The recent muni market selloff we are calling ‘T cubed’ – taxation, tariffs, and Trump talk. It is one of a number of selloffs over the past 17 years.

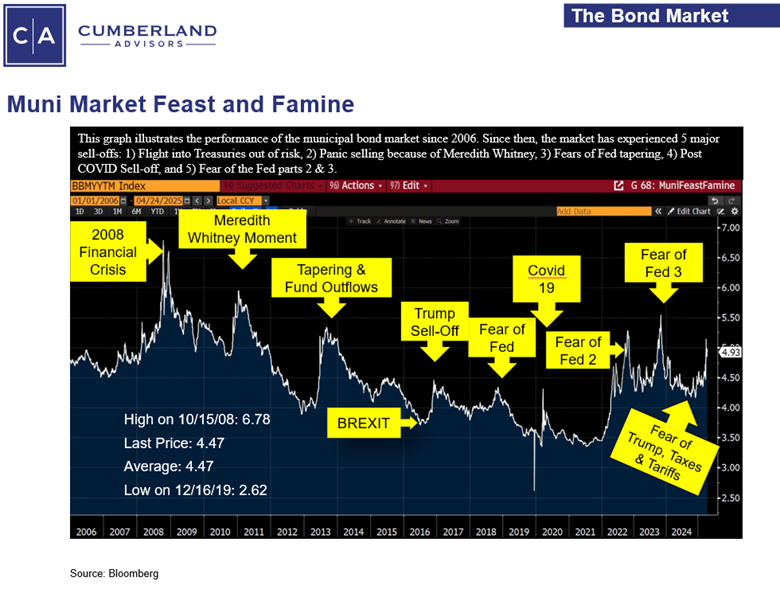

Our first slide is an old standby chart of ours, “Muni Feast and Famine.” You can see the various selloffs in the muni market since 2008. Some – like 2008 and 2010 – are muni-centric selloffs related to concern about muni credit and not correlated with a selloff in Treasuries. In fact, in 2008 after the failure of Lehman brothers, muni-market participants will remember that Treasury yields headed LOWER (as we hit recession) while muni yields initially moved higher (amid fears of municipal defaults and credit). Other selloffs – the taper tantrum, fear of the Fed (pick your chapter), and others – were related to a general fear of rising interest rates. The Taper Tantrum under former Fed Chairman Ben Bernanke is a good example.

The most recent muni selloff occurred this March and April. The first trigger was the prospect of possible taxes on munis. We have written about this and discussed the three avenues for taxation. Discussions included taxing municipal bonds going forward, taxing both existing and future municipal bonds, and putting a 28% tax bracket cap on the benefit of municipal bonds. We thought that none of these legislative alternatives had a high probability of passing (though not zero). All of this talk, though, had the effect of freezing the muni market. As the federal government, downsized by DOGE, envisions state and local governments picking up the tab for costs that the federal government once helped to cover, it is disingenuous to shift these tasks and financial burdens to state and local governments and then not continue to afford those entities the benefit of financing necessary expenditures at an advantageous rate. Recently, in a positive development, French Hill, Chairman of the House Financial Services Committee, wrote a letter to the House Ways and Means Committee fully supporting the current tax-exempt status of municipal bonds, citing their critical role in maintaining and making improvements to United States infrastructure.

The second trigger for the muni selloff was tariff talks. Tariff talk-related uncertainties created tremendous volatility in both equity and bond markets. The volatility certainly spilled over to the muni market. The eventual 90-day moratorium on tariffs had a calming effect for a few days on the muni market, but then Trump’s criticism of current Fed Chairman Jay Powell – the third trigger – sent volatility even higher. The president even talked about removing Jay Powell as Fed chairman, though the position is safeguarded by the Federal Reserve Act, which states that Fed governors can be removed only “for cause” and not dismissed over policy disagreements. The president’s vehemence caused even more volatility in the Treasury markets, with the 10-year Treasury moving between 3.87% and 4.60% within FOUR days. That kind of volatility is massive, making it impossible for municipal bond dealers to hedge either new issues or secondary blocks. The result was a huge drop in the bid side and a GIVEAWAY of bonds in new issues. You can see this from the graph below, “Bond Buyer 40 YTM, Oct. 2024–April 2025,” showing the jump in yields. But in our first chart above, “Muni Feast and Famine,” we see the common denominator that this selloff shares with all others – yields INCREASING at an INCREASING rate. Yield increases have all been opportunistic points at which to add more municipal yield at attractive rates.

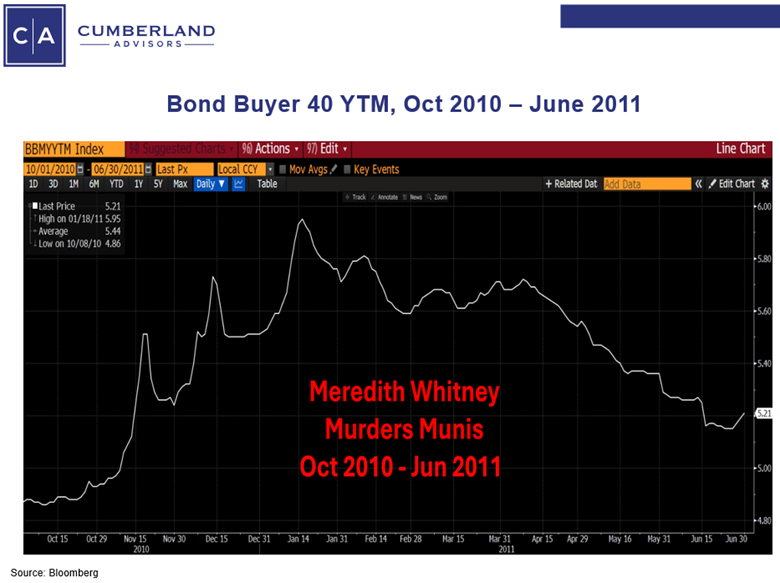

A good similar example to the recent turmoil occurred back in 2010. On an early December Sunday night that year, noted bank analyst Meredith Whitney appeared on “60 Minutes” on CBS and proceeded to say there would be billions of dollars of defaults by municipal bond pensions in the following year. She based her observations on deteriorating state and local government finances, including underfunded pensions and declining revenues at the state and local government level. Since munis are not normally a talking point on network news shows, these remarks caused incredible damage to the market and waves of selling in the bond market – mostly from bond funds, but also individuals. Dealers quickly became overwhelmed, and yields backed up very swiftly. At the time, we asked to debate Whitney at any venue she wished and were turned down. Our view (and others’ as well) was that state and local governments have monopolistic powers in many cases, and there are measures to control spending, raise taxes, and increase revenues that aren’t available to corporations. Indeed, her views painted a picture far more dire than reality, and the muni market began to come back over time. But the Meredith Whitney selloff does point out how sometimes the TALK of one person – whether a bank analyst or a president of the United States – can single-handedly disrupt markets in the extreme.

The key here, as always, is that markets revert to their mean over time. And that crowd behavior still exists. We expect some normalcy to return to the muni market.

John R. Mousseau, CFA

Vice Chairman | Chief Investment Officer

Email | Bio

Sign up for our Market Commentaries

Cumberland Advisors Market Commentaries offer insights and analysis on upcoming, important economic issues that potentially impact global financial markets. Our team shares their thinking on global economic developments, market news and other factors that often influence investment opportunities and strategies.

Links to other websites or electronic media controlled or offered by Third-Parties (non-affiliates of Cumberland Advisors) are provided only as a reference and courtesy to our users. Cumberland Advisors has no control over such websites, does not recommend or endorse any opinions, ideas, products, information, or content of such sites, and makes no warranties as to the accuracy, completeness, reliability or suitability of their content. Cumberland Advisors hereby disclaims liability for any information, materials, products or services posted or offered at any of the Third-Party websites. The Third-Party may have a privacy and/or security policy different from that of Cumberland Advisors. Therefore, please refer to the specific privacy and security policies of the Third-Party when accessing their websites.