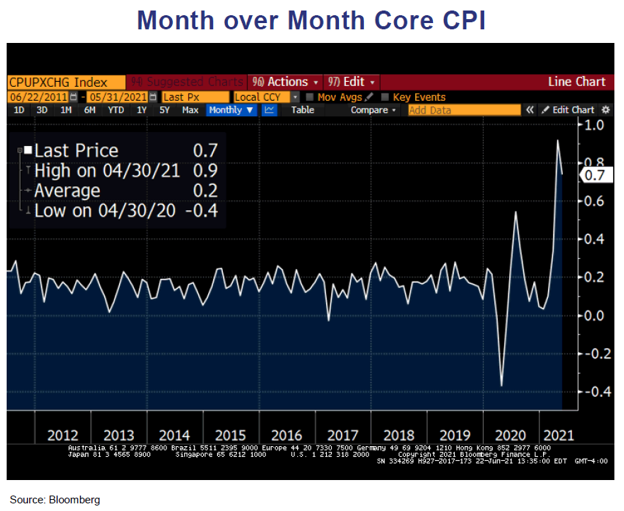

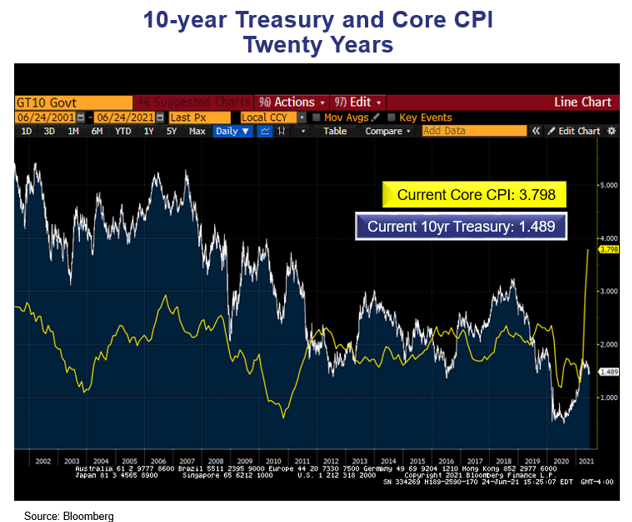

The quarter in general was one that saw continued increases in month-over-month inflation but little real reaction in the bond markets. The Federal Reserve has continued to stress that the recent upticks in inflation are “transitory” and that inflation will revert to a more normal level.

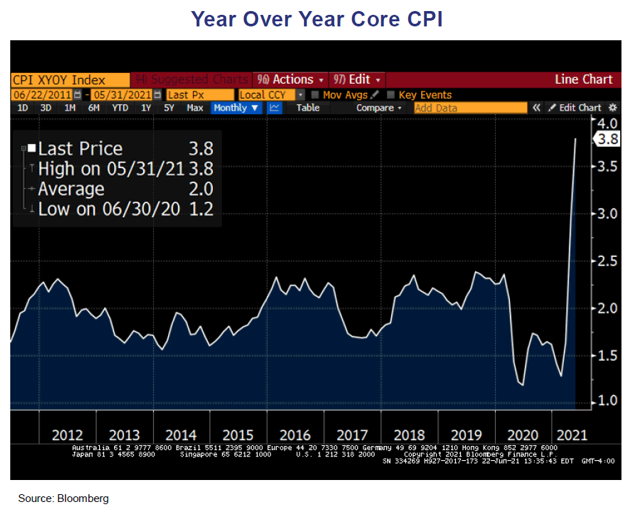

The next chart shows the year-over-year Core CPI numbers going back ten years.

We are not much worried about the year-over-year numbers. We know that last year’s lower numbers are being replaced by higher numbers this year. For example, Core CPI numbers for March, April, and May 2020 were 0, -0.4, -0.1 respectively, while this year those months produced 0.3, 0.9, 0.7. The bond market knows those negative numbers are being replaced with positive ones and has discounted them accordingly. What we ARE watching is the continued month-over-month numbers and what the trend shows as we enter further into the summer.

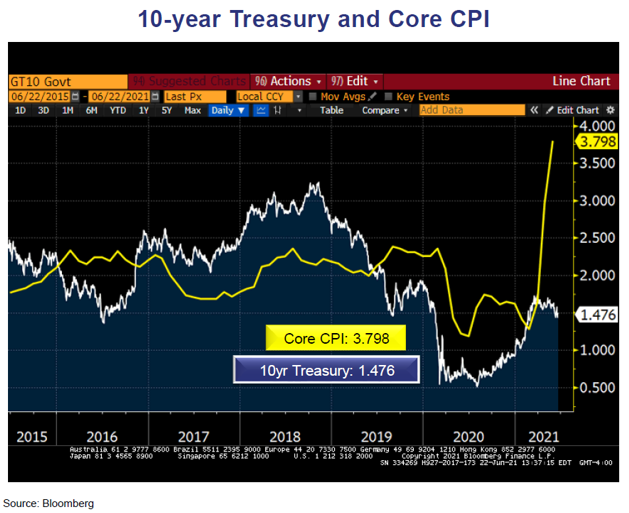

Reviewing this chart over the past 2 years, we can see that in mid-2019 we witnessed a drop in the US 10-year yield. That was US yields catching up with the lower yields that were prevalent in both Europe and Japan at the time. And then we see the steep drop last year amidst the onset of Covid in the US and around the world. Starting in August of 2020 last year we begin to see the 10-year bond yield move higher, for a variety of reasons: a Democratic victory for the White House, announcements of vaccines in late November, and then the Democratic victory in the Senate after the Georgia runoffs in January. All of this helped to push 10-year bond yields markedly higher off the pandemic lows of last year. And we returned briefly to a positive real interest rate – but it was short-lived, given the thrust up in inflation. There is no question that the rapid advance of inflation is holding real yields (inflation-adjusted yields) hostage.

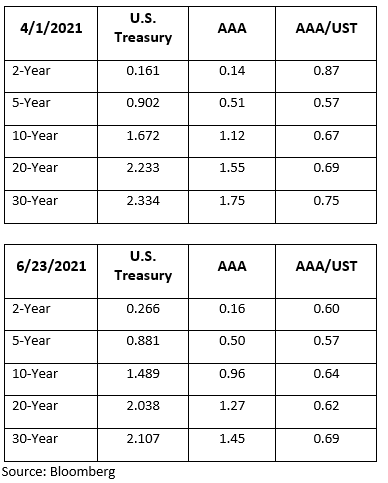

On the tax-free side, we can see in the first charts the drop in the municipal/Treasury yield ratios. We believe that this has been the result of two thing at work. Rabid demand for munis – even at low yields – has dominated the quarter and indeed the first half of the year. The market has smelled a tax hike from the new administration since the start of the year and has been buying accordingly – even at rates that almost defy economic sense. It’s cheaper to buy a US Treasury or high-grade taxable instrument than to own a tax-free bond. We have seen these buying sprees in the past, and they too revert to the mean over time. The other effect has been a drop in tax-free bond supply. Issuance has fallen in the first half versus what would be a normal first half because overall muni health has been good. Most municipalities have been in very good shape because of higher tax collections of sales taxes, income taxes, and cap gains taxes. At the same time, we know that there has been plenty of federal help for state and local governments in general and for pandemically affected ones in particular. As the economy gets more and more open, we expect some cutbacks in the federal money and municipalities issuing a little more debt at the margin. No doubt the specter of higher taxes will keep any updrift in tax-free yields somewhat in check.

Links to other websites or electronic media controlled or offered by Third-Parties (non-affiliates of Cumberland Advisors) are provided only as a reference and courtesy to our users. Cumberland Advisors has no control over such websites, does not recommend or endorse any opinions, ideas, products, information, or content of such sites, and makes no warranties as to the accuracy, completeness, reliability or suitability of their content. Cumberland Advisors hereby disclaims liability for any information, materials, products or services posted or offered at any of the Third-Party websites. The Third-Party may have a privacy and/or security policy different from that of Cumberland Advisors. Therefore, please refer to the specific privacy and security policies of the Third-Party when accessing their websites.

Cumberland Advisors Market Commentaries offer insights and analysis on upcoming, important economic issues that potentially impact global financial markets. Our team shares their thinking on global economic developments, market news and other factors that often influence investment opportunities and strategies.