The Bureau of Alcohol, Tobacco, Firearms and Explosives began a controlled fire on April 29th, 2025, as part of its ongoing investigation into the cause of the devastating Palisades Fire in California. The very next morning, the retail order period began for a $990-million-dollar debt issuance to fund the Los Angeles Department of Water and Power (LADWP), the municipal bond issuer who arguably will be most impacted by both the results of that ATF probe and the ongoing legal challenges related to the Palisades Fire.

This power system revenue bond deal was the first time LADWP has come to market since the devastation, whereby concerns arose quickly around potential liability related to both the cause and response to the event. In January, we published an article titled “Fire Exit,” discussing the bonds in light of inverse condemnation regulations in California, the risk of liability to LADWP, and possible scenarios of bond upside and downside performance in the near to mid term. At the time, the cause of the Palisades Fire was a complete unknown, and LADWP was fully in the crosshairs.

Today, many people are pointing to smoldering ashes from a smaller fire that started from fireworks on New Year’s Day, while arson has not been ruled out, nor has negligence, as the area has trails and foot traffic. LADWP bondholders’ initial fears that the fire was started by a transformer or power line have been reduced, though they cannot be fully eliminated yet. However, there have been reports that there are no power poles near the currently suspected point of origin. Though the risk is not zero, it appears significantly less likely that the initial spark came from LADWP infrastructure. The larger unknown risk to LADWP relates to liability and inverse condemnation laws regarding infrastructure decisions, such as keeping the Santa Ynez Reservoir offline and empty during the fire, and/or negligence in not de-energizing power lines, which potentially led to additional ignitions. These accusations are being denied and challenged by LADWP, one argument being that they are not required to provide firefighting water without a contract to do so.

All this said, the deal this week was a critical test to measure investor confidence in the utility’s creditworthiness. On January 14th, 2025, S&P downgraded LADWP’s power system revenue bonds from AA- to A with a negative outlook and also two-notched its water revenue bonds from AA+ to AA- with a negative outlook. The downgrades reflected concerns over potential liabilities, litigation risks, and emergency preparedness in the wake of the wildfires. Interestingly, LADWP did not contract S&P ratings for this bond issue, leaning instead into Moodys Aa2 (Negative), Fitch AA- (Negative), and Kroll AA (Stable). As we previously wrote, the Palisades Fire itself was one factor for risk outlook; but the market’s heightened concerns regarding embedded fire-related risks will persist, particularly in California, given the state’s liability laws.

Market Reaction: Spreads Widen Following the Wildfires

The immediate aftermath of the Palisades Fire saw significant volatility in LADWP bond spreads. Prior to the fires, LADWP was trading in many areas of the credit curve at 10 to 20 basis points below the national Bloomberg AAA scale, reflecting both significant investor confidence and ongoing demand for highly rated California bonds. During the fires, traders had difficulty finding clearing levels and liquidity, with bonds of differing structures trading at times between +40 to +80 basis points higher than the AAA scale, with water revenue bonds holding in better than power revenue bonds.

BAM Insurance: A Cushion Against Market Uncertainty

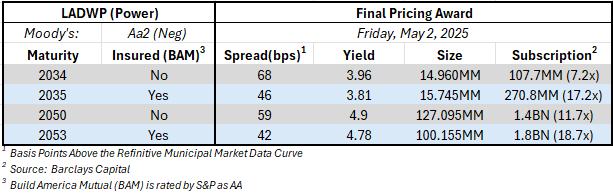

One notable feature of LADWP’s latest issuance was the inclusion of Build America Mutual (BAM) insurance on select maturities. BAM’s backing provides an additional layer of security for investors, helping to reduce concerns over liability risk. When BAM insures a bond, it is insuring both the principal and interest payments over the investment period. In this week’s deal, the differential between insured and uninsured LADWP bonds was evident in both pricing and investor appetite.

Below is a picture of the pricing differentials between insured and uninsured LADWP bonds during the deal, from both a demand and spread standpoint.

The entire deal did extremely well from a subscription standpoint. That said, the charted results show that uninsured bonds required higher spreads and saw weaker relative demand, as investors weighed the risks associated with potential wildfire-related liabilities. In contrast, BAM-insured maturities attracted even more significant interest, benefiting from the perceived stability of the insurance guarantee. This divergence underscores the value of credit enhancement for issuers facing significant environmental and legal uncertainties.

Valuation

In both cases, the spreads were significantly higher than for other California issuers with similar ratings. Ten-year, AA-/Aa2 California State general obligation bonds currently trade around +10/AAA scale, and A1/AA- San Francisco Unified School District 10-year bonds are valued in the secondary around +22/AAA scale.

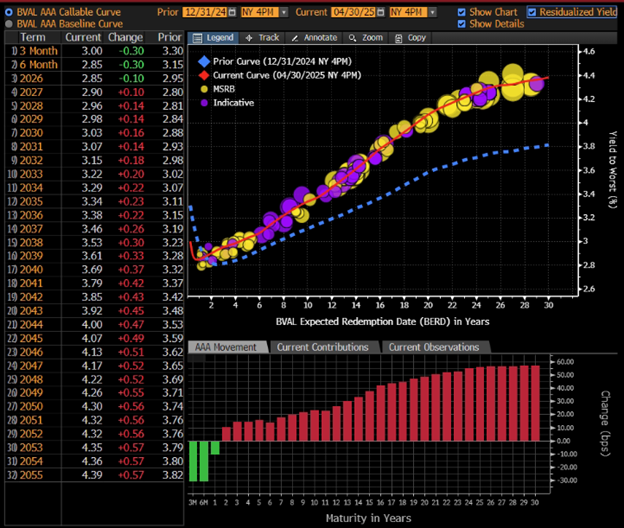

Investors who exited their LADWP position early in the year may have had the ability to re-enter the name in this week’s deal, while spreads were still under pressure, but this time potentially obtaining the insurance wrapper. In fact, in terms of overall yields, over the first four months of 2025 the 10-year Bloomberg AAA scale has increased 23 basis points, and the 30-year has increased 57 basis points. Therefore, some investors may have locked in a similar or even higher all-in yield versus the bonds they sold during the fire, while also potentially obtaining the insurance benefit from BAM-insured maturities within the deal.

Change in the BVAL AAA municipal curve over the first four months of 2025:

*Source: Bloomberg LP

The bonds may provide notable upside if the issuer avoids cause, as expected by many, and then can manage its other related lawsuits effectively. LADWP will likely focus on its infrastructure and on strengthening risk management moving ahead, as discussed in its 2024–2025 strategic plan. Further, the consistently high demand for California-based bonds will likely continue and provide some consistent tailwind should LADWP manage litigation and execute goals successfully. However, risks remain, and the BAM-insured maturities do provide additional support.

Looking Ahead

As LADWP navigates the financial and operational challenges posed by the Palisades Fire, investor sentiment will continue to be shaped by litigation outcomes, regulatory developments, and future credit rating actions. The controlled burn initiated to investigate the fire’s cause and potential negligence or mismanagement of power lines or water reservoirs adds another layer of complexity, but the resolution of questions surrounding the cause of the fire will eliminate much of the uncertainty around LADWP, and the market will move forward with new information.

Despite these uncertainties, the strong demand for the deal and, in particular, the BAM-insured bonds, suggest that investors remain willing to engage with LADWP — particularly if there are increased safeguards in place.

Resources

“LADWP Strategic Plan, 2023–2026,”

https://www.ladwp.com/sites/default/files/2024-05/Fiscal%20Year%202024-2025%20Strategic%20Plan.pdf

“ATF conducts first of series of controlled fire testing in Palisades area,”

https://www.nbclosangeles.com/news/local/atf-conducts-first-night-of-series-of-controlled-fire-testing-in-palisades-area/3689744/

“ATF Continues Investigation Into Palisades Fire Cause, Which Includes Controlled Burn,”

https://www.yahoo.com/news/atf-continues-investigation-palisades-fire-191050361.html

“Investigators comb a scorched slope to solve a mystery: How did the Palisades Fire start?”

https://www.nbcnews.com/news/us-news/palisades-fire-start-investigators-comb-scorched-slope-solve-mystery-rcna187712

“What was the cause of the Pacific Palisades fire?”

https://www.independent.co.uk/news/world/americas/la-fires-palisades-cause-arson-santa-ana-winds-b2679010.html

“Lawsuits claim LADWP power lines caused Palisades Fire, claim cover-up,”

https://www.dailyjournal.com/articles/384513-lawsuits-claim-ladwp-power-lines-caused-palisades-fire-claim-cover-up

“LA Municipal Utility Says No Evidence Energized Power Line Caused Fire,”

https://www.claimsjournal.com/news/national/2025/03/26/329689.htm

“Pimco Warns LA City Utility Faces Steep Liabilities After Fires,”

https://www.claimsjournal.com/news/national/2025/01/30/328697.htm

“Eaton & Palisades Fires Update | Lawsuits Reveal Allegations of Negligence by Southern California Edison & LADWP,”

https://southpasadenan.com/catastrophic-wildfires-in-southern-california-lawsuits-reveal-allegations-of-negligence-by-southern-california-edison-and-ladwp/

“LADWP faces lawsuit over Palisades Fire,”

https://www.dailyjournal.com/articles/382862-ladwp-faces-lawsuit-over-palisades-fire

“LADWP Cites 114-Year-Old Court Ruling to Defend Against Lawsuits Over Pacific Palisades Fire,”

https://palisadesnews.com/ladwp-cites-114-year-old-court-ruling-to-defend-against-lawsuits-over-pacific-palisades-fire/

“LA Water Department Sued Over Wildfire Response,”

https://www.newsweek.com/la-water-department-sued-wildfire-response-2015113

“LADWP Sued in Connection with Palisades Fire,”

https://www.kabc.com/2025/01/16/ladwp-sued-in-connection-with-palisades-fire/

Benjamin C. Pease

EVP & Managing Director of Asset Management | Chief Innovation Officer

Feedback | Bio

Sign up for our Market Commentaries

Cumberland Advisors Market Commentaries offer insights and analysis on upcoming, important economic issues that potentially impact global financial markets. Our team shares their thinking on global economic developments, market news and other factors that often influence investment opportunities and strategies.

Links to other websites or electronic media controlled or offered by Third-Parties (non-affiliates of Cumberland Advisors) are provided only as a reference and courtesy to our users. Cumberland Advisors has no control over such websites, does not recommend or endorse any opinions, ideas, products, information, or content of such sites, and makes no warranties as to the accuracy, completeness, reliability or suitability of their content. Cumberland Advisors hereby disclaims liability for any information, materials, products or services posted or offered at any of the Third-Party websites. The Third-Party may have a privacy and/or security policy different from that of Cumberland Advisors. Therefore, please refer to the specific privacy and security policies of the Third-Party when accessing their websites.