Part 7 of our ESG series.

Last Sunday, we featured takeaways regarding the governance (G) dimension of ESG, drawn from the closing session of GIC’s ESG Conference held at Rowan University on Friday, October 14, 2022, in Glassboro, NJ. This week we turn to another session held that day, titled “Investment Implications of ESG Investing” (https://www.interdependence.org/resources/environmental-social-and-corporate-governance-with-rowan-university-investment-implications-of-esg-investing/#.Y5nWzC-B3XQ).

Moderated by Lisa McIntire Shaw, GIC’s Vice Chair of Programs, the discussion featured Perth Tolle, founder of Life + Liberty Indexes and creator of the Freedom 100 EM Index (FRDM index); Patty Healy, Cumberland’s Senior Vice President of Research; and John Mousseau, Cumberland’s President, and Director of Fixed Income.

By way of enticing readers to view the entire session, we will offer a few highlights below and excerpt snippets from the discussants. (The audio is better for this session, so we are not encapsulating the entire discussion.)

Perth Tolle briefly discussed her firm’s freedom-weighted emerging-market index, which enables allocations to freer countries rather than to autocracies, which account for a large swath of emerging markets. Later in the session, Perth discussed at some length “autocracy risk” and its impact on investing:

ESG, as we have been discussing the bond area and also in equities, has mostly been done on the security level. But in emerging markets, that’s more difficult to do because if you look at the emerging-markets data, it's very unreliable. The lack of free speech and free press and free expression — without those things you don’t really have any free contradiction to government or company data that comes out; and there’s no third-party independent authority on this data, so the data is less useful to measure the impact in ESG and other types of data as well. So if you look at a country that doesn’t have these freedoms..., it’s very difficult to do ESG, but also it becomes a little meaningless. If you look at the ESG product in the emerging-markets base, ESGE, the iShares ESG — and that’s the biggest one in the US — there’s no alcohol, tobacco, gambling; but genocide is perfectly fine. So it becomes a little bit hypocritical, I think, in most people’s view, and there is some pushback on that now.

But also it’s an investment risk, so it’s an expropriations risk; it’s a huge risk in the unfree market, and that has a huge impact on investment returns…. If you look at China as an example…, there is real growth, because China rolled back their Mao-era policies and went to better economic policies that led to this growth; but investors have not really taken part in that, and that’s because of the lack of transparency in ownership, lack of transparency in their books and their accounting. A lot of their returns get expropriated to the government; and so investors, in a time of extreme growth, did not participate at all, basically…. That’s a risk of investing in autocracies, where you don’t have any kind of accountability on both data and where returns go.

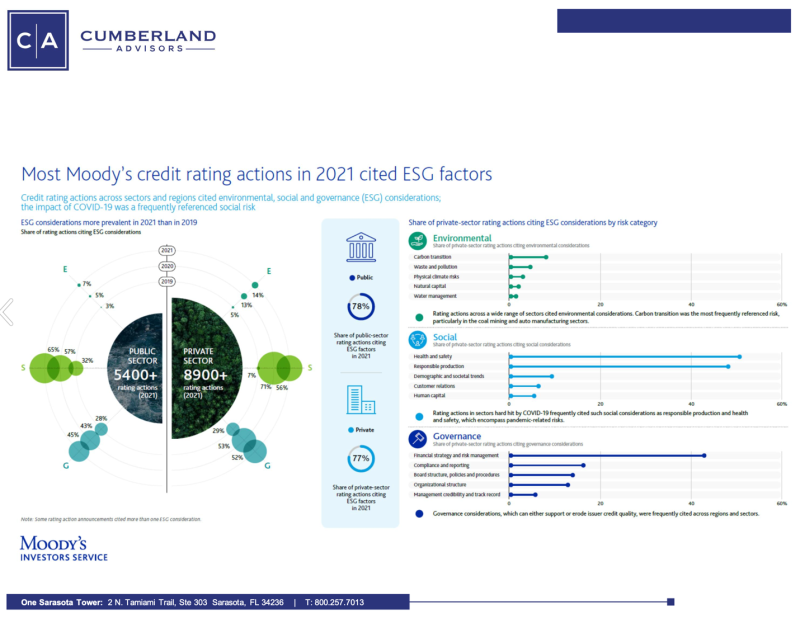

Turning to the municipal bond market, Patty Healy talked about how Cumberland views credit risk “through an ESG lens,” and then used a slide from Moody’s to explain how ESG factors are gaining prominence (see below).

(https://www.interdependence.org/resources/environmental-social-and-corporate-governance-patricia-healy/#.Y5scYC-B060)

We quote Patty and her explanation of the slide as follows:

So this slide from Moody’s, out of the past three years, the ratings of debt that they have done, both national and international, private and public sector, and you can see that each year —from 2019 to 2021–2022 — the number of ESG-related ratings have gone up. You can see that … the social risk, especially because of Covid, became very very prominent; and then the third point from the slide is that the role of G is growing. So it’s a short time period, but it seems to be happening very quickly.

John Mousseau discussed the importance of full and accurate disclosures from the perspective of bond buyers. He noted in a series of slides the modest underperformance of the “Green Bond Index” versus the S&P 500 (see https://www.interdependence.org/resources/environmental-social-and-corporate-governance-john-mousseau/#.Y5siYy-B060), but he drew some forward-looking conclusions:

As you can see here, over three years, and over two years, and over one year, they’ve all been outdone by the general index. Now, what does that mean? That means that in the long run people are probably paying up with lower yields to start with…. There’s probably an investment cost right now, but that doesn’t mean it stays this way all the time, either. Just common sense would tell you that if you’re going to get more and more ESG issuance, that may eventually have a give to the market, and some of it builds on itself. The market wants ESG issuance; therefore, that spurs on more fund and ETF ESG products, which adds more disclosure, which demands higher costs, etc.

As for states that are being impacted by climate-change-related disasters, such as Florida and Texas, John sees the handwriting on the wall:

Whether they want to or not, they will be coming kicking and screaming to become ESG issuers because they are going to have to do that…. So I think what you have happen is you’ll see these types of instruments being issued — there’s going to be enough of them that there’s going to be a yield give to the market, and if there’s a yield give, you’ll see that performance relation flip over.

The session offered the audience many more valuable insights to consider, and we heartily encourage readers to check out all the rest of the 53-minute session, including deep dives in the Q&A. The link, again, is https://www.interdependence.org/resources/environmental-social-and-corporate-governance-with-rowan-university-investment-implications-of-esg-investing/#.Y5nWzC-B3XQ.

We wish readers a pleasant winter Sunday and a safe journey during the holiday season and into the new year.

David R. Kotok

Chairman & Chief Investment Officer

Email | Bio

Links to other websites or electronic media controlled or offered by Third-Parties (non-affiliates of Cumberland Advisors) are provided only as a reference and courtesy to our users. Cumberland Advisors has no control over such websites, does not recommend or endorse any opinions, ideas, products, information, or content of such sites, and makes no warranties as to the accuracy, completeness, reliability or suitability of their content. Cumberland Advisors hereby disclaims liability for any information, materials, products or services posted or offered at any of the Third-Party websites. The Third-Party may have a privacy and/or security policy different from that of Cumberland Advisors. Therefore, please refer to the specific privacy and security policies of the Third-Party when accessing their websites.

Cumberland Advisors Market Commentaries offer insights and analysis on upcoming, important economic issues that potentially impact global financial markets. Our team shares their thinking on global economic developments, market news and other factors that often influence investment opportunities and strategies.