The Fed has decided. The political outcomes gain temporary clarity (not all, but most). 2022 earnings reports are coming in mid-January (JPM is Jan. 13). So, what happens next?

We thank Tom Essaye for granting permission to use a chart from the November 10 edition of his daily newsletter Sevens Report (https://sevensreport.com/market-multiple-levels-sp-500-chart-16/). Tom wrote about scenarios and created this three-possibility visual metric. We like the way Tom’s chart captured the concept. Readers may plug in their own numbers and do their own calculations.

Tom’s point is clearly articulated in his newsletter. There are ranges and scenarios. We do not know which scenario will occur. The only thing we know about the stock market in 2023 is that the outcomes are wide-ranging and the results are uncertain. We’re two months away from earnings expectations with some confidence (maybe).

As we have written many times, there is a difference between uncertainty and risk. Risk analysis has methods to assign probabilities of outcomes. Uncertainty means the risk probabilities cannot be estimated with high confidence. We are presently facing uncertainty.

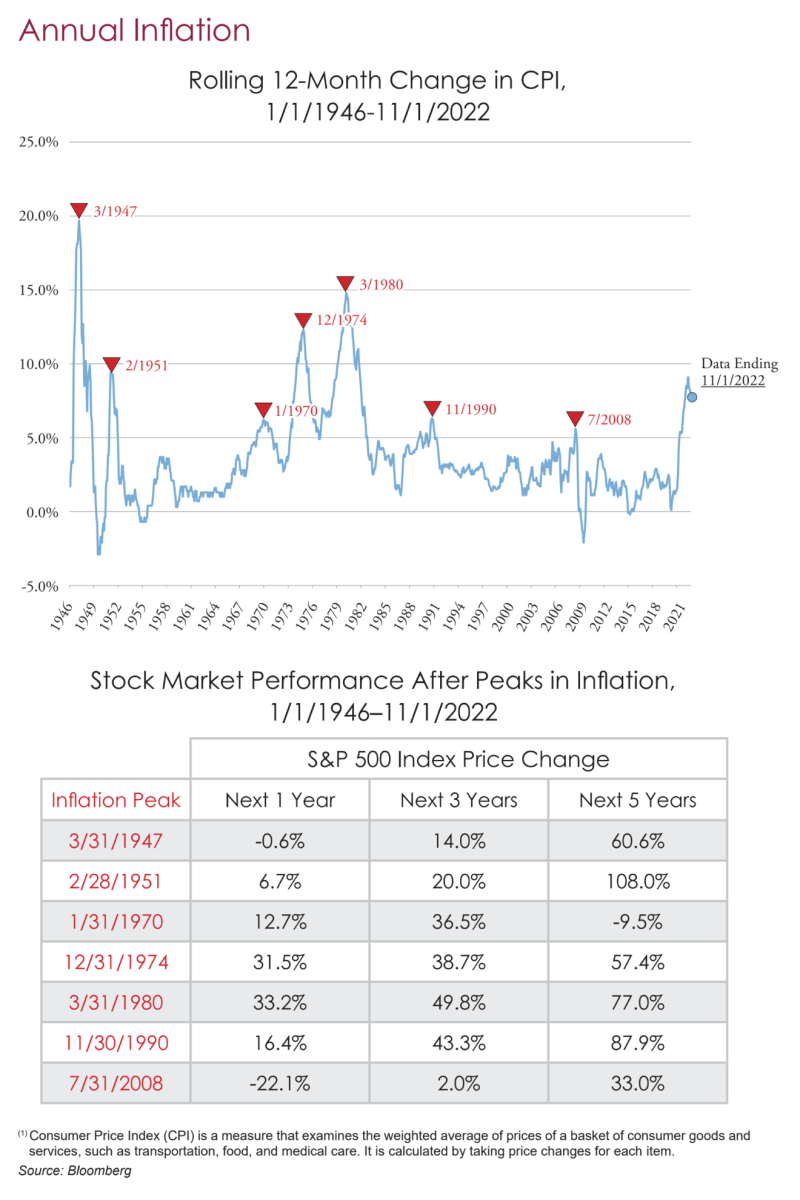

Let’s segue to the inflation and stock market pricing dilemma. We thank Ben Stevens of AMG Funds for permission to use a chart that has compared the peaking in the CPI with the stock market outcomes following that peak. The series has examined the history since the end of World War Two. The chart, titled “What Happens When Inflation Peaks,” appeared in Renaissance Investment Management’s November 2022 Market Update. Note that since this chart was prepared we have had an additional data point and it continues the ”rolling over” trend.

The conclusion is that a peaking of inflation without a serious recession leads to a bullish stock market for the period following the CPI’s peaking. BUT, there are a couple of prominent exceptions.

The ultimate issue comes down to whether or not there will be a serious recession. If you think the answer is yes, then you see the recent stock market rally from the lows as a rally in a bear market and expect that more damage lies ahead and lower stock prices are in the 2023 future timeframe. If you think the outcome of Fed policy is a “soft landing” or a mild and short-lived recession, then you can trade this market as if a bull phase has commenced and the market lows have been seen for this cycle. Turn on financial radio or television, and you will hear and see many opinions scattered across a wide range. Some of them are offered with robust conviction. I’m scheduled for Bloomberg radio on December 27th at 6 PM eastern time. Please tune in.

Today, my personal view is that we do not know yet and cannot yet know. The uncertainty we described above means that probabilities of the recession-severity outcome are very difficult to derive in the current environment of an expanding regional shooting war in Europe, a worldwide financial sanctions and payments war, disruptive culture-war politics in a divided US government, growing internal security concerns (electrical grid vulnerability is a good example), and a medical health sector that is hampered by labor shortages and therefore not able to deliver the services we have taken for granted for decades. Now that the political culture war has reached into the public health system so deeply as to discourage new entrants into the healthcare professions, we are experiencing the outcomes in negative ways. Remember that healthcare is 17–18% of the GDP of the United States. It might be higher if trained people could be found and hired to fill the vacant positions.

Now to an exception to the chart series above.

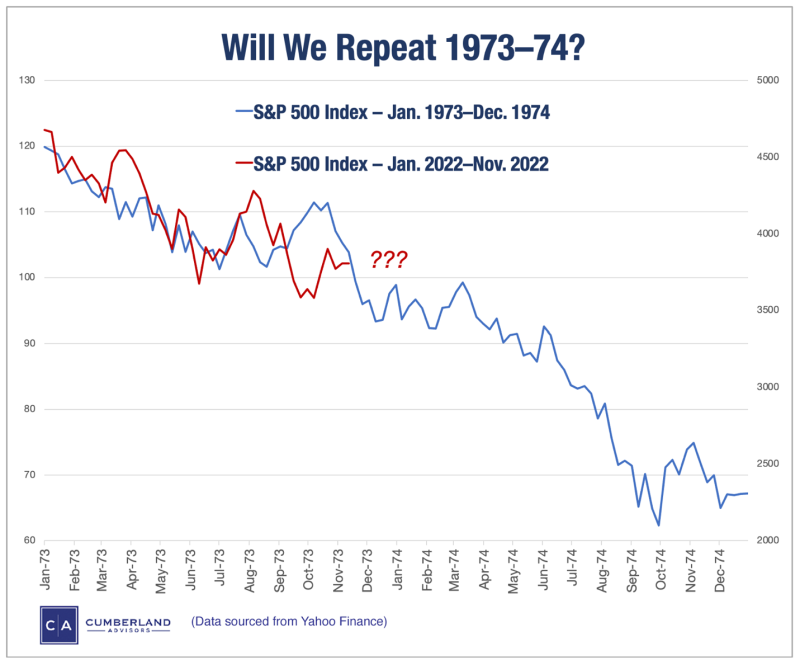

We've talked about inflation and markets and about earnings and recession risk. So, here’s what’s worrying me as I look at the history: 1973–1974.

I remember that period well. Cumberland Advisors was founded in 1973. My founding partner, Shep Goldberg (now deceased), and I were busily creating our new investment advisory firm 50 years ago. That's right: 2023 is Cumberland's jubilee year.

Here's what we encountered.

Markets had recovered from the 1969–1970 bear market. Inflation was a mild concern but was starting to worry some of us. Then, in the summer of 1973, Egyptian president, Gamal Abdel Nassar, closed the Straits of Tiran on the Red Sea and started a cascade of events which led to the Yom Kippur War and the Saudi-led Arab oil embargo and a quadrupling of the price of oil. All that happened in the first two years of Cumberland's existence.

In the 1973–1974 bear market, stocks lost about half of their value from peak to trough. Interest rates spiked higher and higher and reached the highest levels seen since the American Civil War. Inflation exploded higher. The US economy and other parts of the world entered a recession, and it deepened and deepened. The Federal Reserve under Arthur Burns was trying to deal with inflation spiking, recession worsening, and global geopolitical shocks all at the same time.

The first year and a half of money management at the new Cumberland Advisors was a trial by fire. Clients didn't want to do anything. They were terrified. The economic outlook was bleak. The headlines were awful. But markets bottomed at the end of 1974, and a bull market ensued. I remember it well — Cumberland participated in that bull market.

Over the last half century, I have learned that the cliché about history is accurate: "History never repeats itself, but it often rhymes." (That sentiment is most often attributed to Mark Twain, but it seems that a psychoanalyst named Theodor Reik proves a likelier source. See https://quoteinvestigator.com/2014/01/12/history-rhymes/.) Studying history is one of the greatest value-added propositions an investment advisor can utilize, in my opinion.

Today, nearly every one under 40 in the financial profession has little personal knowledge and experience with rising inflation and rising interest rates and geopolitical shocks. Some may have studied prior periods in a book or a college course. But they weren't adults when the rubber was hitting the road.

Those of us who have been around and are still here and have what we hope to be functioning memory see things differently. I'm one of those. I have some colleagues at Cumberland who also qualify for membership in the Old Fossil Club. And our job is to remind the "kids" at Cumberland that history is to be respected.

Here's my final take. We don't know if what lies ahead will indeed rhyme and if 1973–1974 is the metaphor to guide us. We explained why above. What we do know is that uncertainty abounds. Here's our reference so far:

As Cumberland's US Equity ETF accounts wrap up 2022, they end the year with a cash reserve. They are not fully invested. They are overweight the aerospace-defense sector, the healthcare sector, and the alternate energy sector with sensitivity for climate change-induced activities.

The only thing we know about 2023 is that it will arrive. And of particular worry for me is the deadlocked, divided culture war that is disrupting the government of the United States, its political subdivisions, the system of education, and the nation’s healthcare.

Please note that the cash position and the portfolio changes may occur at any time. We hope readers have a safe happy holiday and new year.

David R. Kotok

Chairman & Chief Investment Officer

Email | Bio

Links to other websites or electronic media controlled or offered by Third-Parties (non-affiliates of Cumberland Advisors) are provided only as a reference and courtesy to our users. Cumberland Advisors has no control over such websites, does not recommend or endorse any opinions, ideas, products, information, or content of such sites, and makes no warranties as to the accuracy, completeness, reliability or suitability of their content. Cumberland Advisors hereby disclaims liability for any information, materials, products or services posted or offered at any of the Third-Party websites. The Third-Party may have a privacy and/or security policy different from that of Cumberland Advisors. Therefore, please refer to the specific privacy and security policies of the Third-Party when accessing their websites.

Cumberland Advisors Market Commentaries offer insights and analysis on upcoming, important economic issues that potentially impact global financial markets. Our team shares their thinking on global economic developments, market news and other factors that often influence investment opportunities and strategies.