Our general understanding of “between a rock and a hard place” is that there is a problem and we have two options, neither of which is desirable. (And since we are in the middle of a Rolling Stones tour, we should also point out that “Rock and a Hard Place” was also on the Stones Steel Wheels album and is definitely worth a listen. An underrated song.

The Federal Reserve now finds itself caught in a quandary between a low fed funds rate target, low longer term rates in the 10-year and 30-year bond – both nominally and in relation to inflation – and inflation itself, which the Fed has characterized as “transitory” since last spring but which it is finding to be very persistent, no matter how it is measured. The headline Consumer Price Index has a 12-month trailing inflation rate of 5.4%; the CORE CPI has a trailing 12-month rate of 4%; and the Personal Consumption Expenditure Deflator (the Fed’s favorite measurement) is clocking in at 4.4% on a trailing 12-month basis.

The problem is that all the inflation indicators are WELL ABOVE both short-term and long-term rates. Since inflation picked up last spring, REAL (after-inflation) yields have become VERY negative.

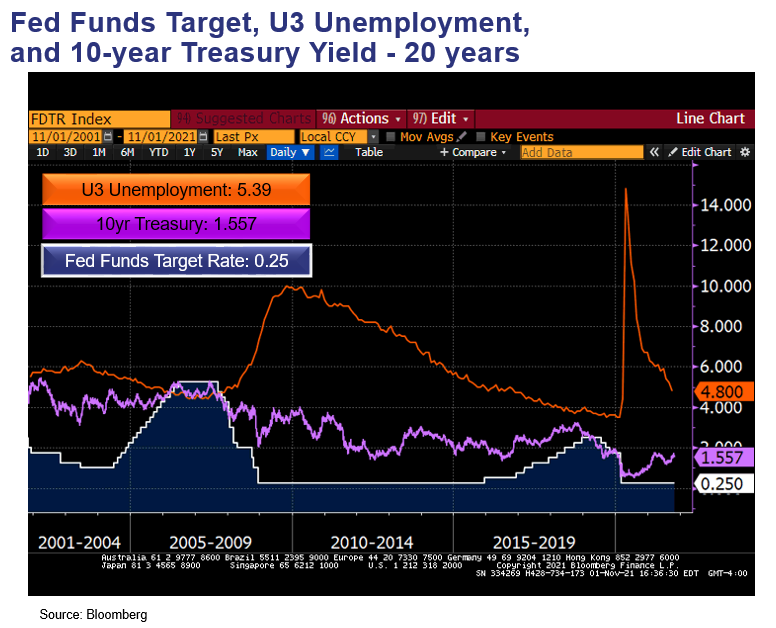

The first graph below is a comparison of the fed funds target rate and core inflation going back 20 years.

The story of the last twenty years can be told in different blocks of time. The Fed started to raise short-term interest rates not long after the start of the war in Iraq in 2003, in response to the lift that war gave to the economy and inflation (as most wars do). Within three years, inflation began to turn downward, but the Fed continued to raise rates — even as inflation trended down (and then turned back up). After the onset of the Great Recession at the end of 2008, inflation plunged as economic activity cratered in the wake of the Lehman Brothers’ bankruptcy. The Fed eventually cut short-term rates to the 0–0.25% level, the same level where they are now. They left them there until December of 2015, when they hiked rates and left them there for an entire year before they launched a series of rate hikes that eventually caught up with inflation. They began to cut rates again in 2019 as the equity market started to express extreme displeasure with the high level of short-term rates. Longer-term rates followed, and then we hit the COVID-induced recession, with very swift cutting of shorter rates, an initial drop in inflation, and then the SHARP rise in inflation. It’s very clear now that the gap between fed funds and inflation is the highest it has been in over 20 years.

When we put unemployment in the picture, it’s easy to see that the Fed is VERY patient in keeping the fed funds rate low until unemployment drops to an acceptably low level. This is why the Fed went from 2008 to 2015 without a rate hike.

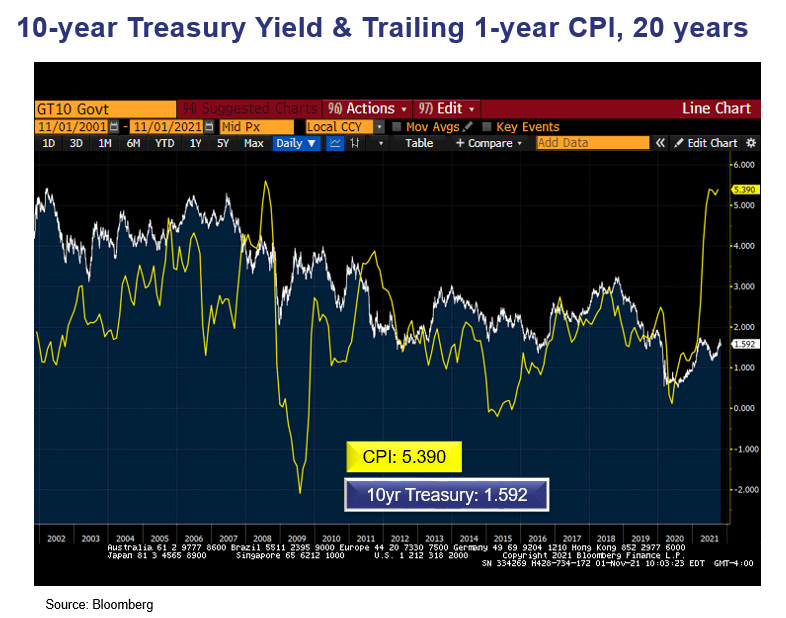

Now let’s take a look at longer term bond yields and inflation and the gap between them.

If this graph were stretched far to the left, we would see that most of the time in the past 40 years 10-year bond yields were at or above the rate of inflation, providing a positive REAL yield after inflation. The extraordinary amount of stimulus in response to the pandemic, along with a wealth of federal programs, has helped to bring down the unemployment rate (previous graph) but has boosted not only inflation but also inflation expectations as expressed by breakeven inflation rate.

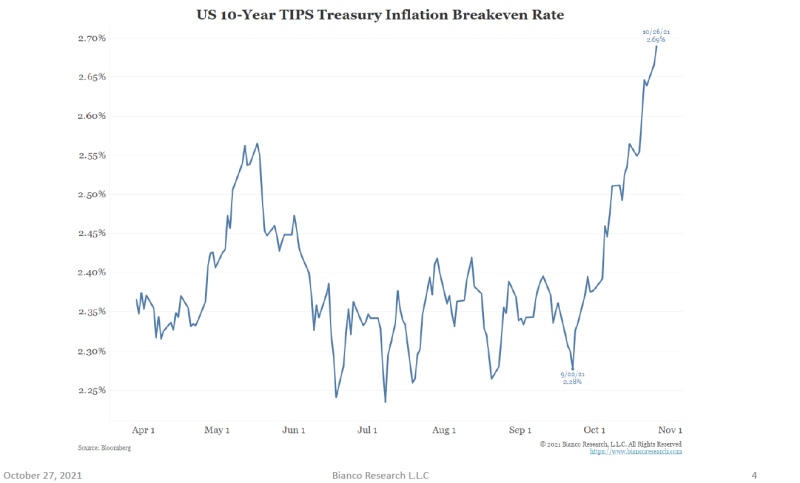

Inflation expectations have risen over the past year. And while inflation expectations as reflected by breakeven rates (the difference between a TIPS inflation-indexed bond and a nominal bond of the same maturity), are an imperfect indicator of the eventual level of inflation, they tend to be good on the direction.

So now the Fed is facing rising inflation (they characterize it as transitory; the markets are now viewing it as more persistent) and rising inflation expectations. Both should drop when supply chain bottlenecks and disruptions are alleviated. But we know that in the short term the fastest way to lessen the gap between demand and supply is to raise prices, and that is what we are witnessing across many industries.

On Wednesday, Nov 3rd the Federal Reserve announced the tapering of their purchases, cutting back their buying of $120 billion per month of US Treasuries and mortgage-backed securities by $15 billion per month (think $10 billion of Treasuries and $5 billion of mortgages). At that schedule, the bond-buying tapering should be finished by the end of July 2022. Remember this still means the Fed is accommodative, just at a slower rate. It’s doubtful that the Fed accelerates the announced pace of tapering for fear of moving interest rates higher too quickly. The Fed KEPT the fed funds target at 0–25 basis points as expected. Our belief is that, as in earlier crises, the Fed wants to wait until unemployment is back down to an acceptable level before they start to raise short-term rates.

We think the Federal Reserve would like to see a gradual rise in long rates, so that when they are ready to start raising short-term rates, it will be into a STEEPER yield curve. The Fed would be loath to raise short-term rates when longer rates were low, as a flat yield curve (little difference between short-term and long-term rates) paints a gloomy picture for bank lending. When the banking system cannot borrow short-term and lend longer-term and make a reasonable spread, their reaction is to curtail credit, and that causes a credit crunch.

So that is why the Fed is between a rock and a hard place. But the Federal Reserve is a self-learning institution — it learns from mistakes as well as successes. And there is great evidence of that. We think a gradual rise in long-term rates, a drop in the run rate of inflation (but higher than pre-COVID levels), and an eventual movement later next year in short-term interest rates would lead us to an outcome that is best expressed by another Rolling Stones song: “You Can’t Always Get What You Want” … but you get what you need.

Please see my colleague Bob Eisenbeis’ piece titled The FOMC’s Dilemma (Part 2) https://www.cumber.com/market-commentary/fomcs-dilemma-part-2.

Don’t forget to change your clocks back on Saturday to standard time. 😊

Links to other websites or electronic media controlled or offered by Third-Parties (non-affiliates of Cumberland Advisors) are provided only as a reference and courtesy to our users. Cumberland Advisors has no control over such websites, does not recommend or endorse any opinions, ideas, products, information, or content of such sites, and makes no warranties as to the accuracy, completeness, reliability or suitability of their content. Cumberland Advisors hereby disclaims liability for any information, materials, products or services posted or offered at any of the Third-Party websites. The Third-Party may have a privacy and/or security policy different from that of Cumberland Advisors. Therefore, please refer to the specific privacy and security policies of the Third-Party when accessing their websites.

Cumberland Advisors Market Commentaries offer insights and analysis on upcoming, important economic issues that potentially impact global financial markets. Our team shares their thinking on global economic developments, market news and other factors that often influence investment opportunities and strategies.