I want to start this commentary with a personal statement: The opinion that I articulate at the end of this commentary is my personal view. I have colleagues who agree and also those who disagree. I’m writing this piece in support of the Federal Reserve and the actions it took to avert a serious Depression-era-like contagion in the banking sector. With that said, here we go.

We will start by extracting this summary from the Fed’s recent Financial Stability Report.This summary is clear and outlines what has been discussed frequently in the financial media. It takes three minutes to read. Let’s continue this discussion below the box and assume that readers have read the contents of the box.

(Board of Governors of the Financial Reserve System, Financial Stability Report, May 2023, https://www.federalreserve.gov/publications/files/financial-stability-report-20230508.pdf.)

Let me recognize and offer a hat tip to Bill Nelson, Chief Economist at the Bank Policy Institute, for his observations made public in his May 5 missive “Forward Guidance: This Is Not Normal,” which can also be found at this link: https://www.linkedin.com/pulse/normal-bill-nelson/. In an email exchange with me, Bill Nelson specifically noted that the BPI piece is in the public domain and is quotable but that any attribution I make in quoting him should say that these are his views and not necessarily the views of his organization. I personally thank Bill Nelson for granting the permission to quote him.

In an addendum, Bill Nelson noted a peculiarity and described it as follows:

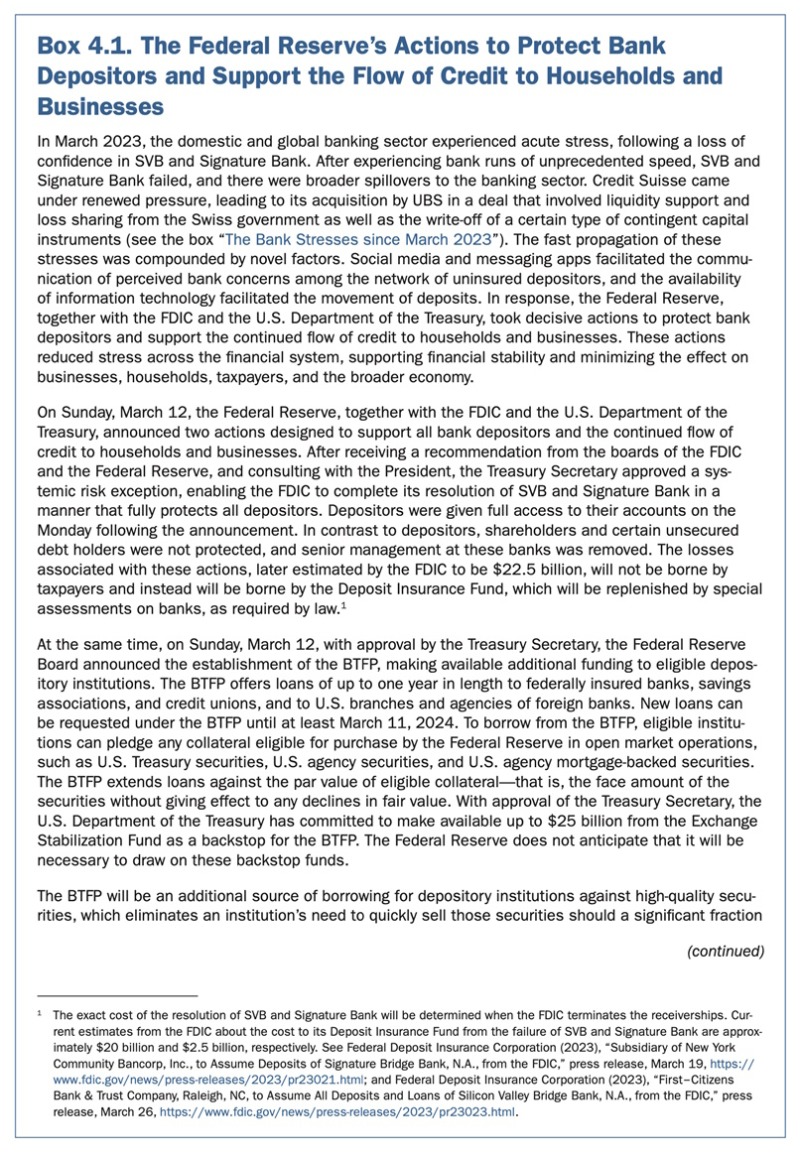

“The report includes an entire section on the Federal Reserve’s actions in response to the recent banking turmoil pp. 53–54. The section discusses regular discount window lending (primary credit) and lending under the Bank Term Funding Program. In the section and in the entire report, there is no mention of Fed lending to bridge banks or to the FDIC as receiver even though such lending currently accounts for 73 percent of Fed lending in response the banking turmoil.”

In his earlier missive, Bill Nelson identified the reference to a footnote in a Thursday afternoon Fed H 4.1 report that called attention to a special usage by the Fed of a lending power. Bill Nelson described it as “not normal.”

In another missive sent on May 2 (“Forward guidance: The Committee may not signal a pause tomorrow, just leave the door open to one”), Bill Nelson raised several issues including one germane to this commentary. Let me cite and discuss that one in my missive today. He wrote,

“The Fed is lending $170 billion to the SVB and Signature receiverships, more than three times peak regular discount window loans in the Covid crisis and half again as much as during the GFC. What are the terms on the loans? What is the rate, what is the collateral, what are the other terms? Were the loans extended under Section 10B of the Federal Reserve Act or Section 13(13) or both? Why didn’t the FDIC use its own sources of funding? Has the Fed lent to bridge banks before? Usually, the Fed is very transparent about its lending. Why the secrecy?”

In his May 5 note cited above, Bill Nelson used the title “This is not normal” to describe the Fed’s activity of lending to a receiver. We will excerpt one paragraph below, but we recommend readers take the time to read Bill Nelson’s entire analysis. Again, readers can find at this link: https://www.linkedin.com/pulse/normal-bill-nelson/. He wrote,

“At the end of the day yesterday, the Federal Reserve announced that it was lending to the receivership formed when First Republic was closed, adding to its existing loans to the receiverships for SVB and Signature. The receiver in all these cases is the FDIC, so the Fed is lending to the FDIC. The announcement took the form of a note at the top of the Fed’s weekly balance sheet report (the H.4.1, here) and in footnote 7 to ‘other credit extensions’ on table 1 in that report. Other credit extensions grew $57.8 billion over the week ending Wednesday, May 4, 2023, and now stands at $228.2 billion. By way of comparison, primary credit (what people mean when they say ‘discount window lending’) peaked at $50.7 billion in the Covid crisis and $110.7 billion in the Global Financial crisis.”

My own (Kotok) interpretation follows.

The Fed determined that it had to act quickly to stave off a contagion; I believe that was and is a correct view. SVB and Signature were back-to-back failures, and neither had the structure to allow a facilitated merger like First Republic’s. So, the Fed had to find a way to provide the liquidity needed to bridge the gap of time for the FDIC. The creative way was to lend to the FDIC as the receiver of SVB and Signature once the FDIC had seized the two banks. That allowed the Fed to offer emergency financing to another federal agency, and the FDIC indemnified the Fed. In other words, the Fed will be paid in full, and the timing of that payment is unknown now and will be determined by the status of the FDIC Deposit Insurance Fund (DIF). The Fed knows that the FDIC must change the fee structure used by the FDIC to collect an insurance premium from all banks. This process takes time. And the current proposal of a tiered insurance premium with larger banks paying a different rate than the community banks or smaller banks do is under discussion now. Target for implementation in 2024.

In addition to this timing issue, there is another pressure point that the Fed had to help overcome.

The FDIC has a credit line with the US Treasury. It is $100 billion. It takes Congress to change that amount, and the amount hasn’t changed in years. But what happens when the FDIC needs to access the credit line and the US Treasury is facing the debt-ceiling political fight? Normally the Treasury can and does routinely sell cash management bills to fund cash needs. But, right now, the Treasury is facing a declining cash balance and can borrow only up to the debt ceiling limit. So, using the Treasury credit line for FDIC purposes becomes a difficult and risky thing to do.

Hence, the Fed found the way to work around this problem by direct lending to the FDIC once the FDIC became a receiver of SVB and Signature. My guess — and this is only my personal opinion — is that the Fed would have done the same thing for First Republic if it had to and will do this for others if the Fed becomes the “last resort” during the current debt-ceiling political battle.

So, in addition to the timing issue, the Fed found a way to deal with the debt ceiling negative impact on the banking system deposit insurance fund.

In my opinion, it is the Fed that saved the day, week, and month. The Fed facilitated the FDIC. The bankers paid the price of their errors. The businesses and individuals who deposited in those banks were preserved. Hence, the Fed averted a banking collapse contagion.

Some folks agree with me, Fred Feldkamp wrote, “The barrier to ‘moral hazard’ risk in US law is that shareholders get a brief period to recapitalize and then get nada when FDIC comes in. There are rare ‘open bank’ situations, but none of those come near to applying today.”

Many others argued against the FED. They are a convenient target as one can read and glean from financial media and commentary. So, we must ask if we are better off because the depositors weren’t bankrupted? Are we better off without a downward spiral of sequential business failures?

Let me conclude.

Because of the intervention of the Federal Reserve, we have not experienced a broad banking-sector contagion. This is true even after the total bank failure amounts now exceed the numbers of the Great Financial Crisis of 2007-8-9. We will see the aftermath of the shock in tighter credit standards, more capital requirements, higher FDIC premiums, and intensified supervision. But we won’t see a sequential meltdown of the economy as banks collapse. The depositors transferred the deposits to other institutions. They didn’t lose them. The losses were on the shareholders, preferred and common, and on the bank holding company bondholders. This is the correct place for risk-taking, and the outcome reflects the results of taking the risk when it works against the investor.

Saving the US economy from a broad-based systemic meltdown is the job of the central bank. They did it. And they did it at a time when the US Treasury is under duress from a political fight about the debt ceiling. The fight is purely political; it has no economic merit. It threatens the stability of the United States. As in the 2011 debt ceiling fight, the penalty is already incurred in the run up to the resolution. The debt ceiling fight has already cost us billions. For proof, just look at the pricing of the credit default swaps for the United States.

The hero is the Fed; the miscreant behavior is happening in the political system and the Congress.

That’s my opinion, and I’m sticking to it.

A postscript. The FDIC has already started to repay the Fed. The expected restructuring of the FDIC’s Deposit Insurance Fund is identified, and the terms of assessments are now clear. And the debt ceiling fight seems to be heading toward resolution. Now, we can go back to the markets and their focus on the forthcoming recession (or not), the commercial real estate financing issues, the inflation fighting policy elements, the shortage of workers in certain sectors, the stagnant population of the US, and the decline in American’s life expectancy. Just a few items to think about.

In the US Equity ETF Portfolio, we are still holding a cash reserve. We believe that there will be opportunities in the US stock market, but they have not fully arrived. Of course, this position may change at any time.

Links to other websites or electronic media controlled or offered by Third-Parties (non-affiliates of Cumberland Advisors) are provided only as a reference and courtesy to our users. Cumberland Advisors has no control over such websites, does not recommend or endorse any opinions, ideas, products, information, or content of such sites, and makes no warranties as to the accuracy, completeness, reliability or suitability of their content. Cumberland Advisors hereby disclaims liability for any information, materials, products or services posted or offered at any of the Third-Party websites. The Third-Party may have a privacy and/or security policy different from that of Cumberland Advisors. Therefore, please refer to the specific privacy and security policies of the Third-Party when accessing their websites.

Cumberland Advisors Market Commentaries offer insights and analysis on upcoming, important economic issues that potentially impact global financial markets. Our team shares their thinking on global economic developments, market news and other factors that often influence investment opportunities and strategies.