As we wind down 2023’s year in bonds, the long, strange trip is ending up at the same ten-year bond yields that we started with.

The ten-year US Treasury bond closed 2022 at 3.88%, and with the last day of this year upon us, the ten-year yield stands at 3.80%. The less than 10-basis-point difference masks a rollercoaster year during 2023. After rising to 4% at the beginning of March, we saw the yield on the ten-year plunge to 3.55% by the end of March over concern about the bank crisis that involved the collapse of California-based Silicon Valley Bank and New York-based Signature Bank. The ten-year Treasury hit its low yield for the year in early April at 3.31%. The rest of the year saw an upward migration in yield, spurred on not only by continued hiking by the Fed of the federal funds rate to the current level of 5.25–5.5% but also by fairly hawkish language through the summer and fall about keeping short-term rates HIGH for LONGER.

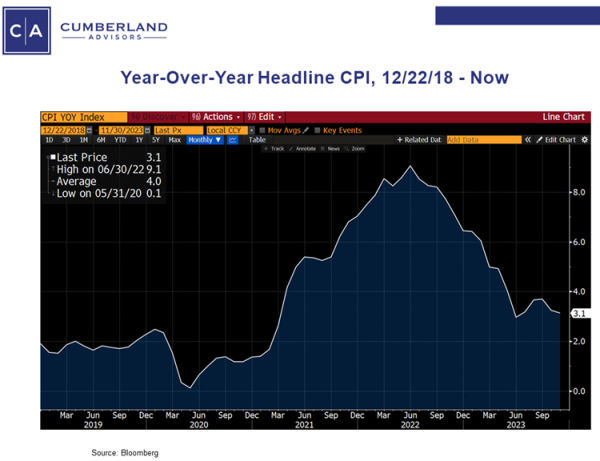

A downgrade of the United States bond rating by Fitch Ratings, as well as a heavy Treasury financing calendar put further pressure on the market. By midsummer the ten-year yield had risen to 4%, and the balance of the summer and early fall saw a migration up to 5%. As we have written in past missives, in our opinion, a lot of this weakness was fueled by FEAR of the Federal Reserve. Headline CPI continued to come down in 2023, but the flattening out of this progress helped to spook the bond market this fall, as this was accompanied by some stronger than anticipated job numbers.

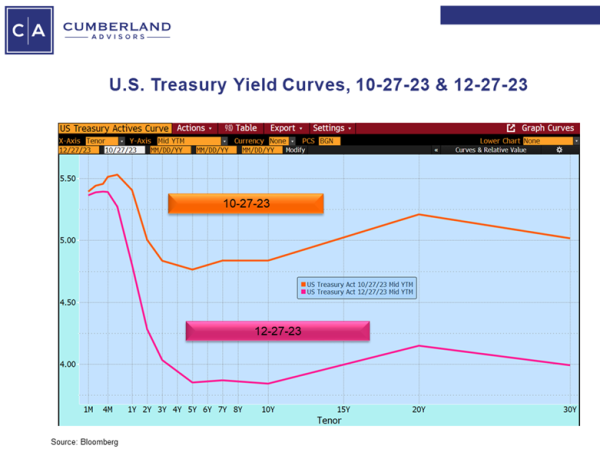

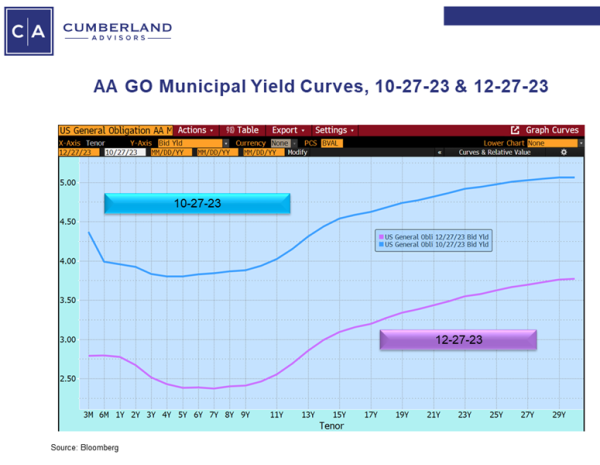

The turnaround in the bond market began in late October after the ten-year yield pierced the 5% ceiling. In addition, longer tax-free yields rose significantly in the fall, moving from 4.5% to almost 5.25% by mid-October. This was not from bond fund liquidations as much as from very large amounts of new issuance that was priced very cheaply by the underwriting community. As was the case in November of 2022, the 5% tax-free threshold did not stay around long.

The great bond market rebound for the end of 2023 began in earnest in early November with a downward surprise in the non-farm payroll numbers for October. This came after some less-harsh language by the Fed, which kept interest rates at the current levels but noted some “moderation” in the economy. The change in tone in the bond market was seismic as the orientation turned from “high for longer” to “when will the Fed cut short-term rates?” This change has been accompanied by a number of drops in various economic data. Philly, Chicago, Dallas Fed manufacturing, and business conditions indices continue to decline. However, CPI and PPI numbers have continued to behave. Housing indices have declined, and well-publicized company layoffs (e.g., Maersk, Hasbro) continue to hit the headlines.

So, since late October the ten-year US Treasury has moved from over 5% to 3.90% and the long tax-free, high-grade muni yield has moved from nearly 5.25% to just over 4%. It has been a breathtaking move. Below we show both the US Treasury yield curve on October 27th and now, as well as the AA tax-free municipal bond yield curve. As you can see, the changes are dramatic.

As we move into 2024, it is pretty evident that the bond market has done an about-face and forward marched from “high for longer” on short-term rates to discounting Federal Reserve rate cuts next year ranging from 75 to 150 basis points. We think the longer end of the bond market can move lower in yield over the next year, but we have already had a sizeable move. We will expect some reversion to the mean and choppiness in yields at the start of the year. Either inflation or the economy will have to continue to slow to move the Fed into cutting mode. But the narrative has clearly turned.

We wish all our readers an incredibly happy 2024, and as always, we welcome any questions. Happy New Year.

John R. Mousseau, CFA

Chief Executive Officer, & Director of Fixed Income

Email | Bio

Links to other websites or electronic media controlled or offered by Third-Parties (non-affiliates of Cumberland Advisors) are provided only as a reference and courtesy to our users. Cumberland Advisors has no control over such websites, does not recommend or endorse any opinions, ideas, products, information, or content of such sites, and makes no warranties as to the accuracy, completeness, reliability or suitability of their content. Cumberland Advisors hereby disclaims liability for any information, materials, products or services posted or offered at any of the Third-Party websites. The Third-Party may have a privacy and/or security policy different from that of Cumberland Advisors. Therefore, please refer to the specific privacy and security policies of the Third-Party when accessing their websites.

Cumberland Advisors Market Commentaries offer insights and analysis on upcoming, important economic issues that potentially impact global financial markets. Our team shares their thinking on global economic developments, market news and other factors that often influence investment opportunities and strategies.