Cumberland has utilized separately managed accounts (SMAs) to execute its fixed-income strategy since the company’s inception in 1973, long before SMAs were popularized in the early 2000s.

The reasons for managing money in this fashion are the same today as they were then:

- Transparency (You know what you own.)

- Flexibility to make strategic changes

- Ability to manage transaction costs and best execution

- Active management

SMAs offer individually catered portfolio management to address clients’ objectives, including tax management, income production, state-specific needs, cash flow-specific needs, and ability to institute investment restrictions. SMAs differ from pooled vehicles like mutual funds in that each portfolio is unique to a single account.

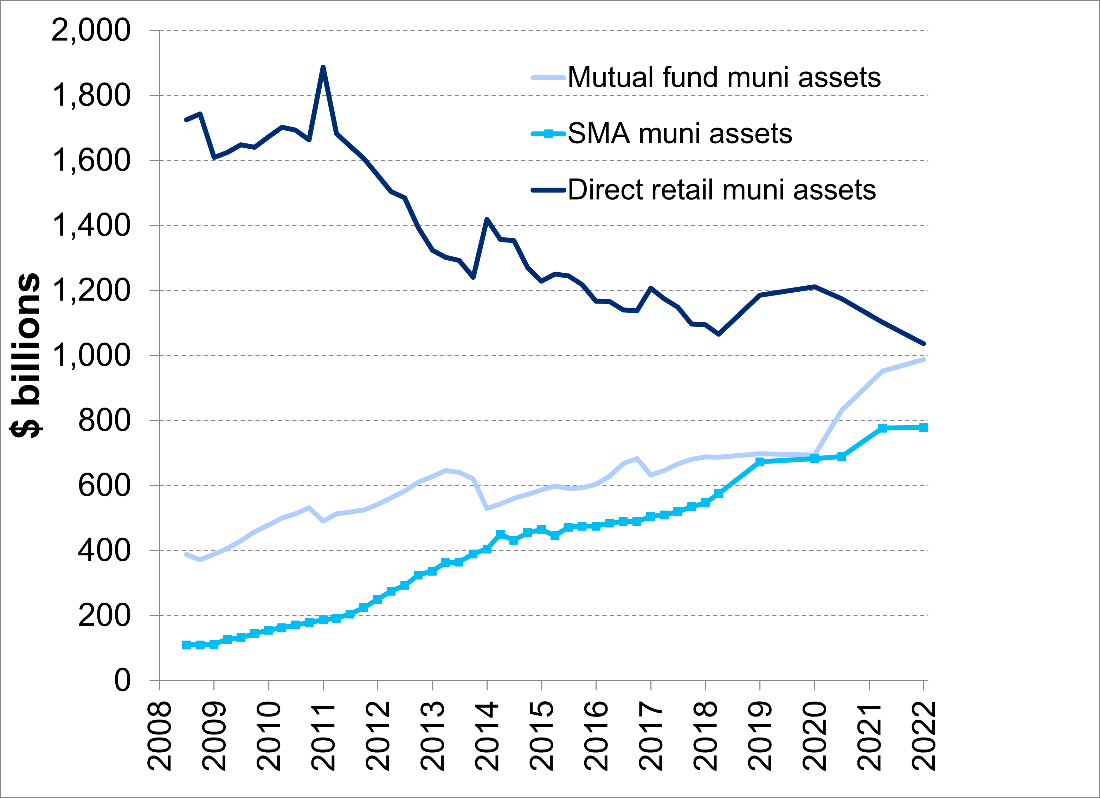

Growth in SMAs: Federal Reserve Funds Flow Data

The advantages of SMAs have led to their increased use by investors. According to Citi Research, SMA municipal fixed-income assets, both taxable and tax-exempt, have grown from $100 billion in 2008 to $779 billion in Q4 2021. SMA details are not separately reported by the Federal Reserve, so Citi Research uses a survey of its customers and Federal Reserve flow of funds data to arrive at an estimate. Note in the charts below that SMA municipal and mutual fund assets have increased while direct retail has declined. SMA growth had been higher than that of mutual funds, but more recently mutual fund growth has been greater. ETFs have been gaining in popularity for their ease of trading, low fees, and pricing throughout the day; however, they remained a small portion of the market at $83 billion at year end 2021.

Fund Flows

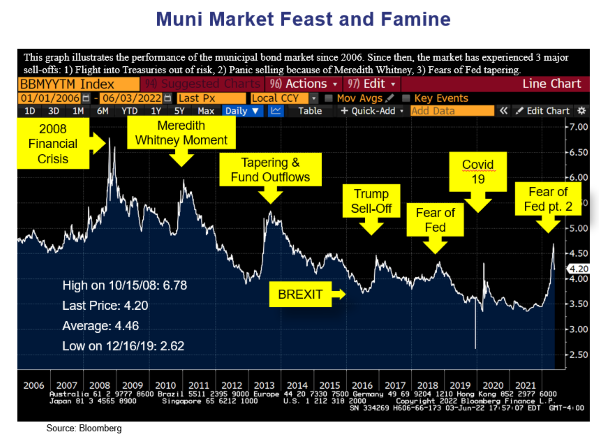

Mutual fund performance is affected by fund flows and herd mentality and thus presents opportunities for active fixed-income management. Flows into and out of mutual funds can turn very quickly. When investors are dumping assets, the mutual fund portfolio manager may not be able to fully practice active management and must liquidate funds as required by redemptions.

This trend was abundantly clear over the past three months as mutual funds experienced outflows totaling over $60 billion as fear of inflation and Fed action loomed. Muni yields rose faster than Treasurys did, and the ratio of muni yields to Treasury yields in the long end was over 100%. So an investor could have a yield over 4%; and depending on which state the investor lives in, the taxable equivalent yield could be 6 – 7%. John Mousseau's April 14, 2022 commentary, "Fore!," notes that muni yields had risen to attractive levels.

The run-up in rates was swift, and the move back to a more normal level of interest rates was also somewhat swift. A manager positioned appropriately can take advantage of such opportunities. Heavy outflows have occurred numerous times over the past ten years: the Covid-19 sell-off in March 2020, fear of the Fed in 2018, and the run-up in rates after Trump’s election, to mention a few.

Supply and Demand

Supply and demand can affect bond performance. The tax-exempt municipal supply has been affected by changes introduced in the Tax Cut and Jobs Act, which no longer allow municipalities to refinance certain bonds. These changes have led to an increase in the issuance of taxable muni bonds. Tax-exempt bonds enjoy strong demand from US investors, especially in high-tax states. Taxable munis see demand from crossover buyers that have become more familiar with the US municipal bond market. At Cumberland Advisors we use mostly taxable munis in our taxable strategies.

Seasonal supply and demand shifts also provide opportunities for investing or exiting a position. For example, muni bond demand is generally strong in June, July, and August with reinvestment of coupon payments, maturities, and call proceeds.

Municipal Bond Credit Quality

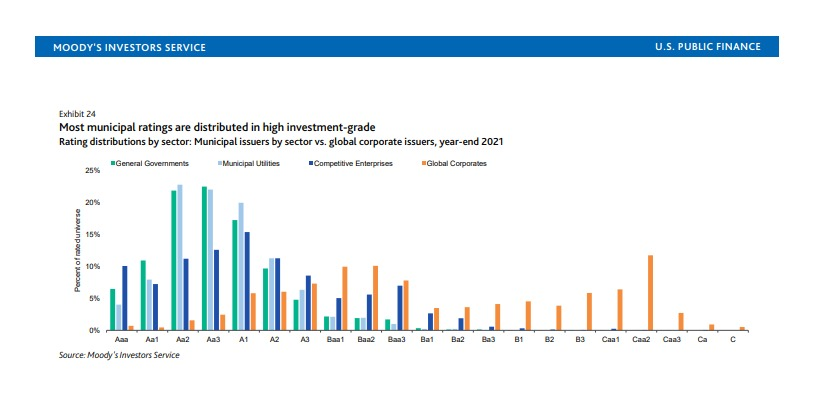

Municipal bonds in general have higher ratings, less correlation to corporate bonds, and higher yields than other worldwide offerings. Moody’s data show that many muni bonds are rated in the Aa category while corporate bond ratings are skewed to the lower ratings, including non-investment-grade and many in the Baa category.

Efficiencies

At Cumberland we buy bonds in large lots and allocate positions to individual portfolios, a strategy which allows for better execution and pricing for our clients compared with doing individual trades for each client.

Retail accounts do not enjoy the economies of scale that are available to an SMA manager. In addition, active SMA managers that practice total-return investing may have credit-research resources and relationships with many broker dealers that allow them to achieve competitive execution and develop strategies to optimize investment holdings to meet individual clients’ needs.

While mutual fund shares can be purchased and sold any day in any amount, an SMA account has many individual holdings that may take longer to sell. However, when an investor sells shares in a mutual fund, the price received is calculated at the end of the day, based on the net asset value of the fund. If an investor is instead invested in high-quality liquid bonds like the ones Cumberland purchases in its accounts, then barring an extraordinary event in the market, there should be ample liquidity, and the bonds could be sold at a time that maximizes price. Additionally, knowledge of our clients’ needs has Cumberland looking ahead to provide liquidity when needed. SMAs can also give every client the advantage of providing the portfolio manager with sectors or categories to be excluded or included for a client’s desired impact, such as no tobacco-related securities or an emphasis on education or water quality. Customization is not possible with a mutual fund.

Separately managed accounts generally have higher minimum investment requirements than mutual funds, ETFs, and robo advisors do; so they are not available to all investors. But as an investor acquires more assets and develops more highly tailored goals and objectives, an SMA may be appropriate.

Finally, the management fee charged on SMA accounts can be affected by the competitive environment. The fee is based on the type of strategy and can be scaled based on the level of assets invested. There may also be custodial fees charged to the account. Mutual funds have an expense ratio, which includes a management fee as well as miscellaneous ancillary expenses, custodial expenses, and a distribution charge. Many have various levels of sales charges. So, it is important to look at all expenses when comparing funds.

The Cumberland Approach

At Cumberland we have a top-down approach to investment management. We look at global macroeconomic conditions and policies to assess interest rates and growth prospects and position our portfolios accordingly. Each market and/or sector is evaluated as to how it fits in the global outlook as well as how its idiosyncratic elements may affect supply and credit quality.

The majority of our fixed-income portfolios are managed on a total-return basis using a barbell strategy to take advantage of changes in interest-rate and technical movements more quickly. The use of a barbell strategy allows us to invest in various short-term instruments that are liquid and to use them as ammunition to buy longer-dated bonds when interest rates rise or to take advantage of the higher coupons of longer-maturity bonds compared with shorter-dated bonds. Floating-rate notes and inflation-protected securities are investments that can help returns in the face of inflation and rising interest rates.

Returns of an account are measured against a benchmark, which is usually an index that is widely recognized. Outperformance may mean that individual portfolio returns are less negative than the benchmark’s or that positive returns are greater than the benchmark’s return.

Fixed-income total-return investing takes into consideration price appreciation or depreciation and the effects of coupon income generated and reinvested. Coupon payments over time are a large contributor to the return of an account, but the timing of buying and selling and the choice of where along the curve to buy or sell can greatly impact returns. Other buy-sell considerations include duration, or the sensitivity of a bond to changes in interest rates; embedded options such as call features; supply and demand; coupon structure; and credit-quality trends. All of these can affect the performance of a portfolio relative to an index or benchmark. Finally, to quote Cumberland’s John Mousseau, “Active management means active thinking, not always active trading.”

At Cumberland we continue to operate as our founders did, investing clients’ funds in separately managed accounts. Our approach to investing is top-down and takes account of global interest-rate expectations and credit-quality trends. Accounts are actively managed with a total-return or income orientation, depending on clients’ needs.

Patricia Healy, CFA

Senior Vice President of Research & Portfolio Manager

Email | Bio