We’re going to look at World War 2 (WW2) versus the World War COVID-19 (WWC) events now unfolding and see what we can glean about markets, economies, interest rates, inflation rates, and the overall outlook.

Let’s start with the stock market. We expect this will be a multi-part series.

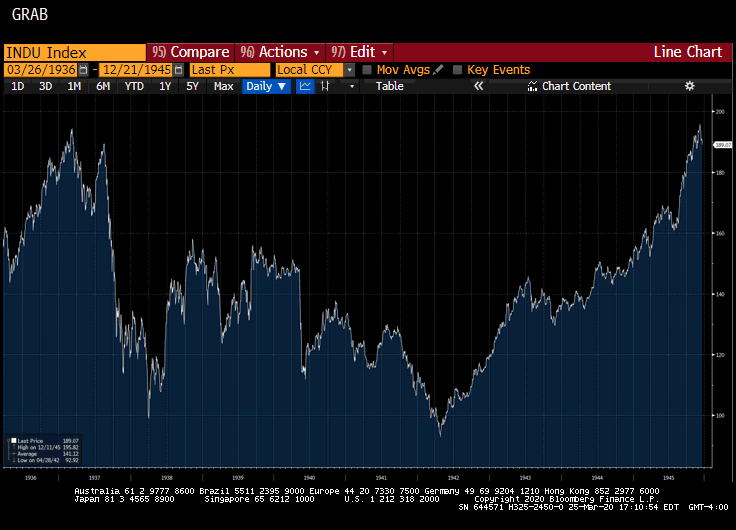

Below is a chart that shows the stock market for the period from the late 1930s until 1945, after WW2 concluded.

[caption id="attachment_51845" align="aligncenter" width="736"] Chart Source: Bloomberg[/caption]

Chart Source: Bloomberg[/caption]

Here’s a very brief summary of the WW2 events. In the chart, readers can see the market responding to the sequence. Hitler achieved power in full in 1933. The US began emerging from the Great Depression that year, too. You can see the market post Depression peak in 1937 and the retest of that peak in the same year. The realization that the world might be heading to war contributed to the intense bear market of 1937–1938, but after mid-1938 the American economy grew rapidly in the runup to WW2. Remember: we were a supplier to allies.

Four subsequent dates become significant. (I want to stress markets here rather than get bogged down in historical detail.) Hitler invaded Poland in September 1939. The battle for Poland lasted only about a month before a German victory. That brought Britain into the war because of its treaty with Poland. By early 1941 Hitler had conquered, or controlled through treaties, much of continental Europe and had formed the Axis alliance with Italy and Japan. The Nazi push westward forced the major evacuation of Allied forces from the French coast to Dunkirk in May–June 1940. The Battle of Britain began in midsummer 1940, and the bombing of London intensified that fall and winter. The Japanese attack on Pearl Harbor on December 7, 1941, accelerated the WW2 bear market to the April 1942 bottom. Pearl Harbor made US officially at war.

April 1942 is a critical month and year. The United States was able to drop a bomb on Tokyo, thanks to a US forces team led by pilot Jimmy Doolittle, a famous military test pilot, civilian aviator, and aeronautical engineer before the war. That effort and the ensuing struggle of the 16 crash-landed B25 bomber crews to survive and escape from China are memorialized in the 1943 book Thirty Seconds Over Tokyo, by Captain Ted W. Lawson, a pilot on the mission (https://www.amazon.com/dp/B005CWHKNQ/) and in the eponymous 1944 film based on the book (https://en.wikipedia.org/wiki/Thirty_Seconds_Over_Tokyo). The news of the morale-lifting Doolittle raid brought a sudden halt to the WW2 bear market.

Why the abrupt shift in sentiment?

For four years, the news had been terrible and steadily worsening. Americans were living under severe restrictions and with considerable fear. Public sentiment dipped to pessimistic extremes. We conclude this from historical accounts; we didn’t have the sentiment measurement tools then that we have now.

The Doolittle raid itself didn’t really do much physical damage or kill many people, but it established that the Japanese heartland was vulnerable to American air attack, and it served as a retaliation for the attack on Pearl Harbor four months earlier. Thus the primary result was a psychological shift worldwide. In the US, Americans suddenly realized that the outcome of the war was not inevitable doom or even a protracted stalemate. In other Allied nations the message was the same. Among the Axis powers the opposite reaction occurred: For the first time their vulnerability was made clear.

Now, in the intensifying war against the coronavirus, sentiment is once again extremely negative. All modern-day measures affirm the extreme. Fear of death is the most powerful human emotional state.

The engines of this war against the virus are in the hands of the medical professionals and the scientists. And they are fully engaged, notwithstanding all the political errors we see at various levels of our governments. In WW2 there were many errors, and now in WWC there are many serious mistakes, too.

That said, we believe the United States and the world now needs a “Doolittle moment.” It may come in the form of a treatment protocol that is decisively effective and not merely conjectural. And it will eventually come with a vaccine. As soon as the population can see and believe that the fear of death and sickness will be diminished or removed, sentiment can and will abruptly change.

With that shift, a durable bull market for stocks can occur. We believe it will come. We do not yet know if the S&P low under 2200 was an interim bottom or a “Doolittle” bottom.

Furthermore, we believe that the post-COVID19 pent-up demand will launch an intense economic recovery. But we cannot get there without removing the fear of illness and death. We cannot get there without credible methods of treatment. We cannot get there without thorough further research into the disease; treatments for it; a vaccine; and, critically, tests for the antibodies that can protect us from COVID-19 in future.

But we can reach those goals rapidly, as soon as the goals are seen as both credible and achievable. We see the advancement in the curated daily reports.

Our forecast for the eventual economic recovery is that it will be U-shaped. We do not see an L with a three- or four-year persistently down Great Depression like period. Our forecast for the stock market itself is more like a V. We only need the Doolittle moment to get there.

More commentaries in our COVID-19 series are coming, focused on economic topics like interest rates and the deficit. For now, please be careful and safe.

You will know the Doolittle moment when you see it. Meanwhile, our largest overweight position is the US healthcare sector which has been fully rebalanced and is fully invested.

David R. Kotok

Chairman of the Board & Chief Investment Officer

Email | Bio

Links to other websites or electronic media controlled or offered by Third-Parties (non-affiliates of Cumberland Advisors) are provided only as a reference and courtesy to our users. Cumberland Advisors has no control over such websites, does not recommend or endorse any opinions, ideas, products, information, or content of such sites, and makes no warranties as to the accuracy, completeness, reliability or suitability of their content. Cumberland Advisors hereby disclaims liability for any information, materials, products or services posted or offered at any of the Third-Party websites. The Third-Party may have a privacy and/or security policy different from that of Cumberland Advisors. Therefore, please refer to the specific privacy and security policies of the Third-Party when accessing their websites.

Sign up for our FREE Cumberland Market Commentaries

Cumberland Advisors Market Commentaries offer insights and analysis on upcoming, important economic issues that potentially impact global financial markets. Our team shares their thinking on global economic developments, market news and other factors that often influence investment opportunities and strategies.