The FOMC will be meeting later this month, on Sept 21–22, and will be faced with what appears to be mixed evidence on progress towards its employment and inflation objectives. New claims for unemployment insurance for the week ending September 4 were down to 310,000, and have showed continued improvement since midyear, and are the lowest since March 2020.

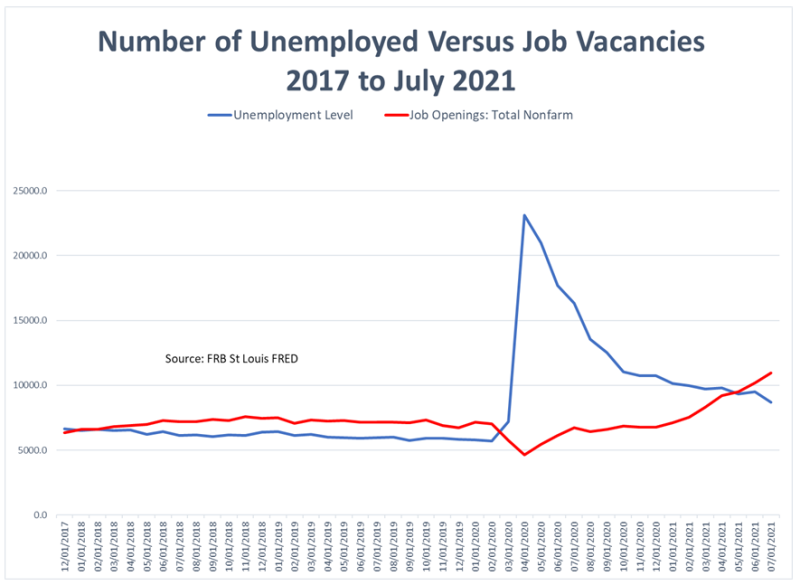

While the number of unemployed people collecting unemployment insurance is down to 2.6–2.7 million, depending upon whether we look at seasonally adjusted or not-seasonally adjusted data, there are still 8.4 million unemployed. The FOMC will have two more updates on the unemployment situation before its September meeting. Additionally, while the data are basically backward looking, we did get new data on job layoffs and turnover. Those data show that in July there were more job openings than there were unemployed people seeking work.

We must remember, however, that July was a big month for job creation — the economy created 1,053,000 jobs. But in August that number fell to only 235,000 jobs, so the tightness of the labor market suggested by the July JOLTs data may not reflect what is going on in the job market now, especially as the economy reckons with the fourth wave of the pandemic. The Ying and Yang in the job market makes evaluating policy progress towards full employment difficult to assess at the moment. And complicating the issue are the data on inflation.

In advance of its release of the CPI for the month of August, the BLS released estimates of the Producer Price Index, which was up 0.7% for the month after increases of 1% for each of the previous two months, reflecting an increase of 8.3% on a year-over-year basis from last August. This data only added fuel to concern about inflation, since it is argued that increases in input prices are ultimately reflected in consumer prices, which of course plays into the story of whether the price increases presently being observed are only transitory.

While it is possible to construct complex inflation forecasting models, simple linear regressions can provide us with some enlightening insights. Since the PPI comes out before the CPI or PCE does, it is possible to run linear regressions with either CPI or PCE as the dependent variables to be forecast, with the independent variables consisting of the PPI for the month, the PPI one month earlier, and the PPI two months earlier. The resulting equations, estimated using data from 2009 to the present, can be used to infer the speed and extent to which producer price increases find their way into consumer price measures. Briefly, the results suggest that about 50 to 60 percent of the variation in the CPI and PCE can be explained by variation in the current month’s PPI. Additionally, for the CPI, about 50% of the increase in the PPI is reflected in the current month’s CPI, and about 41% is reflected in the PCE. Adding the two previous months’ PPI values does not significantly increase the overall explanatory power of the estimated equations, nor do the inclusion of the additional month’s PPI get reflected in significantly higher embedded inflation. Additionally, for the PCE only about 60% of the previous month’s PPI gets transferred to the current PCE; for the CPI 48% of the current month’s PPI is reflected in the estimate of the CPI; and the previous month’s PPI adds only another 12 percentage points.

Putting all this together, what does the current month’s 0.7% increase in the PPI, combined with previous month’s increases of 1% and 1% imply for upcoming releases of CPI and PCE for the month of August? The equations imply that we might expect a 0.5% increase in the CPI and 0.4% increase in the PCE for August. These numbers, when annualized, will surely cause additional speculation about how transitory the price increases are as the FOMC contemplates what its policies will be.

Robert Eisenbeis, Ph.D.

Vice Chairman & Chief Monetary Economist

Email | Bio

Links to other websites or electronic media controlled or offered by Third-Parties (non-affiliates of Cumberland Advisors) are provided only as a reference and courtesy to our users. Cumberland Advisors has no control over such websites, does not recommend or endorse any opinions, ideas, products, information, or content of such sites, and makes no warranties as to the accuracy, completeness, reliability or suitability of their content. Cumberland Advisors hereby disclaims liability for any information, materials, products or services posted or offered at any of the Third-Party websites. The Third-Party may have a privacy and/or security policy different from that of Cumberland Advisors. Therefore, please refer to the specific privacy and security policies of the Third-Party when accessing their websites.

Cumberland Advisors Market Commentaries offer insights and analysis on upcoming, important economic issues that potentially impact global financial markets. Our team shares their thinking on global economic developments, market news and other factors that often influence investment opportunities and strategies.