Cumberland has utilized separately managed accounts (SMAs) to execute its fixed-income strategy since the company’s inception in 1973, long before SMAs were popularized in the early 2000s.

The reasons for managing money in this fashion are the same today as they were then:

- Transparency (you know what you own)

- Flexibility to make strategic changes

- Ability to manage transaction costs and best execution

- Active management

SMAs offer individually catered portfolio management to address clients’ objectives, including tax management, income production, state-specific needs, cash flow-specific needs, and ability to institute investment restrictions. SMAs differ from pooled vehicles like mutual funds in that each portfolio is unique to a single account.

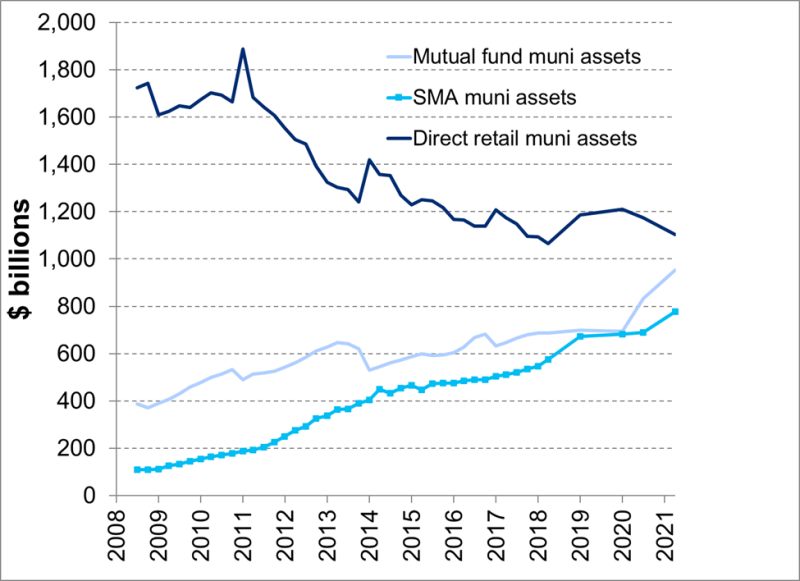

Growth in SMAs: Federal Reserve Funds Flow Data

The advantages of SMAs have led to their increased use by investors. According to Citi Research, SMA municipal fixed-income assets, both taxable and tax-exempt, have grown from $100 billion in 2008 to $776 billion at the end of Q2, 2021. The SMA details are not separately reported by the Federal Reserve, so Citi Research uses a survey of its customers and Federal Reserve flow of funds data to arrive at an estimate. Note, in the charts below, that the rate of growth of SMA municipal and mutual fund assets has grown while direct retail has declined. SMA growth had been higher than mutual fund growth, but more recently mutual fund growth has been greater.

Mutual fund performance is affected by fund flows and herd mentality and thus presents opportunities for active fixed-income management. Flows into and out of mutual funds can turn very quickly. When investors are dumping assets, the mutual fund portfolio manager may not be able to fully practice active management and must liquidate funds as required by redemptions. In these cases, the most liquid and generally higher-quality assets may be sold first in order to minimize effects on net asset value (NAV). Alternatively, when assets are pouring into mutual funds, the increased demand for assets results in higher prices and can present a selling opportunity for SMA managers.

Supply and demand can affect bond performance. The tax-exempt municipal supply has been affected by changes in the Tax Cut and Jobs Act that no longer allow municipalities to refinance certain bonds. These changes have led to an increase in the issuance of taxable muni bonds. Tax-exempt bonds enjoy strong demand from US investors, especially in high-tax states. Taxable munis see demand from crossover buyers that have become more familiar with the US municipal bond market. At Cumberland Advisors we use mostly taxable munis in our taxable strategies.

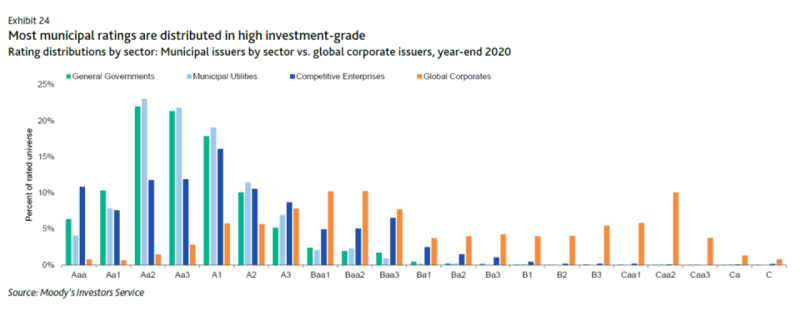

Municipal Bond Credit Quality

Municipal bonds in general have higher ratings than and less correlation to corporate bonds, as well as higher yields compared to other worldwide offerings.

Efficiencies

At Cumberland we buy bonds in large lots and allocate positions to individual portfolios, a strategy which allows for better execution and pricing for our clients compared with doing individual trades for each client.

Retail accounts do not enjoy the economies of scale that are available to an SMA manager. In addition, active SMA managers that practice total-return investing may have credit-research resources and relationships with many broker dealers that allow them to achieve competitive execution and develop strategies to optimize investment holdings to meet individual clients’ needs.

While mutual fund shares can be purchased and sold any day in any amount, an SMA account has many individual holdings that may take longer to sell. However, when an investor sells shares in a mutual fund, the price received is calculated at the end of the day, based on the net asset value of the fund. If an investor is instead invested in high-quality liquid bonds like the ones Cumberland purchases in its accounts, then barring an extraordinary event in the market, there should be ample liquidity, and the bonds will be sold at a time that maximizes price. Additionally, knowledge of our clients’ needs has Cumberland looking ahead to provide liquidity when needed. SMAs can also give every client the advantage of providing the portfolio manager with sectors or categories, such as “green” or “ESG,” to be excluded or included. Customization is not possible with a mutual fund.

Separately managed accounts generally have higher minimum investment requirements than mutual funds, ETFs, and robo advisors do, so they are not available to all investors. But as an investor acquires more assets and develops more highly tailored goals and objectives, an SMA may be appropriate.

Finally, the management fee charged on SMA accounts can be affected by the competitive environment. The fee is based on the type of strategy and can be scaled based on the level of assets invested. There may also be custodial fees charged to the account. Mutual funds have an expense ratio, which includes a management fee as well as miscellaneous ancillary expenses, custodial expenses, and a distribution charge. Many have various levels of sales charges. So it is important to look at all expenses when comparing funds.

Is the Bond Rally Over?

We have been in a 40-year rally in the bond market; and although rates are rising, yields remain low; and worldwide negative rates are becoming less negative.

If you don’t pay attention to points of entry and the other details, you can miss out on performance. Similarly, in an increasing interest-rate environment – which may be upon us, given the potential for rising inflation – points of entry and exit can affect performance. The use of a barbell strategy allows us to invest in various short-term instruments that are liquid and to use them as ammunition to buy longer-dated bonds when interest rates rise or to take advantage of the higher coupons of longer-maturity bonds compared with shorter-dated bonds. Floating-rate notes and inflation-protected securities are investments that can help returns in the face of inflation and rising interest rates.

We are addressing municipal assets in this commentary; however, we also manage taxable fixed-income, equity, and balanced accounts. In managing equity accounts, we utilize exchange-traded funds (ETFs) and actively conduct sector rotation. Exchange-traded funds allow more flexibility and generally lower total trading costs than individual-stock portfolios do. We will consider using fixed-income ETFs in smaller balanced accounts to get the benefit of diversification.

The Cumberland Approach

At Cumberland we have a top-down approach to investment management. We look at global macroeconomic conditions and policies to assess interest rates and growth prospects and position our portfolios accordingly. Each market and/or sector is evaluated as to how it fits in the global outlook as well as how its idiosyncratic elements may affect supply and credit quality.

The majority of our fixed-income portfolios are managed on a total-return basis using a barbell strategy to try to take advantage of changes in interest-rate and technical movements more quickly. In a total-return account, the return is measured against a benchmark, which is usually an index that is widely recognized. Outperformance may mean that individual portfolio returns are less negative than the benchmark’s or that positive returns are greater than the benchmark’s.

Fixed-income total-return investing takes into consideration price appreciation or depreciation and the effects of coupon income generated and reinvested. Coupon payments over time are a large contributor to the return of an account, but the timing of buying and selling and where along the curve to buy or sell can greatly impact returns. Other buy-sell considerations include duration, or the sensitivity of a bond to changes in interest rates, embedded options such as call features, supply and demand, coupon structure, and credit-quality trends. All of these can affect the performance of a portfolio relative to an index or benchmark. Finally, to quote Cumberland’s John Mousseau, “Active management means active thinking, not always active trading.”

At Cumberland we continue to operate as our founders did, investing clients’ funds in separately managed accounts. Our approach to investing is top-down and takes account of global interest-rate expectations and credit-quality trends. Accounts are actively managed with a total-return or income orientation, depending on clients’ needs.

Links to other websites or electronic media controlled or offered by Third-Parties (non-affiliates of Cumberland Advisors) are provided only as a reference and courtesy to our users. Cumberland Advisors has no control over such websites, does not recommend or endorse any opinions, ideas, products, information, or content of such sites, and makes no warranties as to the accuracy, completeness, reliability or suitability of their content. Cumberland Advisors hereby disclaims liability for any information, materials, products or services posted or offered at any of the Third-Party websites. The Third-Party may have a privacy and/or security policy different from that of Cumberland Advisors. Therefore, please refer to the specific privacy and security policies of the Third-Party when accessing their websites.

Cumberland Advisors Market Commentaries offer insights and analysis on upcoming, important economic issues that potentially impact global financial markets. Our team shares their thinking on global economic developments, market news and other factors that often influence investment opportunities and strategies.