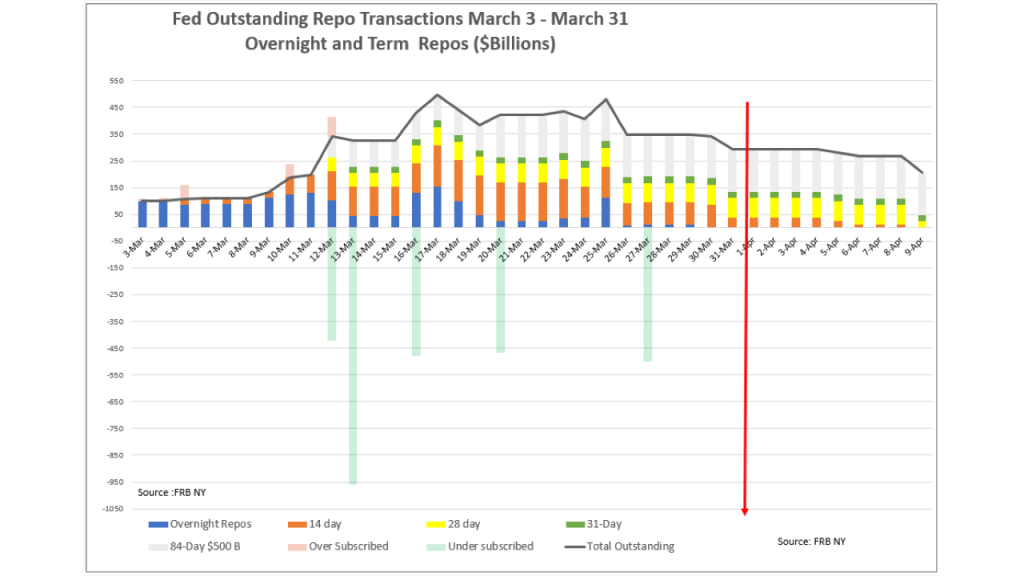

Fed Outstanding Repo Transactions March 3 - March 31

Fed repo transactions have been declining is volume both in terms of outstanding credit being supplied as well as in take-downs of the daily offerings. Today no one-day credit was applied for and only $250 million of the $45 billion 13 day-offering was taken down. Most interesting is of the five the widely touted $500 billion 84-day and $500 billion 28 day offerings that have been put forward so far, which could have injected $2.5 trillion of liquidity into financial markets, only a total of $150 billion has been taken and none was taken of the $500 billion 28-day offering on March 27th.

This pattern suggests there the so-called liquidity squeeze in the repo market was a concern at the time but not a reality in fact and may be overblown.

Robert Eisenbeis, Ph.D.

Vice Chairman & Chief Monetary Economist

Email | Bio