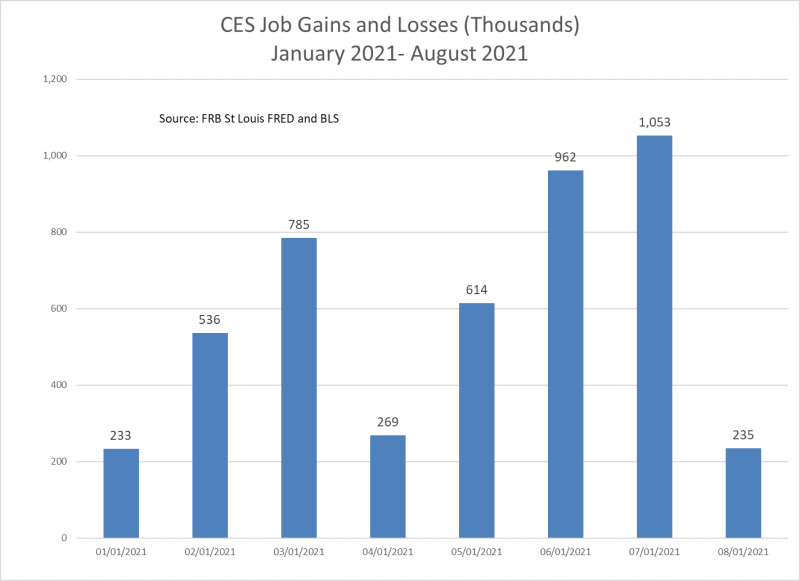

Once again, the latest release of the Employment Situation by BLS, which indicated that only 235,000 jobs were created in August, has demonstrated how difficult forecasting is. For example, the Dow Jones survey of economists predicted that 720,000 jobs were created, a forecast that turned out to be off by a factor of nearly 3. ADP predicted that 374,000 jobs were created, an error of about 60%. The August number was clearly disappointing and down significantly from the 1,053,000 and 962,000 jobs created in the two previous months, as shown in the chart below.

It looked as if the recovery was well underway, but then the fourth wave of COVID-19 virus began to hit the economy. As expected by some, higher infection rates triggered a return to many of the protections responsible people engage in, such as wearing masks, social distancing, curtailing restaurant dining and other leisure activities.

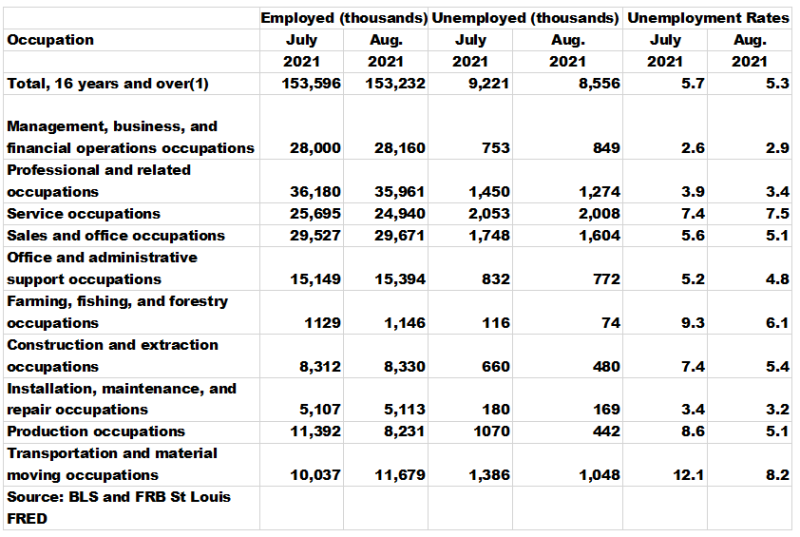

Those precautions show up in the employment report details on industry segments in the table below. Overall, employment of those 16 years and older dropped about 364,000, with professional and service occupations declining 219,000 and 755,000 respectively and production occupations declining by 3.2 million. Offsetting gains were noted in sales and office occupations, office and administrative support occupations, and management, business and financial operations occupations. Unemployment declined in the population as whole; and for those who were identified as working in a particular job category, unemployment declined in every category except management, business, and financial operations. The overall unemployment rate also declined in August, and gains were particularly notable in the farming, fishing and forestry; production; and transportation and material moving occupations. This trend aligns with the stories we have heard about the shortage of truck drivers. The inference from all these data is that the number of unfilled positions must have declined, since that number recently exceeded the number of unemployed people seeking work.

The threshold question is, what does this report mean for policy? Fed Chairman Powell suggested in his Jackson Hole speech that progress had been made towards the Committee’s employment and inflation objectives, and the FOMC would soon be in a position to begin tapering its asset purchases, which he had hoped might be completed by year end. But these more recent data suggest that the full-employment objective remains a ways off, and there may further backsliding if the COVID-19 virus keeps infecting more and more people. By its November 2–3 meeting, the FOMC will only have additional information on unemployment insurance claims but no new job creation and employment data. This fact, coupled with the disappointing new jobs numbers, suggests that tapering and further removal of policy accommodation may be a ways off yet.

Links to other websites or electronic media controlled or offered by Third-Parties (non-affiliates of Cumberland Advisors) are provided only as a reference and courtesy to our users. Cumberland Advisors has no control over such websites, does not recommend or endorse any opinions, ideas, products, information, or content of such sites, and makes no warranties as to the accuracy, completeness, reliability or suitability of their content. Cumberland Advisors hereby disclaims liability for any information, materials, products or services posted or offered at any of the Third-Party websites. The Third-Party may have a privacy and/or security policy different from that of Cumberland Advisors. Therefore, please refer to the specific privacy and security policies of the Third-Party when accessing their websites.

Cumberland Advisors Market Commentaries offer insights and analysis on upcoming, important economic issues that potentially impact global financial markets. Our team shares their thinking on global economic developments, market news and other factors that often influence investment opportunities and strategies.