the increase in inflation is just a bump in the road or whether inflation is still on the desired path. Is growth too strong in terms of demand (which might drive prices up again)? Market commentators are largely still expecting a 25-basis-point cut in rates, but others are expecting the FOMC to pause its process. It is clear that FOMC participants are wrestling with the issues and keeping their views close to their vests. See for example recent speeches by Reserve Bank Presidents Daly, Goolsbee, and Kugler.[1] Governor Waller, in a Washington speech on December 2, noted, “Recent data have raised the possibility that progress on inflation may be stalling at a level meaningfully above 2 percent.” He went on to note that he personally favored cutting rates at the December meeting but was still open to further review of incoming data, a view that was echoed by Governor Kugler. Federal Reserve Bank of St. Louis President Musalem took a more sympathetic view towards a pause in rate cuts in a December 4th speech. He stated, "Along this baseline path, it seems important to maintain policy optionality, and the time may be approaching to consider slowing the pace of interest rate reductions, or pausing, to carefully assess the current economic environment, incoming information and evolving outlook." So, while most expect a rate cut, it clearly is not a certainty, especially given the incoming data on inflation and the overall strength of labor markets and the economy.

[1] See “Inflation Is Stubborn And Jobs Are Plentiful. So Why Does Everyone Expect Rate Cuts?” (Diccon Hyatt, Investopedia, Dec 6, 2024), “The Fed is on course to cut interest rates in December, but what happens next is anyone’s guess “(Jeff Cox, CNBC Dec. 7, 2024),” “Why Powell and the Fed should pause interest-rate cuts in December “(Greg Robb, Market Watch, Dec 7, 2024), or “Fed policymakers steer clear of December rate-cut guidance” (Howard Schneider and Ann Saphir, Reuters, Dec 3, 2024).

Robert Eisenbeis, Ph.D.

Vice Chairman & Chief Monetary Economist

Email | Bio

Links to other websites or electronic media controlled or offered by Third-Parties (non-affiliates of Cumberland Advisors) are provided only as a reference and courtesy to our users. Cumberland Advisors has no control over such websites, does not recommend or endorse any opinions, ideas, products, information, or content of such sites, and makes no warranties as to the accuracy, completeness, reliability or suitability of their content. Cumberland Advisors hereby disclaims liability for any information, materials, products or services posted or offered at any of the Third-Party websites. The Third-Party may have a privacy and/or security policy different from that of Cumberland Advisors. Therefore, please refer to the specific privacy and security policies of the Third-Party when accessing their websites.

Sign up for our FREE Cumberland Market Commentaries

Cumberland Advisors Market Commentaries offer insights and analysis on upcoming, important economic issues that potentially impact global financial markets. Our team shares their thinking on global economic developments, market news and other factors that often influence investment opportunities and strategies.