Moody’s Investors’ Services downgraded United States debt from Aaa to Aa1 last week, on May 16th (Moody’s has rated US debt Aaa since 1919). While these days you can’t say anything is a certainty, we certainly would not characterize the downgrade as a surprise. This follows the downgrade by Fitch Ratings from AAA to AA+ on August 1, 2023, and more importantly, the downgrade by Standard & Poor’s from AAA to AA+ almost 14 years ago, on August 5, 2011. Market reactions have differed greatly.

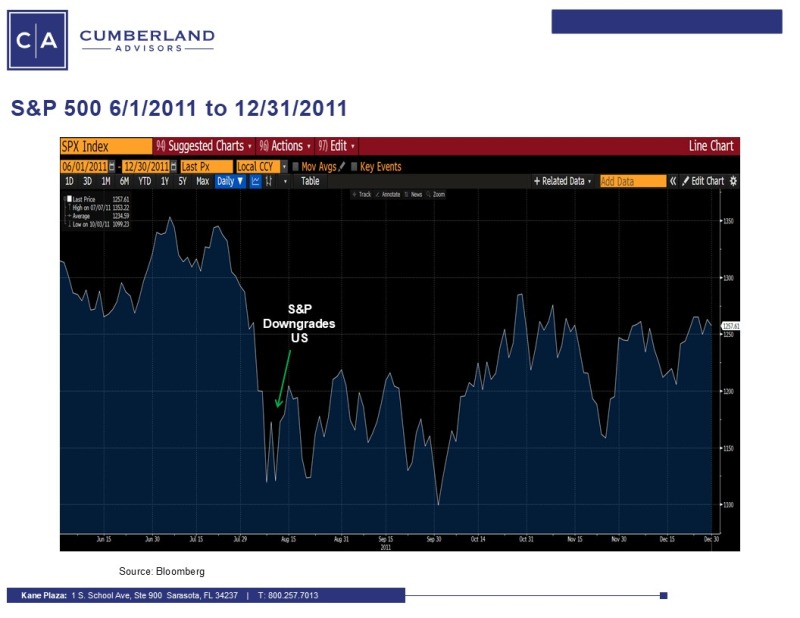

The first two charts below show the change in the ten-year US Treasury yield and the S&P 500 when the markets opened on Monday August 7, 2011. You can see the rush to US Treasuries, with the yield on the ten-year treasury dropping from 2.56% on the Friday before the downgrade to 2.32% on close of business Monday August 8th (this would approximate to a 40-basis-point change today). The ten-year yield continued to decline, with a close of 1.7% in early October before it stayed in a 40-basis-point range before closing the year at 1.88 %. Normally, when a credit is downgraded, yields rise at the margin and prices drop (relative to other bonds). In August 2011 the reaction was counterintuitive. Yields fell sharply, as the US was still considered the safe haven and the sentiment towards Congress was that it was dysfunctional and unable to agree on a fiscal path. Therefore, the markets reached for the world’s most liquid asset (which had been downgraded). Risk off was prevalent in the stock markets as well. The S&P 500 dropped 6.7% on that Monday, August 8th, and by early October was down 8.4% from the pre-downgrade level. However, soon after, the stock market began to rise, buoyed by a Federal Reserve which gave forward guidance that they would keep interest rates low. The S&P 500 finished the year +4.8% from the pre-downgrade level. Clearly, investor expectations mattered and the Fed policy did as well, as there was no logical alternative at the time to US Treasuries as a safe haven. This kept bond yields low and helped equities recover.

What about this time?

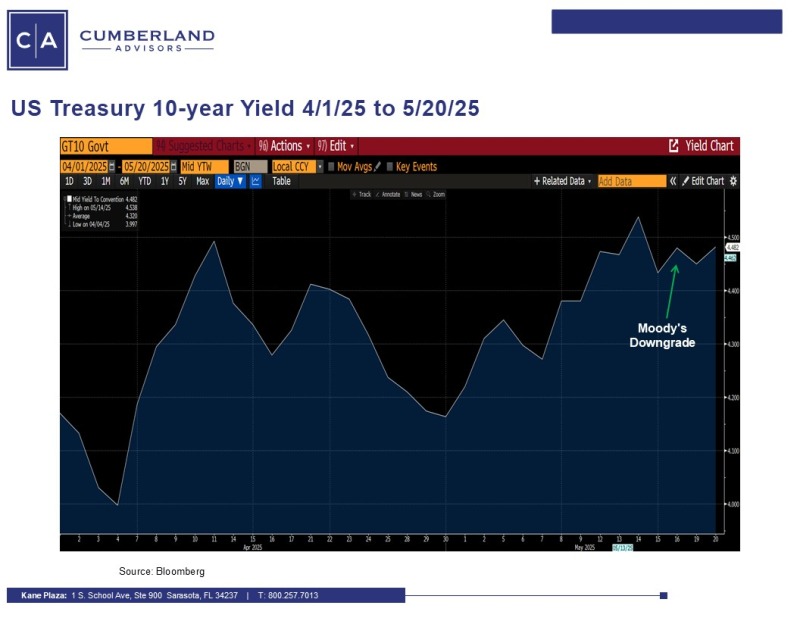

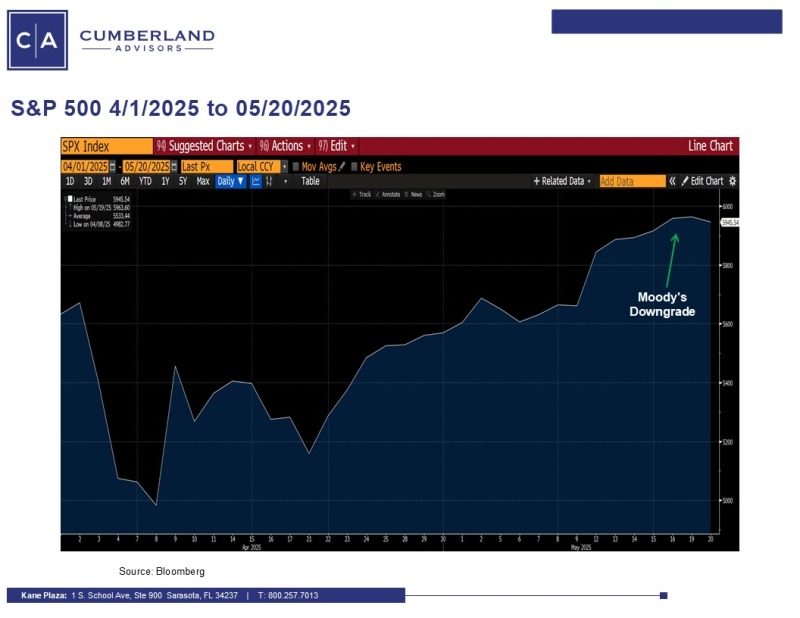

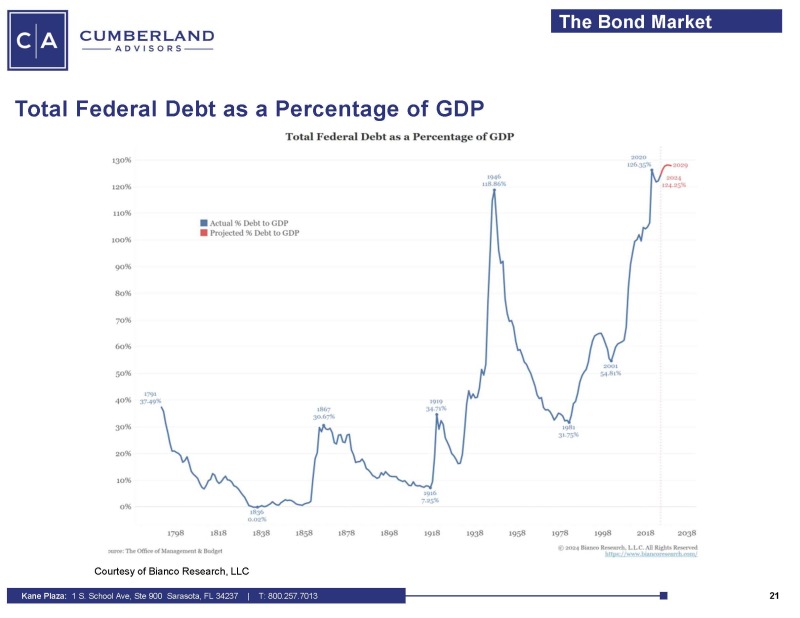

Market reactions were much more muted and different from fourteen years ago. The ten-year Treasury bond jumped in yield from a May 16th close of 4.48% to 4.56%. The S&P 500 has had a similar yawn, with Monday showing a rise of less than 1/10% and now down as of Tuesday about 0.8% from Friday’s pre-downgrade close. Why the muted reactions? Well, as with any other such events, the reaction to the first event – in this case, the S&P downgrade in 2011 – produces sharp movements in markets. The subsequent downgrades, by Fitch Ratings in 2023 and Moody’s last week, have diminishing effects. Moreover, it seems the US has come to live with a Congress and Administration that have turned a deaf ear towards deficits. The following chart (thanks to our friends at Bianco Research) shows the US debt as a % of GDP. It’s only been this high during wartime. And the current budget negotiations, as well as tariff discussions, seem to have weighed on investor’s minds as potentially bringing larger deficits and possibly higher inflation, respectively. There are now other robust markets for sovereign debt, such as Germany and Japan, so the US Treasury as the world’s safe haven has not been abandoned, but it has company.

The weeks ahead will be telling as Congress grapples with a budget as well as with tariff negotiations. Our thoughts are that the volatility witnessed in the markets will not be as much as in March and April, when both bond and stock markets were buffeted by tariff talks and Jay Powell’s discussions. The economy should be the telling event.

John R. Mousseau, CFA

Vice Chairman | Chief Investment Officer

Email | Bio

Sign up for our Market Commentaries

Cumberland Advisors Market Commentaries offer insights and analysis on upcoming, important economic issues that potentially impact global financial markets. Our team shares their thinking on global economic developments, market news and other factors that often influence investment opportunities and strategies.

Links to other websites or electronic media controlled or offered by Third-Parties (non-affiliates of Cumberland Advisors) are provided only as a reference and courtesy to our users. Cumberland Advisors has no control over such websites, does not recommend or endorse any opinions, ideas, products, information, or content of such sites, and makes no warranties as to the accuracy, completeness, reliability or suitability of their content. Cumberland Advisors hereby disclaims liability for any information, materials, products or services posted or offered at any of the Third-Party websites. The Third-Party may have a privacy and/or security policy different from that of Cumberland Advisors. Therefore, please refer to the specific privacy and security policies of the Third-Party when accessing their websites.