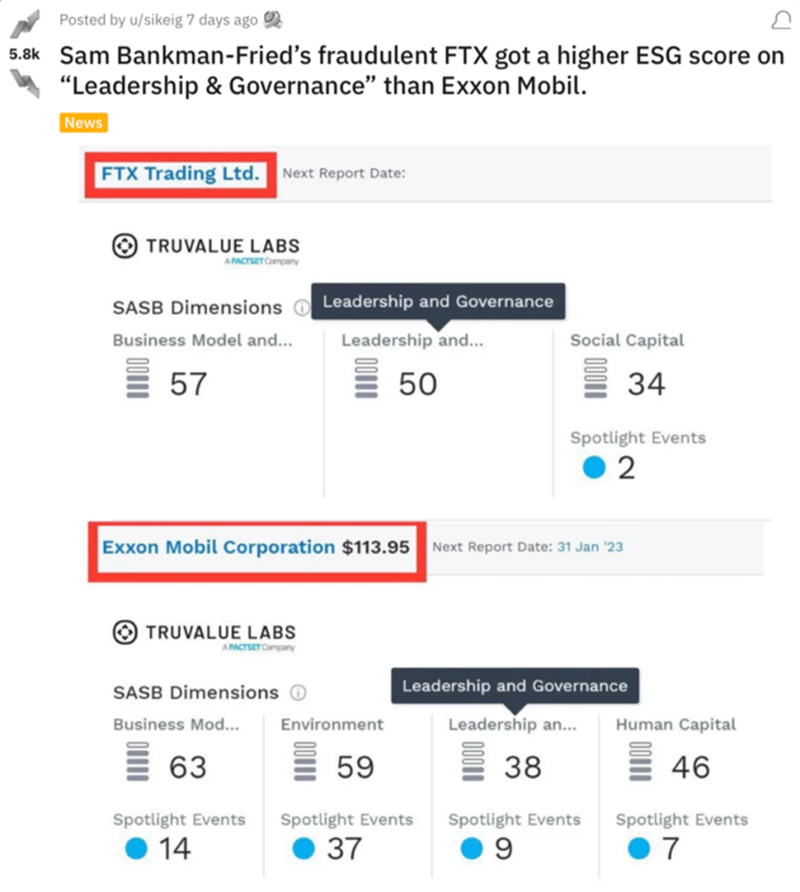

In an embarrassment to one user of ESG ratings and factor models, FactSet’s Truevalue Labs rated FTX higher than it rated Exxon in leadership and governance. Below is a screenshot of the ratings posted and tweeted. We verified this from Reddit.

An article in Financial News, forwarded by Kent D., reported on this finding: “ESG firm raises eyebrows for ranking collapsed crypto giant FTX higher on governance than Exxon Mobil,” https://www.fnlondon.com/articles/esg-firm-raises-eyebrows-for-ranking-collapsed-crypto-giant-ftx-higher-on-governance-than-exxon-mobil-20221117.

Notice that Exxon has an environmental rating. FTX does not. That is notwithstanding the fact that Bitcoin miners consume huge amounts of electricity chasing a new “coin.” Some of us use the secondary effects in evaluating ESG factors; clearly the rater here did not. Note the mile wide gap between the governance rating of a major American public company regulated under US law and complying with full disclosure and auditing standards versus the FTX fiasco of no audit, offshore regulation (or lack of it) and failed disclosure.

So, what does the AI-driven Truevalue (Factset) rating say about ESG multifactor ratings as a whole? Nothing.

ESG ratings remain what they are: a system of assessment of many factors that leads to observations and conclusions. Used correctly, they help with investment decision-making. As we have written in the past and will repeat through the links below, ESG factors can help improve investment returns for those who are willing to use them correctly.

And what does the response say about the folks who concluded that FTX had a higher governance score than Exxon? That says a lot.

Is the problem with the rating system? Or, is it with the person who assigned the rating? Readers can easily surmise the various viewpoints about this rating (or mis-rating).

Last, what does this example deliver to the political culture warriors who attack and undermine ESG without really even understanding its value-added proposition? It gives them another dart to throw. Some readers have thrown such darts in my direction because I am one of those who uses ESG factors and is not shy about saying so. So, dear dart thrower, if it makes you feel better to throw darts at me, have at it. As the movie line goes “Frankly, my dear, I don’t give a damn.”

At Cumberland, we use ESG factors in our work. We examine them in depth. We assess them in both the shorter-term realm and in the longer-term investment realm, as we do other factors that may impact investment returns.

Let me add one more opinion point to close out this commentary. We have argued that American governance authorities should not add to “moral hazard” and regulate crypto. We asked, instead, that they stay away. Many emailed me in support of that position. Those emails came from clients and readers and academics and friends who are in the governmental and central banking arena. None of them disagreed.

The only folks who disagreed with me were those who have suffered losses speculating in the crypto space or are aligned with those who have suffered losses from the fiasco. They’re angry and some are “lashing out”. Others, like a prominent hedge fund, are apologetic to their investors; that one took a $150 million loss and admitted it. Still others are now saying that the ESG principle of a reliable audit with full disclosure is a sound principle and, henceforth, they will only invest client’s money where there is an audit by one of the big 4 firms. Cumberland is a believer in the “certified audit” standard.

The ones who want a government bailout are now playing politics. One publicly has clamored for FDIC insurance coverage of crypto.

In my opinion, they are not entitled to it and don’t deserve it. They took a speculative risk. They liked the profit. But they have no stomach for the loss. Do you think such an asymmetric view should prevail? I don’t.

And please note that moral hazard-inducing schemes end up asymmetrical in the cost versus the benefit because politicians get in the way. Just take a few minutes to look at the publicly reported SBF contributions to American politicians, both Democrats and Republicans.

So here we are in the midst of an unfolding scandal, multiple investigations, growing contagion risk, various regulators and administrators examining fraud and theft, and several different national jurisdictions vying for dominance. Dear readers, this is dangerous turf now because of the political forces yelling “We have to do something!”

Those voices need a response which says NO! Let speculators win or lose, but don’t bail them out, and don’t create additional moral hazard. The horse is out of the barn. Stop chasing it.

In 1992, two prestigious giants collaborated on a book that is just as prescient today as it was thirty years ago. Paul Volcker and Toyoo Gyohten wrote Changing Fortunes: The World’s Money and the Threat to American Leadership (https://www.amazon.com/Changing-Fortunes-Worlds-American-Leadership/dp/0812922182). In that book they defined moral hazard in the glossary: “The dilemma that arises because measures taken to reduce the adverse consequences of risky behavior tend to make such behavior more likely.”

History is replete with examples of monetary fiascos funded by speculators. From the South Sea Bubble to the Teapot Dome scandal, to the Florida land deals, to the Savings & Loan crisis, to the housing finance bubble in the Great Financial Crisis, to today’s latest FTX-crypto chapter, there is a long list and that list is still being written.

As for FTX and the current fiasco, a lot more is likely to be revealed as investigations unfold. The lawyers are busy. And the new books are being drafted already. Michael L., Thomas F., James R., and Niall F., are you listening?

For a reading reference, we recommend Bubble in the Sun: The Florida Boom of the 1920s and How It Brought on the Great Depression, by Christopher Knowlton (https://www.amazon.com/Bubble-Sun-Florida-Brought-Depression/dp/1982128372).

For history we suggest Extraordinary Popular Delusions and the Madness of Crowds, by Charles Mackay (https://www.amazon.com/Extraordinary-Popular-Delusions-Harriman-Definitive/dp/0857197428/).

For some of the recent commentaries we have published on ESG, including reader responses, see the list below:

“ESG Part 1: Introduction and October 14 Conference Information,”

https://www.cumber.com/market-commentary/esg-part-1-october-14-conference-information

“ESG Part 2: Jackson, Mississippi,”

https://www.cumber.com/market-commentary/esg-part-2-jackson-mississippi

“ESG: Readers Respond re Jackson,”

https://www.cumber.com/market-commentary/esg-readers-respond-re-jackson

“ESG Part 3: The Florida Debate,”

https://www.cumber.com/market-commentary/esg-part-3-florida-debate-0

“ESG Part 4: Union County, FL,”

https://www.cumber.com/market-commentary/esg-part-4-union-county-fl

“ESG Series: More Responses,”

https://www.cumber.com/market-commentary/esg-series-more-responses

“ESG Part 5: Texas,”

https://www.cumber.com/market-commentary/esg-part-5-texas

Also, this past Sunday’s piece on readers responses to Texas, can be found on Cumberland’s website, www.cumber.com.

David R. Kotok

Chairman & Chief Investment Officer

Email | Bio

Links to other websites or electronic media controlled or offered by Third-Parties (non-affiliates of Cumberland Advisors) are provided only as a reference and courtesy to our users. Cumberland Advisors has no control over such websites, does not recommend or endorse any opinions, ideas, products, information, or content of such sites, and makes no warranties as to the accuracy, completeness, reliability or suitability of their content. Cumberland Advisors hereby disclaims liability for any information, materials, products or services posted or offered at any of the Third-Party websites. The Third-Party may have a privacy and/or security policy different from that of Cumberland Advisors. Therefore, please refer to the specific privacy and security policies of the Third-Party when accessing their websites.

Cumberland Advisors Market Commentaries offer insights and analysis on upcoming, important economic issues that potentially impact global financial markets. Our team shares their thinking on global economic developments, market news and other factors that often influence investment opportunities and strategies.