Joe McAlinden has given us permission to share his excellent discussion (May 1) of JPMorgan and First Republic. We are copying the entire discussion below. We thank Joe for granting permission.

__________

JPMorgan's First Republic Rescue Cuts Contagion Fears, Raises Questions about Shareholder Compensation

Joe McAlinden, McAlinden Research Partners

May 1, 2023

Summary: After a prolonged death spiral, First Republic Bank was finally seized by regulators this morning and subsequently sold to JPMorgan. The deterioration of First Republic accelerated last week after a dismal first quarter report, but it was not very surprising that JPM was the ultimate rescuer – having telegraphed a lot of interest in the bank over the last couple of months. Billions in associated costs to the FDIC's insurance fund will still flow downstream to America's larger banks, but guaranteeing a buyer at this stage was extremely critical for the broader financial sector.

Since JPMorgan purchased the bank, minus its corporate debt and prefered shares, from federal regulators that seized the bank, and not shareholders, it remains to be seen what First Republic's equity will be worth now that its been sold. That could complicate things for owners of other troubled banks, considering the ongoing turmoil in the sector should not be declared over yet.

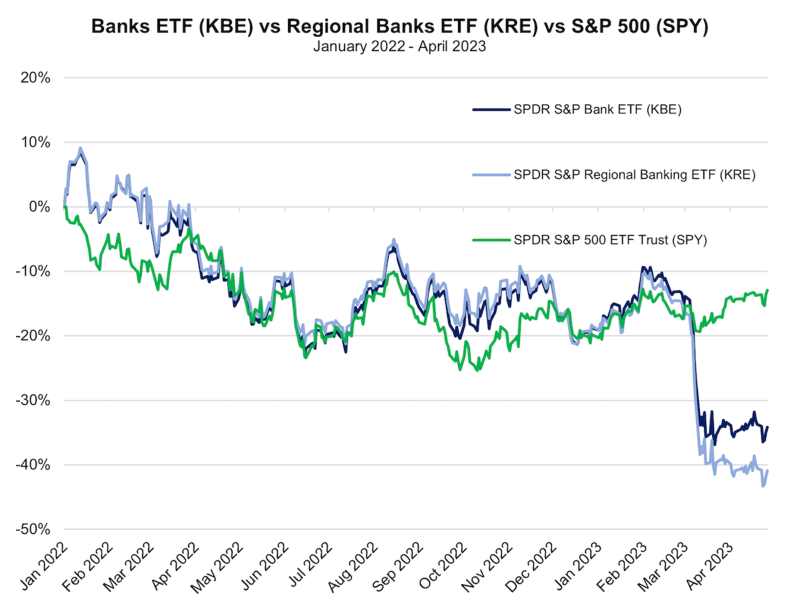

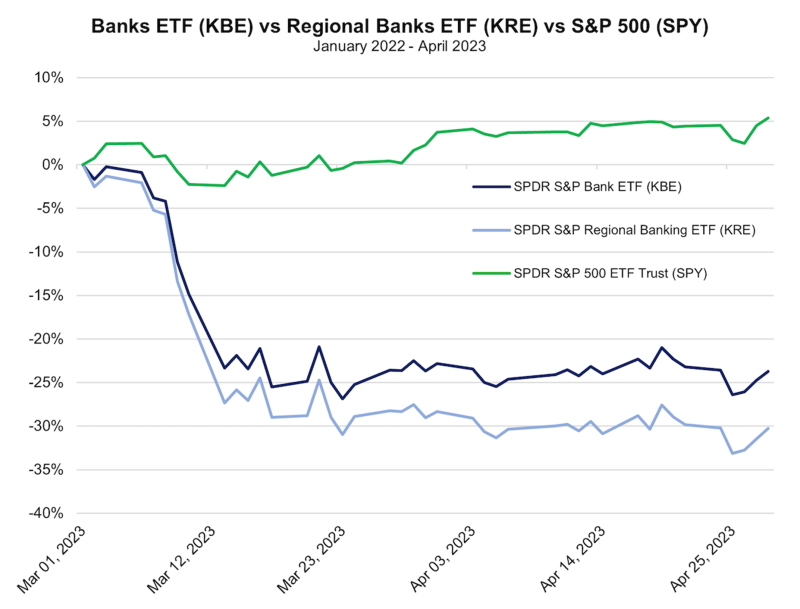

Related ETFs & Stock: SPDR S&P Bank ETF (KBE), SPDR S&P Regional Banking ETF (KRE), JPMorgan Chase & Co. (JPM)

__________

The deterioration of First Republic (FRC) accelerated rapidly last week, following a first quarter earnings report that painted a desperate picture. Though the bank disclosed it had $45.1 billion of cash and unused borrowing capacity, enough to cover more than double its remaining uninsured deposits, shareholder concerns were not assuaged. A subsequent -80% decline in their stock price throughout the week meant that a bank carrying roughly $330 billion in combined deposits and assets was valued at a market capitalization of just about $600 million. By mid-week, it was almost certain that First Republic would soon enter receivership and join the likes of Silicon Valley Bank (SVB) among those that have failed thus far in 2023.

As the weekend rolled around, reports broke about a joint private and public solution for the rescue of First Republic. Ranked as the 14th largest American bank at the end of 2022, FRC inherited the silver medal among US bank failures on Monday morning. First Republic’s collapse is now second only to Washington Mutual’s failure in 2008.

Final bids were reportedly placed by PNC and JPMorgan, with the latter winning out and receiving loss share agreements with the FDIC covering acquired single-family residential mortgage loans and commercial loans, as well as $50 billion of five-year, fixed-rate term financing. In addition to the support provided to JPMorgan, cleaning up First Republic’s failure will cost the FDIC another $13 billion. That money will be paid by the nation’s banks, which pay premiums to support the agency, and piled on top of a $23 billion hole in its insurance fund created by the collapse of Silicon Valley Bank and Signature Bank in March. Per Reuters reporting, this load will largely be borne by the nation’s larger banks.

It wasn’t a huge surprise to see JPMorgan become the ultimate acquirer, having led a consortium of a dozen banks to inject $30 billion of uninsured deposits into First Republic back in mid-March. By that time, FRC shares had already tumbled below $35.00, but JPMorgan issued an overweight rating for the stock and a $62.00 price target in the aftermath of the deposit injection.

Moreover, this kind of buyout is not unfamiliar territory for JPM, which acquired the flailing investment bank Bear Stearns in 2008, an institution that once managed $400 billion in assets and carried a market cap of $25 billion. Bear was sold over the weekend of March 15-16 for a price of just $236 million, which worked out to just $2.00 per share, down from 2007 highs around $140 – a nearly -94% discount from the already withered $30.85 that shares closed at on the Friday prior.

First Republic was trading around $147.00 per share at the start of February, collapsing to just $1.90 by pre-market hours on Monday. It has been reported that JPMorgan will pay $10.6 billion for First Republic, which would imply a value of $58.24 per share across 182 million shares outstanding. However, since JPM's purchase was from the regulators that seized the bank, and not from shareholders, it remains to be seen if any equity will be returned to shareholders for the sale. JPMorgan noted that it would not be assuming FRC's preffered stock.

Though JPM had apparently telegraphed their willingness to be FRC’s savior for some time now, their hesitation to sit on a potential buyout until the last second could suggest they may be more interested in shoring up the banking sector as a whole than expanding their business through First Republic’s assets. JPMorgan CEO Jamie Dimon has been open about his belief that bank failures are not the biggest concern, but the “domino effect” that they can create.

Many may now rush to claim that ongoing distress in the banking sector has concluded, but it is simply too early to make such a conclusion. Banks have increased cumulative emergency borrowings from the Federal Reserve’s discount window and Bank Term Funding Program (BTFP) throughout each of the past two weeks, reaching a five-week high of $155. Bank deposits tracked by the Federal Reserve rebounded slightly in the week to April 19, but the annual rate of decline remained deeply negative at -4.7%. Though long-term rates on US treasuries have broadly eased from the March highs that exacerbated unrealized losses and kicked off the turmoil across US financials, they’ve have begun to rebound once again in anticipation of the Fed raising rates once again at this week’s FOMC meeting. CME’s FedWatch tool currently suggests an 87% probability of a 25bps hike.

Despite the rise in long-term yields, inversion in the yield curve continues to worsen, as exemplified by the difference between the 10-year and 3-month Treasury yields (10yr-3mo) expanding to another record last week and remaining in negative territory for a period of 6 whole months. This has caused significant problems for banks, who borrow money at the short end of the curve and lend at the long end.

The implications that ripple out from massive financial events, like those we have witnessed over the course of just two months, are difficult to calculate. As MRP has highlighted multiple times since March, the time that elapsed between the Fed’s initial decision to support deposits and liquidity across the US banking system in late 2007 and the collapse of Lehman Brothers played out across a period of nine months. As such, MRP will continue to follow the global banking industry’s struggle with liquidity needs and the broader implications for monetary policy. Investors can gain exposure to the banking industry via the SPDR S&P Bank ETF (KBE), as well as the SPDR S&P Regional Banking ETF (KRE).

CHARTS

Kotok Note; as of May 6, 2023, there are no bank ETF holdings in the US Equity ETF portfolio. Of course, that could change at any time. We again thank Joe McAlinden for permission to share his insights with our readers.