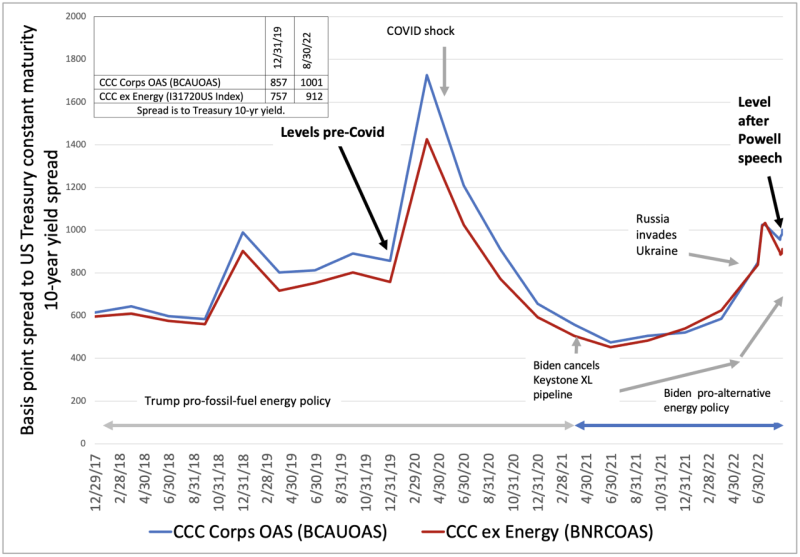

CCC spreads are now significantly higher than the pre-Covid December 31, 2019, level. This widening spread suggests that the Fed’s policy of tightening by raising rates while shrinking its balance sheet is starting to tighten financial conditions.

Data: Bloomberg; Cumberland Advisors

(For higher resolution, follow this link: CCC Credit Spreads Update Chart for Aug-30-2022)

It is important to remember that the spread widening is occurring while both components of this credit spread are rising in actual nominal terms. Also note that the energy price rise windfall to bond holders is exhausted. We examine the windfall, and that is why we show two series together so readers can see the spread with and without the energy price windfall. Credit spreads are extremely important, change with high frequency, and function as a market-based leading indicator. In the present case, these two credit spreads are warning of trouble ahead.

David R. Kotok

Chairman & Chief Investment Officer

Email | Bio

Links to other websites or electronic media controlled or offered by Third-Parties (non-affiliates of Cumberland Advisors) are provided only as a reference and courtesy to our users. Cumberland Advisors has no control over such websites, does not recommend or endorse any opinions, ideas, products, information, or content of such sites, and makes no warranties as to the accuracy, completeness, reliability or suitability of their content. Cumberland Advisors hereby disclaims liability for any information, materials, products or services posted or offered at any of the Third-Party websites. The Third-Party may have a privacy and/or security policy different from that of Cumberland Advisors. Therefore, please refer to the specific privacy and security policies of the Third-Party when accessing their websites.

Cumberland Advisors Market Commentaries offer insights and analysis on upcoming, important economic issues that potentially impact global financial markets. Our team shares their thinking on global economic developments, market news and other factors that often influence investment opportunities and strategies.