We thank readers for their comments about the writings we are offering to explain the machinations of the tax-free municipal bond market. I can arrange a direct discussion with our firm for anyone interested in greater detail. Just email me.

Today’s commentary is in response to several folks who asked for a real-world example and explanation. So, let’s get to a specific example.

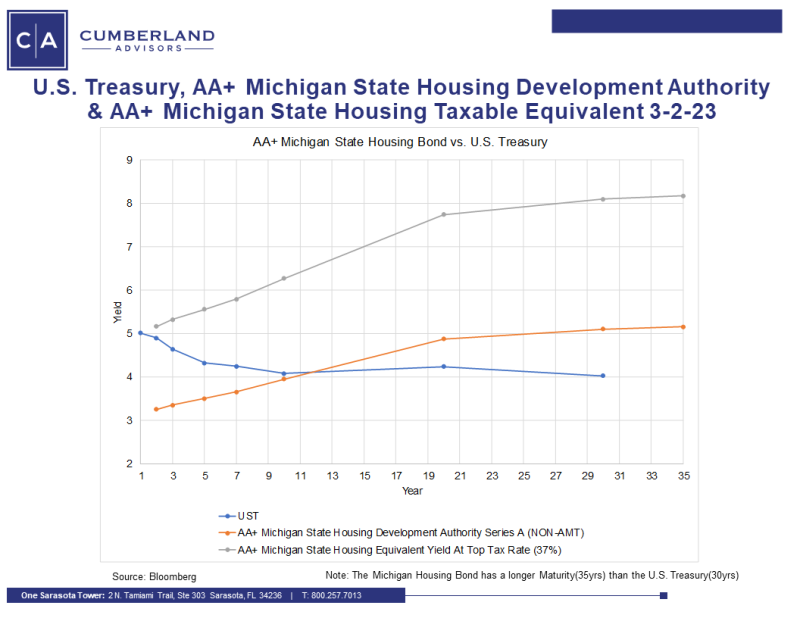

The chart below is based on actual market prices on March 2. The US Treasury yield curve data comes from Bloomberg. The Michigan State Housing bond issue data comes from the final and now publicly available pricing schedule of this new municipal bond issue. These prices and maturities are live prices at that point in time (March 2).

Note that the Michigan issue is a large issue, so it had plenty of liquidity. Of course, the US Treasury bill, note, and bond market is one of the most liquid markets in the entire world. Also note that US Treasury issues are all fully taxable to an American taxpayer who owns them. The Michigan issue, on the other hand, is tax-free to all American taxpayers when it comes to federal taxes. It is also tax-free to Michigan taxpayers and to taxpayers in certain other states. Florida is one of those states.

Here’s the chart.

Now let’s discuss what you see in this “picture worth a thousand words.”

- The US Treasury yield curve is inverted, which means the shortest-maturity Treasury (one-year) is yielding near 5%, and the yields decline as the maturity schedule becomes progressively longer. Note that the 30-year US Treasury bond is yielding about 4%.

- The Michigan tax-free bond yield curve is positively sloped, which means the shorter maturity is the lowest and yields rise progressively as the maturity lengthens. Note that the shortest maturity yield for Michigan is about 3% and the longest maturity is over 5%.

- The third curve is the taxable equivalent yield. That is a hypothetical yield created by “grossing up” the tax-free yield to what it would be if the buyer of the bond substituted a taxable bond for the tax-free bond. We use the maximum 37% tax bracket for this estimate. So, if your tax bracket is lower than the maximum federal rate, the grossed-up number would require a separate calculation to determine your personal taxable equivalent yield.

- Also, note that the Michigan housing bond is a very-high-grade credit with little likelihood of default and with security collateral backing the payments. The US Treasury is deemed the highest-quality credit, even though payment requires the Congress of the United States to pass a debt-limit extension or adjustment. The State of Michigan doesn’t have that legal option. Neither does any other sovereign state. However, of the 50 states, none has defaulted except for Arkansas, which temporarily failed to pay bondholders during the Great Depression era in the 1930s. Arkansas subsequently made up the entire shortfall to the Arkansas bondholders.

Here’s what Cumberland did.

For appropriate clients we bought the Michigan long-term bond at a yield to the client above 5%. And that is a tax-free result. Please remember that the client starts earning that “book yield” from the first day and throughout the life of the bond. There is a sinking fund and structure in place that is designed to pay off the entire bond issue as scheduled.

Why was this long-term bond so cheap compared to other bonds? The pricing seems to make no sense. Remember, these are market-based prices and not opinions of pundits or analysts.

Here’s why. The institutional retail municipal bond buyers are on strike. They’re “scared” — in my opinion, they are frightened by the headlines. So, they are withdrawing their money from the institutional mutual funds that would otherwise be buyers of this bond. In fact, those funds are sellers generally and because of the outflows are not buyers. We are seeing reported outflow rates of about $1 billion a week.

Here’s how this works in normal times.

I’m a fund manager. I get some redemptions, so I have to raise cash to pay out the money. I have no choice but to sell something. Normally, I pick up the phone (or send an email) to someone I know at another institution, and I offer the bond I want to sell. The response is usually yes if that institution has cash inflows and is looking for an enhanced position. So, I very efficiently “cross” my bond in a sale to that institution. I sell; they purchase. I do this trade at a very low brokerage commission cost.

But all this changes when the institutions are getting redemption requests. I must sell. My friend at the other institution also must sell. So must others. So there is no cross sale. And we are busily competing against each other to exit positions. Thus, we are forcing prices lower and yields higher. We have no choice. Michigan Housing bonds were sold into this environment. That’s why they were so cheap.

What about Cumberland?

We manage billions in bonds. But we are not a fund, and we don’t have to sell or buy. We are a separate account manager, so we can pick and choose our spots for entry and exit. That is why we were able to buy a longer-term very-high-grade muni with a yield of over 5% for our clients accounts where that bond is an appropriate addition for that client.

Note that the Michigan bond tax-free yield is equivalent to about 8% as a taxable longer-term investment return. And it has liquidity if you have to sell it in a hurry for an emergency. And it can be “swapped” if you need to do tax swaps for income-tax planning purposes.

Think about what other options exist that have these characteristics and are currently subject to taxation. There are many options for investors. But how many have very-high-grade credit quality and liquidity in an emergency and are likely to hold the permanent tax advantage in spite of an unpredictable and unwieldy Congress and political arena.

That’s something to think about.

Any reader interested in more detail on how we do this is welcome to email me for information.

David R. Kotok

Chairman & Chief Investment Officer

Email | Bio

Links to other websites or electronic media controlled or offered by Third-Parties (non-affiliates of Cumberland Advisors) are provided only as a reference and courtesy to our users. Cumberland Advisors has no control over such websites, does not recommend or endorse any opinions, ideas, products, information, or content of such sites, and makes no warranties as to the accuracy, completeness, reliability or suitability of their content. Cumberland Advisors hereby disclaims liability for any information, materials, products or services posted or offered at any of the Third-Party websites. The Third-Party may have a privacy and/or security policy different from that of Cumberland Advisors. Therefore, please refer to the specific privacy and security policies of the Third-Party when accessing their websites.

Cumberland Advisors Market Commentaries offer insights and analysis on upcoming, important economic issues that potentially impact global financial markets. Our team shares their thinking on global economic developments, market news and other factors that often influence investment opportunities and strategies.