Frank Martins, who is a regional sales director at ValueLine Funds (https://vlfunds.com), sends a regular note with interesting snippets. This one, “Three Financial Facts of the Week,” from June 8, caught my eye:

“The last time a bank backed by the Federal Deposit Insurance Corp. (FDIC) failed was Oct. 23, 2020. As of April 9, 532 days have passed since then, marking the third-longest period without a bank failure in U.S. history. Should the current streak continue through June 24, it would surpass the second-longest period—608 days—without a bank failure since shortly after World War II. Source: Bankrate”

The Fed continues to restate the importance of American systemic financial stability. Here’s the link to the Fed’s most recent financial stability report: “Financial Stability Report – May 2022,” https://www.federalreserve.gov/publications/2022-may-financial-stability-report-purpose.htm.

We ask if simultaneously raising the central bank policy interest rate while also shrinking the central bank’s balance sheet (QT) is a policy method protecting financial stability or if it is instead antagonistic to financial stability. While markets typically look at security prices and credit spreads for these clues, we may also have to watch the banking system itself. Are bank failures to be added to the list of clues?

In his erudite June 8 newsletter email blast, “The Bank of England’s QT plans are better than the Fed’s QT plans,” Bill Nelson, Chief Economist at the Bank Policy Institute (https://bpi.com/people/bill-nelson/), has contrasted the Bank of England with the Fed and discussed in detail important differences between the two central banks’ QT policies. He gives permission to forward his comments to interested parties, and joining his distribution list is free. Readers may, of course, wish to compare for themselves. For BOE policy, see “The Bank of England’s future balance sheet and framework for controlling interest rates,” https://www.bankofengland.co.uk/-/media/boe/files/paper/2018/boe-future-balance-sheet-and-framework-for-controlling-interest-rates. For Fed policy, see “Policy Normalization,” https://www.federalreserve.gov/monetarypolicy/policy-normalization.htm.

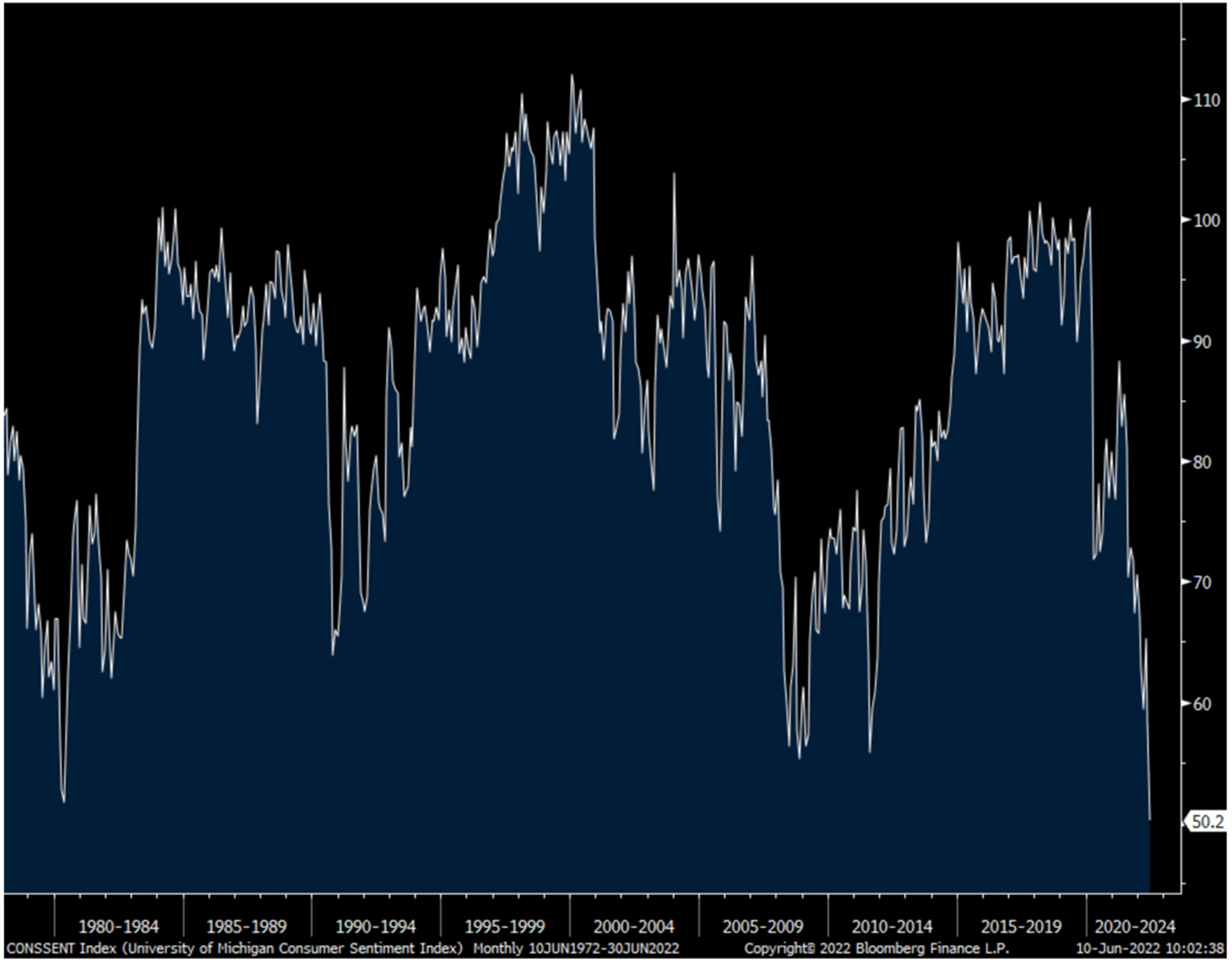

Amid this policy uncertainty, we also see Americans’ consumer sentiment plunging to record lows. In a June 2 interview I had with my friend Danny Blanchflower, he argued that a steep drop in sentiment usually predicts recessions. (See the GIC program “CCB Institutional Alignment Project Event Series: Workforce Development” at https://www.interdependence.org/events/browse/ccb-institutional-alignment-project-event-series-workforce-development/ for that interview and more about Danny.)

Consumer Sentiment

(Chart source: Peter Boockvar, email, June 10; data source: Survey of Consumers, University of Michigan: http://www.sca.isr.umich.edu)

So what happens next?

Will the Fed proceed slowly? Will inflation start to roll over from a peak? Will worldwide central bank tightening become a global recession trigger?

Or…

Will China’s stimulative policy combined with a reopening from Covid-surge lockdowns turn global economic forces in a growth recovery direction? In Russia, will a “praetorian guard” change the leadership of a militaristic disrupter? Can an opening up in the Caribbean lead to the restart of the world’s largest nonproductive oil reserve (Venezuela)? (On that question, please see our brief reading list at the end of this commentary.)

Nobody knows the future. The central bankers are guessing at what the neutral rate is. And the stock market has had a bear-market or near-bear-market correction, depending on how you measure it.

A sage investor once observed in a letter, “Long ago, Ben Graham taught me that ‘Price is what you pay; value is what you get.’ Whether we’re talking about socks or stocks, I like buying quality merchandise when it is marked down.” That investor is Warren Buffett.

At Cumberland, we still have a cash reserve in our US Equity ETF portfolio. We are underweight banks and overweight healthcare and overweight defense-aerospace. This may change at any time.

__________

Addendum: A Brief Reading List on Venezuelan Oil

On June 9, the Council on Foreign Relations highlighted on Twitter a valuable backgrounder, “Venezuela: The Rise and Fall of a Petrostate,” https://www.cfr.org/backgrounder/venezuela-crisis. CFR tweeted, “Shipments of Venezuelan crude oil are expected to head to Europe for the first time in two years after the United States eased some economic sanctions on the country last month.”

“Europe to Receive First Venezuelan Crude in Years as Sanctions Ease,”

https://www.bloomberg.com/news/articles/2022-06-08/oil-giant-eni-books-ships-for-venezuelan-crude-as-sanctions-ease?sref=TG2o5EVv

“EXCLUSIVE Venezuela demands prepayment on spot oil sales after buyer defaults – sources,”

https://www.reuters.com/world/americas/exclusive-venezuela-demands-prepayment-spot-oil-sales-after-buyer-defaults-2022-06-08/

“Crude Exports Disrupted As Venezuela Begins Asking for Advance Payments,”

https://oilprice.com/Latest-Energy-News/World-News/Crude-Exports-Disrupted-As-Venezuela-Begins-Asking-For-Advance-Payments.html

David R. Kotok

Chairman & Chief Investment Officer

Email | Bio

Links to other websites or electronic media controlled or offered by Third-Parties (non-affiliates of Cumberland Advisors) are provided only as a reference and courtesy to our users. Cumberland Advisors has no control over such websites, does not recommend or endorse any opinions, ideas, products, information, or content of such sites, and makes no warranties as to the accuracy, completeness, reliability or suitability of their content. Cumberland Advisors hereby disclaims liability for any information, materials, products or services posted or offered at any of the Third-Party websites. The Third-Party may have a privacy and/or security policy different from that of Cumberland Advisors. Therefore, please refer to the specific privacy and security policies of the Third-Party when accessing their websites.

Cumberland Advisors Market Commentaries offer insights and analysis on upcoming, important economic issues that potentially impact global financial markets. Our team shares their thinking on global economic developments, market news and other factors that often influence investment opportunities and strategies.