In the past week, we have watched a bond market adjustment. For a price change, the movement was dramatic, as bonds such as the 30-year US Treasury benchmark bond lost 10% of its market price when rising rates caused a market repricing of outstanding issuance. We nickname the market agents who are involved in these violent moves the “bond vigilantes.”

That’s what happens when a long-duration instrument confronts an upward shift in the yield curve. A person who bought the bond before the price change gave up 5 years’ worth of interest income abruptly from the repricing by market forces.

But how many folks whom you know voluntarily bought that 30-year US Treasury bond during the last year? And there’s the real question for bond management. We’re excluding the institutional portfolios that had no choice in this decision.

At Cumberland, total-return bond accounts have been running a duration of about 4. And they have favored a barbell structure. That strategy continues. The nine-person bond management team, headed by a multi-decade bond management veteran John Mousseau, know about bond vigilantes. They also know to keep their helmets on and not get in the way of the shooting.

The only way a total-return bond manager can have cash to buy a new, higher-yielding, longer bond in the future is to remain patiently in shorter duration until the opportunity presents itself.

So let’s add to this perspective in the context of the pandemic.

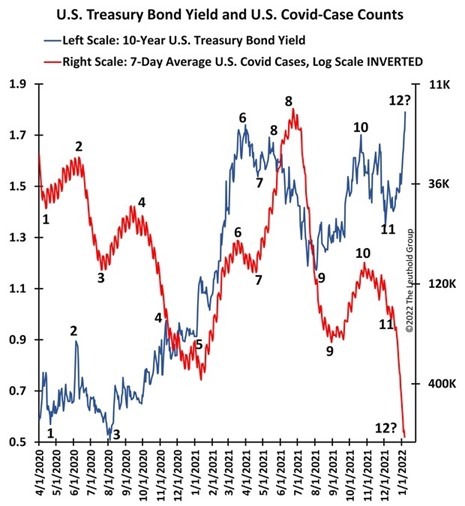

Jim Paulsen opened a recent market commentary entitled, “Is Omicron About To PAUSE The Bond Rout?”, with this quote and chart.

“As shown in the accompanying chart, since the very start of this pandemic, every significant change in the U.S. COVID case count has ‘moved’ bond yields in an inverse fashion. That is, until the last couple of weeks?”

(Chart source: https://advisors.leutholdgroup.com/research/paulsen/2022/01/07/is-omicron-about-to-pause-the-bond-route.23392 - requires subscription or trial to view)

Will Jim Paulsen’s chart have a mean-reverting future? Time will reveal the answer. And patience is required. We thank the Leuthold firm for allowing us to share this chart.

As for the bond vigilantes: Moose & Company are on the lookout.

David R. Kotok

Chairman & Chief Investment Officer

Email | Bio

Links to other websites or electronic media controlled or offered by Third-Parties (non-affiliates of Cumberland Advisors) are provided only as a reference and courtesy to our users. Cumberland Advisors has no control over such websites, does not recommend or endorse any opinions, ideas, products, information, or content of such sites, and makes no warranties as to the accuracy, completeness, reliability or suitability of their content. Cumberland Advisors hereby disclaims liability for any information, materials, products or services posted or offered at any of the Third-Party websites. The Third-Party may have a privacy and/or security policy different from that of Cumberland Advisors. Therefore, please refer to the specific privacy and security policies of the Third-Party when accessing their websites.

Cumberland Advisors Market Commentaries offer insights and analysis on upcoming, important economic issues that potentially impact global financial markets. Our team shares their thinking on global economic developments, market news and other factors that often influence investment opportunities and strategies.