This is a brief overview of Cumberland Advisors’ thoughts on financial markets as we head into 2023. We are coming off a rough 2022, one of the rare years with double digit declines in stocks as well as fairly negative returns in bonds. One of our basic investment tenets is that markets revert to the mean over periods of time and that is reflected in our outlook here as well.

Economic Outlook – David Berson

While the US economy remains in growth territory this year, the odds are rising that it will stumble into a recession during 2023. Ongoing tightening by the Federal Reserve, slow (and, in many cases, negative) growth abroad, the jump in energy prices caused by the Russian invasion of Ukraine, and the modest reversal of expansionary fiscal policy as the Covid recession recedes, have combined to put the economy at the precipice of a downturn.

Nothing about economic forecasting is certain, however, and there is still a chance that the economy will simply slow into a soft landing instead. The recent ebbing of inflation may allow the Federal Reserve to take its foot off the brakes of tighter monetary policy in time to let the economy keep moving forward. But because monetary policy works with long and variable lags, the tightening that has already occurred (plus additional, albeit less, tightening to come) will have its primary negative impacts later this year (and perhaps into 2024). This can be seen in the inverted yield curve, with very short-term interest rates (e.g., the 3-month Treasury bill rate) above longer-term rates (such as the yield on the 10-year Treasury note). Additionally, the Conference Board’s Index of Leading Economic Indicators has already fallen to levels (relative to a year ago) from which recessions have always followed. So, while there may be a soft-landing runway ahead, it is very short.

But there is good economic news. The supply chain problems that hit the economy as a result of Covid (and resulting lockdowns) are diminishing — quickly in some sectors. This will allow for both heightened economic activity and slower price gains (if not some outright price declines). Indeed, the 12-month change in prices as measured by the Consumer Price Index (CPI) has moved lower for six consecutive months as supply chains have healed. The positive impacts of improving supply chains on inflation will be helped by slower (negative?) economic growth this year. While overall inflation may not drop all the way to the Fed’s goal of 2.0 percent by the end of 2023, it should be closer and clearly moving toward it. Moreover, the job market remains solid, with the unemployment rate near 50-year lows. If the likely recession next year is on the modest side (as most analysts expect), then increases in unemployment will also be less severe.

The combination of a likely economic downturn and, especially, significantly slower inflation may allow interest rates to decline next year – helped further if financial markets expect the Fed to ease monetary policy later in 2023 or in 2024.

The Fed – Bob Eisenbeis

There is considerable uncertainty about what 2023 will bring and whether the Federal Reserve’s determination to bring inflation down will be too zealous and result in a recession. The Fed has observed considerable progress in terms of bringing PCE inflation down to 2%, with that measure for November standing at 5.5%. But it is still far from the Fed’s target of 2%. CPI inflation for the month of December declined to 6.5%. Big drops were observed in energy, used cars and trucks, and airfares. More importantly, the changes in the CPI suggest similar progress will be shown in the PCE when the December numbers become available.

As for Fed policy, FOMC participants have been out in advance of the blackout period sharing their own views on appropriate policy. They have been uniform in noting the Committee’s determination to bring inflation down to 2% and have signaled being open to either a 50- or 25-basis-point increase at the January 31–February 1 meeting. President Daley of the San Francisco Fed, for example, has suggested that the slower pace of rate increases will be dependent upon the PCI, which may now see a slower increase. If so, there may be a growing set of participants who would lean towards a 25-bps increase on the grounds that the policy is working so far and there is reluctance to risk causing a recession if it isn’t necessary to do so. Where will the rate increases end? That, Chairman Powell now argues, is the key question. Again, participants have shared their views on this recently. Esther George, outgoing president of the Kansas City Fed, sees rates at or near 5% with no recession. At the other extreme, Minneapolis Fed President Neel Kashkari sees the end point at 5.4%. In between those two is Atlanta Fed President Raphael Bostic, who sees the stopping point at about 5.0–5.2% and who also says he is agnostic at this point as to whether the next increase should be 25 basis points or 50. But, of course, these recent views were voiced before we knew what the December CPI was.

One last point: It is important to know who is voting on the FOMC in 2023. Of those cited above, only Kashkari is a voting member. He has now been joined by President Harker and Vice Chair Brainard favoring a slower pace. Best guess is that the increase will be only 25 basis points, with the Committee noting progress that reflects its unstated desire not to cause a recession.

Equity Markets – Matt McAleer

As always, flexibility will remain key to operating successfully in the equity markets, both domestically and internationally. Interest rates and financial conditions will always dictate allocation decisions we make as a top-down investment manager. Our tilt towards value and equal weighting remains consistent, but we cannot ignore the historically large performance spread between value and growth over the past 18 months. We will continue to monitor the dynamics between those two factors on a weekly and monthly basis. Broadly viewed across strategies, Cumberland’s domestic positioning skews defensively entering 2023, with overweight allocations in Healthcare, Defense, Metals, and Energy. We remain underweight growth and technology but fully respect our position risk and currently have a cash sleeve that can react to changes in sector and industry leadership.

After more than a decade of nonperformance, international equity markets have begun to pick up their heads vs. the US markets. The recent uptick in relative strength in broad international indices is noticeable. While Europe has traded well off the September lows, it is impressive that the emerging markets are showing multi-week strength at this point in Q1. We have been focused on the long run of US dollar strength and are heartened by the recent pullback vs. foreign currencies. The Q4 dollar weakness has allowed the emerging markets to breathe a bit. Cumberland’s current international allocation is close to 50/50 between developed and emerging markets, with our most recent buys being in India and Latin America. As in our US strategies, we have a cash sleeve that will be used to reposition into attractive opportunities.

Taxable Fixed Income – Dan Himelberger

2022 was a down year for most asset classes, with the FOMC raising the fed funds rate by over 400 bps while battling inflation. Along with other markets, taxable fixed-income securities experienced sharp declines as Treasury yields shot up and spreads widened out. At the peak on 10/24/22, the 10-year Treasury rose 273 bps to 4.244%, and the 30-year rose 247.6 bps to 4.38%. Yields have since backed off those highs (see the chart below), as market participants began predicting the end of the Fed hiking cycle.

Source: Bloomberg

Spread securities such as corporates and taxable munis also experienced sharp declines as spreads widened. The Bloomberg US Agg Corporate Bond Index peaked at +165 bps, up 73 bps from the beginning of the year. The Bloomberg Taxable Muni US Agg Index also widened, peaking at +147 bps, up 53 bps from the opening of the year. Spreads have come down some as the year ends but remain volatile, as the market is faced with uncertainty surrounding the FOMC.

Going into 2023 we expect continued volatility in taxable fixed-income securities, driven by key economic data and FOMC policy. Market participants will look to predict FOMC policy based on changes in economic data, with a close eye on inflation. These predictions have resulted in higher levels of volatility as 2022 ends, and we expect that volatility to continue in 2023 until there is more clarity on when the rate hikes will end.

We view the higher interest rates and wider spreads as an opportunity to lock in yields that haven’t been available for several years. During 2022, we increased our duration target on taxable fixed-income accounts to take advantage of the higher-yielding opportunities and will continue to look for those opportunities in 2023. Given current market conditions, we plan to maintain our durations longer than the benchmark, as we expect the FOMC will stop raising rates later this year and possibly start cutting before the end of 2023. We will continue taking an active approach to adjusting portfolios while navigating the volatility and look for attractive opportunities to lock in better yields in a higher-interest-rate environment.

Tax-Free Municipal Bonds – John Mousseau

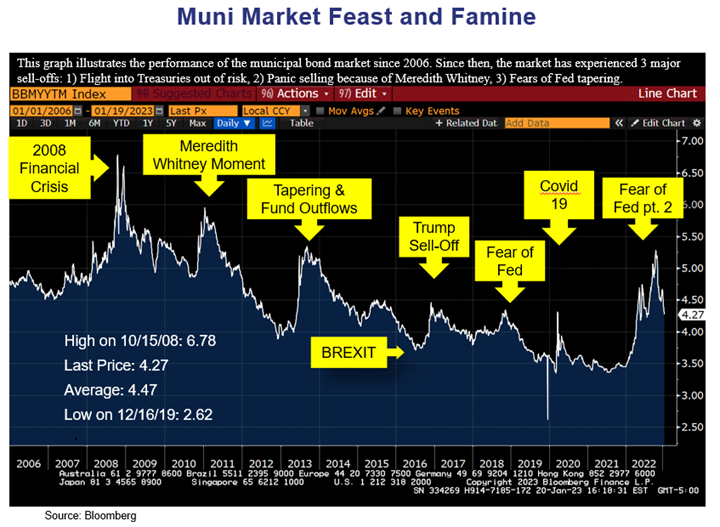

After what will be remember as one of the all-time municipal bond market selloffs, we believe that tax-free bonds should provide better returns in 2023 driven by higher demand (because of higher yields and compelling relative value calculations) and lower supply levels. In what was a brutal year, longer term municipal bonds sold off hard enough to move yields from 2% to 5%. Since early November they have rallied back to begin moving yields back down to 4.25%–4.5% for longer ‘A’ or better rated bonds. Our view is that with a slower economy looming (forecast in part by the inverted US Treasury yield curve) and longer taxable equivalent yields ranging from 6.65% to 8% depending on state tax exemption, tax-exempt municipal bonds offer a compelling risk-adjusted alternative to equities at the margin. The driver behind municipal performance will be slowing inflation coupled with positive flows into bond funds, which saw a disastrous year of liquidations.

As we know from past bond market selloffs in the municipal sector, they generally take a longer time to repair themselves than the duration of the sell off itself, with the exception of the Covid-19 period in March of 2020, when the market rebounded quickly. We feel that the reversion to the mean that we have seen in other municipal market selloffs will manifest in 2023. Early 2023 has witnessed inflows into municipal bond funds.

Municipal issuance was down 21% to $384 billion in 2022 with taxable deals contributing to most of the decline. Most refunding deals can only be done on a taxable basis and with higher rates, taxable muni bonds were down by $68 billon while tax-exempt new issues were down by $30 million in 2022. Supply in 2023 is expected to be in a range from flat to $430 billion with taxable deals on par with 2022. For now, most municipal balance sheets are in good shape so there may not be as much necessity to issue debt.

It is important to remember that the selloff isn’t so much about how high the federal funds rate has risen as it is about how fast we got here from the artificially low rates deployed in response to Covid. We do feel that the Fed started late in raising short-term rates, and the bond markets paid the price for that in 2022. We should see some reversion to the mean in 2023.

Municipal Credit Outlook – Patricia Healy

We expect the credit quality of municipal bonds to be stable. We also expect 2023 to be an eventful year. The changing of the guard in the House of Representatives, albeit by a narrow margin, will likely limit or curtail large spending programs that some have become accustomed to. Event risk in the form of a rollback or denial of federal aid, cyber threats, and extreme weather need to be monitored as well as municipal management’s attention to addressing these risks.

While upgrades outpaced downgrades in 2022, we expect a more stable rating environment in 2023. The airport, port, and toll road positive outlooks have been changed to stable now that many of these credits have reverted to or surpassed pre-pandemic levels, and capacity constraints may limit additional growth. Mass transit-related credits have not returned to pre-pandemic passenger levels; and a rethink on how mass transit is financed, possibly to depend more on taxes and government grants, may be on the horizon. Mass transit systems are expensive to operate but supply essential affordable public transportation and reduce pollution. The healthcare sector and private higher education continue to have negative outlooks, given the difficulty in hiring and higher wages, the evaporation of pandemic stimulus funds and policies, and demographic changes. State and local governments, school districts, and utilities are expected to continue to be stable. Demographic shifts from high-tax states and cities to low-tax jurisdictions may also have an impact on credit quality. States such as New York and California, whose populations are shrinking, may confront budgetary constraints, especially with economically sensitive income and capital gains tax revenue exposure, while fast-growing states such as Texas and Florida will have to contend with growth pressures.

All municipalities will be challenged by the expected slowdown in the economy; however, stability should come from factors we have repeatedly mentioned, such as healthy accumulated reserves, better budgeting and fiscal management, established rainy day funds, improved pension management, good revenue growth, improved property tax bases, and (ironically) increased sales tax revenue boosted in part by inflation. Federal infrastructure funding may reduce the amount of debt some munis need to finance projects as well as allay concerns about issuing debt in a higher-interest-rate environment just when a slowdown in the economy is possible, limiting increases in leverage.

We thank all readers for their interest. Please remember to visit our website (https://www.cumber.com) to find information about Cumberland Advisors, the investment strategies that we offer our clients and partner firms, and other relevant information.

John R. Mousseau, CFA

President, Chief Executive Officer, & Director of Fixed Income

Email | Bio

Links to other websites or electronic media controlled or offered by Third-Parties (non-affiliates of Cumberland Advisors) are provided only as a reference and courtesy to our users. Cumberland Advisors has no control over such websites, does not recommend or endorse any opinions, ideas, products, information, or content of such sites, and makes no warranties as to the accuracy, completeness, reliability or suitability of their content. Cumberland Advisors hereby disclaims liability for any information, materials, products or services posted or offered at any of the Third-Party websites. The Third-Party may have a privacy and/or security policy different from that of Cumberland Advisors. Therefore, please refer to the specific privacy and security policies of the Third-Party when accessing their websites.

Cumberland Advisors Market Commentaries offer insights and analysis on upcoming, important economic issues that potentially impact global financial markets. Our team shares their thinking on global economic developments, market news and other factors that often influence investment opportunities and strategies.