We’re planning on writing some longer-range observations this year as we celebrate 50 years of Cumberland Advisors. That’s right. It’s 2023, and it is Cumberland’s jubilee year!

By January 1973, my founding partner, the late Sheldon “Shep” Goldberg, and I were already readying the launch of a new, fee-for-service-only, registered investment advisor. Shep had a distinguished career path, starting at Bache & Co., and was managing a Manhattan office for Hutton. I was already individually registered as an investment advisor and decided to pass on a bank trust officer position. We had both had enough of the Wall Street approach to high and opaque commission incentives. We both wanted transparency and unbundled costs.

So, we engaged a New York law firm and proceeded. Shep’s friend, the late Marty Proyect, was helpful as a mentor. So was the late Richard “Dick” Blair when we needed original transactions’ clearing and custody.

Cumberland’s official starting date was June 18, 1973. Why that date? Because in those days you applied with paperwork, and the approval came in a letter from Washington. That was the date on the letter.

We started in a two-room office at 718 Landis Avenue in Vineland, NJ. We shared a part-time secretary-assistant, the late Lea Shapiro. Some friends, some of my few private clients, some of Shep’s former brokerage customers, and some family members helped us get started. Our assets under management (AUM) when we launched were a few million.

Then all hell broke loose.

The next 18 months saw a shooting war (October, 1973) in the Middle East, oil quadrupling in price from $3 to $12 a barrel, interest rates rising (by 1974) to the highest levels since the American Civil War, a full-blown recession erupting in America, the country contending with gas lines and shortages, inflation surging and unemployment rising, and Nixon’s resignation in lieu of impeachment. The Dow fell over 40% from around 1000 to around 600.

That was Cumberland’s birth welcome to the money management world.

It's 50 years later, and I look back at that beginning with nostalgia and appreciation. Starting out in an excruciating bear market turns out to be the best preparation for the money management business. We learned quickly how humbling it is. Facing surging inflation, rising interest rates, and an economic shock was important. We had to make portfolio decisions with the wind in our faces, not at our backs.

During this coming year, I will try to share some observations and lessons learned from the half century of Cumberland’s existence. Some writings will be autobiographical, others analytical, and still others will relate personal experiences along the way.

Here’s a single example.

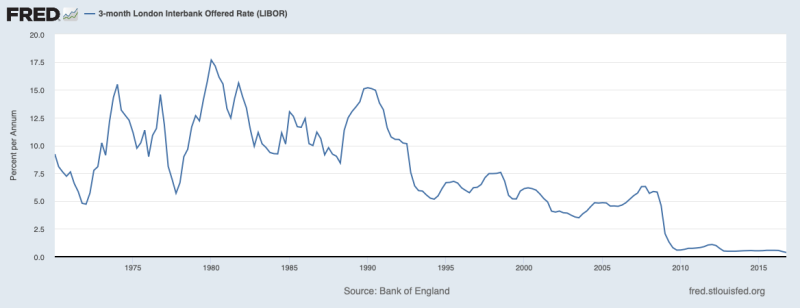

The interest rate on commercial activity is a most critical element for valuing assets and rendering investment advice. Much activity is spent trying to determine what the future interest rate will be and what will change along the way to alter the forecast view. For most of the half century of Cumberland’s existence, the London Interbank Offering Rate (LIBOR) was the critical interest rate. LIBOR started in 1970, and it is ending now. Never did I expect that Cumberland would outlast LIBOR.

Below is a graphic from FRED (St. Louis Federal Reserve Bank data obtained from the Bank of England database). Here’s the history of what was the most important commercial interest rate in the world for decades.

(Bank of England, 3-month London Interbank Offered Rate (LIBOR) [LIOR3M], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/LIOR3M, December 27, 2022. FRED chart based on copyrighted data from the Bank of England’s resource, A Millennium of Macroeconomic Data for the UK, https://www.bankofengland.co.uk/statistics/research-datasets. For more information, please refer to the Three Centuries spreadsheet.)

I look back at the years and the degree of LIBOR fluctuation depicted above and observe how wrong nearly every long-term forecast of interest rates turned out to be. I recall sitting in private consulting meetings with a very young Larry Summers and his esteemed late colleague Rudi Dornbusch as they tried to predict the direction and levels of interest rates. That was my job as the young CIO and economist at the new Cumberland, and I wanted to hear and absorb the thinking of as many others with expertise as I could.

Today, Cumberland measures its AUM in billions, not millions. Our seasoned veterans in forecasting and economics and interest rates and finance include Bill Witherell (OECD), Bob Eisenbeis (Federal Reserve), and now David Berson (Nationwide & Fannie Mae). Seasoned portfolio managers include John Mousseau (bonds), Matt McAleer (ETFS & equities), and Patty Healy (credit), all of whom are ably assisted by other experienced veterans.

Cumberland has over 40 staff members and measures accounts in the thousands and in nearly every state. And we are still a fee-for-service independent investment advisor.

And here we are again confronting a shooting war, inflation, an oil price shock, rising interest rates, a recession risk, and political division in an America recently presided over by a controversial president.

After 50 years, I guess some things never change.

And I guess I will have to go to work tomorrow.

Welcome to 2023.

David R. Kotok

Chairman & Chief Investment Officer

Email | Bio

Links to other websites or electronic media controlled or offered by Third-Parties (non-affiliates of Cumberland Advisors) are provided only as a reference and courtesy to our users. Cumberland Advisors has no control over such websites, does not recommend or endorse any opinions, ideas, products, information, or content of such sites, and makes no warranties as to the accuracy, completeness, reliability or suitability of their content. Cumberland Advisors hereby disclaims liability for any information, materials, products or services posted or offered at any of the Third-Party websites. The Third-Party may have a privacy and/or security policy different from that of Cumberland Advisors. Therefore, please refer to the specific privacy and security policies of the Third-Party when accessing their websites.

Cumberland Advisors Market Commentaries offer insights and analysis on upcoming, important economic issues that potentially impact global financial markets. Our team shares their thinking on global economic developments, market news and other factors that often influence investment opportunities and strategies.