As we come to the end of the second quarter of 2020, the pandemic is still with us, with cases are rising in the South and the West in a resurgence of the virus, amid further issues involving social unrest. Today we take a look at the tax-free municipal bond market.

The following charts tell the story from the end of January. The first two months of the year witnessed a drop in US Treasury yields as well as muni yields as concerns over slowing growth internationally kept bond yields ratcheting down overall. The selloff in the bond markets began in earnest on March 9th amidst concerns over the outbreak of the virus, severe drops in the price of oil triggered by Saudi selling, and the plummeting of the stock market. We wrote about this muni meltdown here: https://www.cumber.com/cumberland-advisors-market-commentary-the-muni-meltdown-timeline-and-the-opportunity-it-presents/.

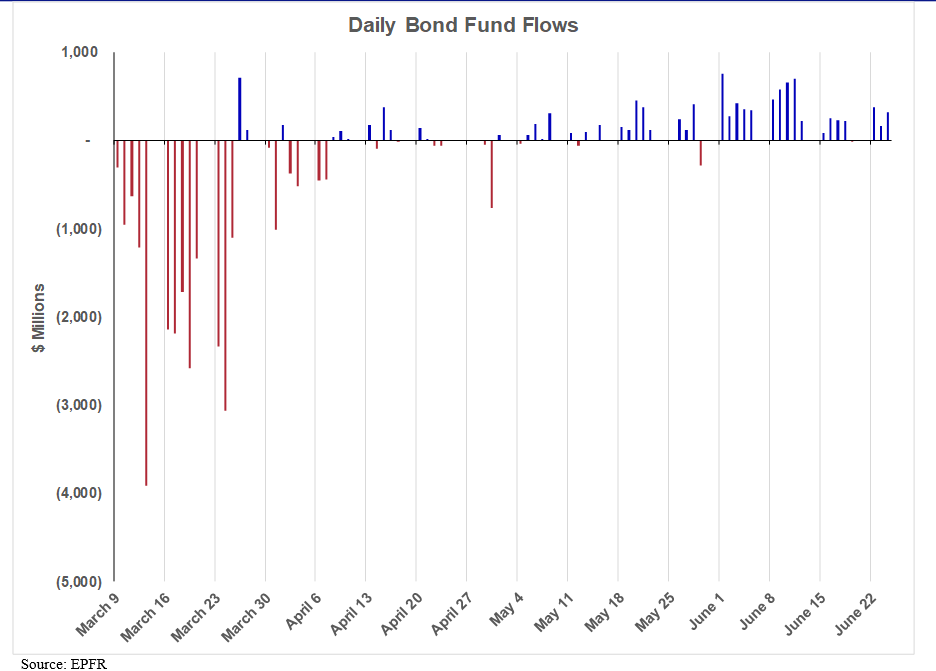

As we can see from the charts, the selloff was furious, with 10-year AAA rates tripling, 30-year rates more than doubling, and quintupling in the short end. This carnage was caused entirely by bond fund selling.

By the end of March, high-net-worth buyers swept in, and the muni market experienced the largest rally in the shortest of amount of time ever. Since then we have seen further drops in long-term rates but very large drops in short-term tax rates, as witnessed by the muni/Treasury ratios for AAA paper. Note the peak in the 2-year muni/Treasury ratio on 3/24 at over 600%. This grotesque yield ratio was caused by the illiquidity in the short-term muni-note market during the liquidity selloff, and bond fund selling was responsible for the damage in the longer end of the market.

In March and April we saw several federal programs ride to the rescue of the municipal bond market. Here are two examples of them.

Federal Reserve Programs and Policies

The Money Market Mutual Fund Liquidity Facility makes loans available to eligible financial institutions, secured by high-quality assets purchased by the institutions from money market mutual funds.

The Municipal Liquidity Facility purchases short-term notes directly from US states (including the District of Columbia) and eligible US counties, cities, and other eligible issuers that were added on June 3. There is no secondary market facility. The Treasury contributed $35 billion as a form of credit protection to the Fed. The MLF can purchase up to $500 billion. The State of Illinois was first to tap this facility.

Just the setting up of these programs helped the market to rally.

There were several other contributing factors as well, among them the backoff-scared issuers who were tentative for a time, with good reason, about entering such a volatile market. Issuance essentially dried up in March, with $18.7 billion after a February that saw $41.9 billion. Issuance in April and May climbed to $29.4 and $28.0 billion respectively. Buyers have clearly started to factor a recovery into the pricing of the muni market.

So, as we start the third quarter, from a nominal standpoint it is almost as if the pandemic hadn’t happened. Muni issuers are enjoying nearly all-time low yields, and we expect that they will take advantage of that fact as we go forward. On a relative basis to Treasuries, the muni market is still cheap; but we have seen a dramatic turnaround from the meltdown days of March.

On a positive note, the infrastructure bill being considered by Congress contains two plusses for the muni market. The first is a resumption of the Build America Bonds program. This program enjoyed great success during the last recession, with the issuance program lasting from April 2009 through December 2010. It allowed issuers to issue bonds in the taxable bond market with a federal subsidy on the interest payments. The issues had to be for new projects, which was the stimulus part of the program. We think that the resumed program may not have the same 35% subsidy that the original program had, but rather may hard-code the subsidy at a lower level. Sequestrations at the federal level caused that original subsidy to go from 35% down to the mid-20% levels over time.

Another positive aspect in the infrastructure program is the return of advance refundings in the tax-free bond market. This practice was removed by the 2017 tax bill but had been a way for municipalities to save money by refunding older higher-coupon bonds to their first call date. Anything that allows municipalities to lower their cost of future funding is a very big positive in our opinion, as we move forward from the pandemic.

Our very best wishes for Independence Day, and please stay safe.

John R. Mousseau, CFA

President, Chief Executive Officer & Director of Fixed Income

Email | Bio

Links to other websites or electronic media controlled or offered by Third-Parties (non-affiliates of Cumberland Advisors) are provided only as a reference and courtesy to our users. Cumberland Advisors has no control over such websites, does not recommend or endorse any opinions, ideas, products, information, or content of such sites, and makes no warranties as to the accuracy, completeness, reliability or suitability of their content. Cumberland Advisors hereby disclaims liability for any information, materials, products or services posted or offered at any of the Third-Party websites. The Third-Party may have a privacy and/or security policy different from that of Cumberland Advisors. Therefore, please refer to the specific privacy and security policies of the Third-Party when accessing their websites.

Sign up for our FREE Cumberland Market Commentaries

Cumberland Advisors Market Commentaries offer insights and analysis on upcoming, important economic issues that potentially impact global financial markets. Our team shares their thinking on global economic developments, market news and other factors that often influence investment opportunities and strategies.