Dear Clients & Friends,

Thank you for joining Cumberland Advisors for this end-of-week update on market conditions, equities & bonds with our President, Chief Executive Officer, & Director of Fixed Income, John Mousseau and Executive Vice President & Director of Equity Strategies, Matt McAleer.

- Matt's theme? Panic.

- Panic into Growth?

- Where might trouble lurk for us? Interest Rates. Matt explains and says, "perception is reality."

- Matt relays what's changed in our positions this week.

- We'd like something with legs the next 12, 24, 36 months.

- International sold off Indonesia and brought Sweden

- Big Q-Names pulling the Nasdaq train these past weeks

John Mousseau, CFA - Fixed Income:

- John provides numbers on Treasuries & Munis

- We didn't see evidence this week that yields should be dropping. Seems like posturing for quarter-end. The evidence we do see is a continuing of an improving economy and jobless claims less than expected. Non-farm payrolls exceeding expectations too.

- Have a safe 4th of July

Matt plans to share data, charts, opinions, and comparisons next week. We had endeavored to deliver this to you today but it's been pushed back just a little. There's an old Yiddish adage you've probably heard, “Mann Tracht, Un Gott Lacht” which translates to “Man Plans, and God Laughs.” One of those weeks!

Have a great weekend and a happy Fourth of July!

-Matt McAleer & Cumberland Advisors

Please send Matt McAleer any feedback from today's email/video. You can reach him at:

-Link to Matt's Email: [email protected]

-Link to Matt's Twitter: https://twitter.com/MattMcAleer4

-Link to Matt's LinkedIn: https://www.linkedin.com/in/matthew-c-mcaleer/

-Call Matt: (800) 257-7013

Other questions or comments? Email us at [email protected] or give us a call at (800) 257-7013.

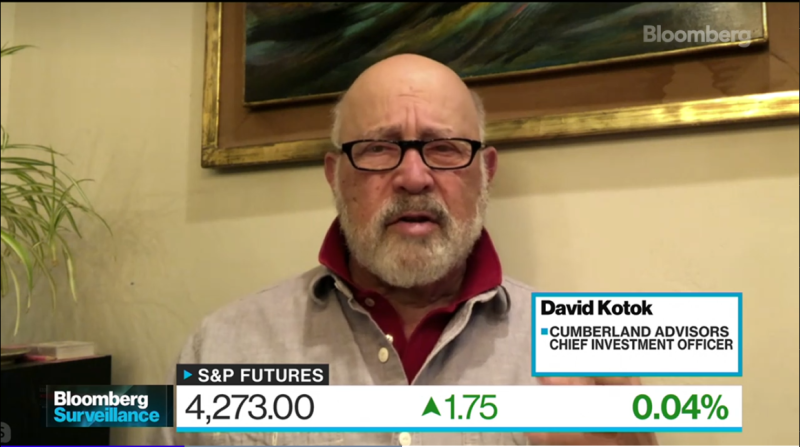

'Strategic Shock' From Covid Will Take Years: David Kotok

Quoted: David R. Kotok | Tue June 15, 2021

Cumberland Advisors: Credit Spreads Are Tight (Video)

Quoted: David R. Kotok | Tue June 15, 2021

Cumberland Advisors Market Commentary offers insights and analysis on upcoming, important economic issues that potentially impact global financial markets. Our team shares their thinking on global economic developments, market news and other factors that often influence investment opportunities and strategies. Our readers appreciate its timeliness, depth of analysis, and quality of research.

Read current and past commentaries here: https://www.cumber.com/market-commentary

June 2021 Jobs Report

Author(s): Robert Eisenbeis, Ph.D. | Fri July 2, 2021

The BLS Current Employment Survey for June 2021 showed a healthy 850,000 jobs, up from 583,000 in May.

International Equities — 2Q 2021

Author(s): William H. Witherell, Ph.D. | Thu July 1, 2021

As the first half of 2021 comes to an end, the global economy is recovering strongly from its sharp decline last year caused by the COVID-19 pandemic. While the disease continues to surge in some countries, particularly those with a slow pace of vaccination, and the Delta variant of COVID proves…

Bond Market Reversion to the Mean – Real Yields Held Hostage

Author(s): John R. Mousseau, CFA | Tue June 29, 2021

The second quarter of 2021 saw a drop in US Treasury yields, as well as in high-grade tax-free bond yields. The charts below show the relative movements during the quarter. The quarter in general was one that saw continued…

Taxable Total Return Review — 2Q 2021

Author(s): Daniel Himelberger | Mon June 28, 2021

As the second quarter drew to a close, the Treasury curve experienced flattening, with short-term Treasury yields rising while longer Treasury yields declined and the stock market set record highs. The largest movement in Treasury yields was in the longer-maturity…

Delta is serious. We offer three items for your consideration.

CIO Overview & Outlook — Q2 2021

Author(s): David R. Kotok | Fri June 25, 2021

As the close of the second quarter approached, we witnessed US stock markets reacted briefly to the outcome of the Federal Reserve’s June meeting. Chairman Powell planted the first seeds indicating a forthcoming change in Fed policy. The anticipation now is that the Federal Reserve will make its…

The MoneyShow Presentation

Author(s): Leo Chen, Ph.D. | Wed June 23, 2021

For those who were unable to hear my presentation at the MoneyShow in Orlando last week, let me summarize the key points and make the slides available to anyone who may have missed them. Please feel free to contact me if you would like to receive the slides of the presentation on our…

The Real Labor Story

Author(s): David R. Kotok, Philippa Dunne, & Doug Henwood | Tue June 22, 2021

There’s a reason John Mousseau, Patty Healy, and I read TLRWire’s daily notes with regularity. This research service is on the cutting edge in capturing important trends concerning the US labor force and other key economic developments. Even when the Bureau of Labor…

Talking About Talking About

Author(s): Robert Eisenbeis, Ph.D. | Mon June 21, 2021

There were no surprises in the FOMC’s June policy statement, and all the interesting information was either in the new set of Summary of Economic Projections or in Chairman Powell’s post-meeting press conference. What seemed to get the most attention in the press and by commentators was the…

Delta for Sunday

Author(s): David R. Kotok | Sun June 20, 2021

“The Delta variant is speeding past sluggish global vaccination efforts, likely bringing a brutal summer of infections across dozens of countries – even in some nations with plentiful vaccine stocks.” (Johns Hopkins Bloomberg School of Public Health Global Health NOW: “Covid-19 ‘on Steroids’;…

Watch the Savings Rate

Author(s): David R. Kotok | Mon June 14, 2021

This link will take you to a chart, courtesy of the Federal Reserve Bank of St. Louis. The chart depicts the personal savings rate from 1960 through 2020: https://fred.stlouisfed.org/series/PSAVERT.

Prior to the pandemic, the savings rate in the United States was reasonably predictable and in the mid single digits. Then along came the pandemic shock, which you can see in the chart. Continued…

An Economist Visits the Grand Canyon

Author(s): David R. Kotok | Sun June 13, 2021

An economist visits the Grand Canyon with his wife. They peer together across that vast, majestic maze, tinted with orange and distant blue. His wife asks, “How old is this?”

He says, “10 million and 6 years.”

“What’s the 6 years?” She demands.

He says, “I was here at a conference six years ago. I asked the ranger how old it was, and he said it was 10 million years old.”

The secret of economics and financial markets is what we are taught in graduate school. Use the decimal point. Fool people with numbers. Make them think we know precisely what we’re talking about when in fact we don’t.

Continued…

Global Corporate Taxation Reform Breakthrough

Author(s): William H. Witherell, Ph.D. | Thu June 10, 2021

Last Saturday, June 5, the G7 finance ministers and central bank governors, meeting in London, issued a communique in which they “strongly support” the G20/OECD efforts to reform the global taxation of…

Cecchetti and Tucker: Five Applications of Monetary Policy

Author(s): David R. Kotok | Wed June 9, 2021

We’re sending readers the link to this excellent primer about the five categories of monetary policy operations in today’s world, each of them representing a role that a central bank plays. Cechetti and Tucker argue that each of these applications of policy should unfold within…

How Many Jobs Were There?

Author(s): Robert Eisenbeis, Ph.D. | Tue June 8, 2021

A comparison of recent estimates of monthly job creation by the Bureau of Labor Statistics (BLS) and estimates generated by Automatic Data Processing (ADP) reveals wide disparities. For example, in February,…

What does the Fed’s wind-down of its corporate bond holdings mean to the market? And what about those jobs numbers?

Author(s): Patricia M. Healy, CFA | Mon June 7, 2021

On Wednesday, the Federal Reserve announced plans to begin winding down its $13.8 billion portfolio of corporate bond holdings purchased during the market dislocation caused by the COVID pandemic and the shutdowns implemented to mitigate it. The Secondary Market Corporate…

Sunday with Michael Lipper

Author(s): David R. Kotok | Sun June 6, 2021

Michael Lipper is an icon in financial market history. After all, he has an index named for him, and that’s the ultimate compliment among economists and financial market practitioners. Lipper is famous for his index on mutual funds and has a distinguished career in the…

Transitory Inflation?

Author(s): David R. Kotok | Thu June 3, 2021

Has the 10-year market-price-based estimate of the CPI peaked (May 12), and will it now decline? If inflation is peaking right now and starts to flatten its trajectory, then the inflation scare is transitory, and all the talking heads on TV have been spewing nonsense. Our…

Is Senator Warren Proposing Musical Chairs at the Fed?

Author(s): Robert Eisenbeis, Ph.D. | Tue June 1, 2021

At a hearing last week, Senator Warren told Randal Quarles, Fed vice-chairman for supervision, she was recommending that he not be reappointed to that position when his term was up in October to President Biden. She had criticized Quarles’ appointment during his confirmation…

Links to other websites or electronic media controlled or offered by Third-Parties (non-affiliates of Cumberland Advisors) are provided only as a reference and courtesy to our users. Cumberland Advisors has no control over such websites, does not recommend or endorse any opinions, ideas, products, information, or content of such sites, and makes no warranties as to the accuracy, completeness, reliability or suitability of their content. Cumberland Advisors hereby disclaims liability for any information, materials, products or services posted or offered at any of the Third-Party websites. The Third-Party may have a privacy and/or security policy different from that of Cumberland Advisors. Therefore, please refer to the specific privacy and security policies of the Third-Party when accessing their websites.

Cumberland Advisors Market Commentaries offer insights and analysis on upcoming, important economic issues that potentially impact global financial markets. Our team shares their thinking on global economic developments, market news and other factors that often influence investment opportunities and strategies.