On June 25, the ad in the Summit County, CO, job listings read, “Line Cooks at Dillon Dam Brewery in DILLON • Line Cooks Day & Night Shifts • $19/Hour + $250 Signing Bonus • $250 Bonus at Successful 60 Day Review • 40 Hours” (Summit Daily email newsletter, June 25, 2021, https://www.summitdaily.com)

Anybody remember all the brouhaha about the minimum wage going up to $15 an hour over three or four years? Remember all those forecasts of economic collapse and disaster? Does anyone hear about them now?

And remember all the noise about all those foreigners taking all those American jobs from Americans?

After only a couple of years of border closings and worker migration suppression, we now witness 9 million unfilled job openings, and the number is growing. Markets are clearing jobs at well above the $15/hour target minimum wage, and that has happened a few years earlier than expected.

In addition, we have a two-year drop in American life expectancy, 1 million excess deaths, and 3.5 million long-haul COVID disabled. Is it any wonder why labor costs are rising and there are not enough people to fill the job openings. It’s not about unemployment benefits; see South Dakota example below.

Many critics are haranguing the Fed about wages rising and labor costs accelerating. Harangue your Congressperson, not the Fed. Senators and House Members made the labor cost mess, not the Fed. If interest rates were two points higher, do you really believe the unfilled job openings would magically be filled? The Fed has no cooking skills for the Dillon Dam Brewery.

We expect continued growth in labor force income. That income will become spending. The country is short 10 million people of working age and inclination. Unless politicians who made policy over the last few years alter their views (not likely), tight labor markets and rising labor costs are destined to continue.

Solution: Reverse the damage done and admit foreigners who want to work. They will fill some of the unfilled jobs and will pay taxes because they don’t want to lose their green cards.

Here are a few reports we’re seeing around the country:

“To continue to boost staffing, NCH is offering sign-on bonuses ranging from $500 to $20,000. Inpatient acute care RNs (bedside), night shift, is such a position offering $20,000.”

(“Florida, Georgia health systems offering nurse sign-on bonuses,” https://www.beckershospitalreview.com/compensation-issues/florida-georgia-health-systems-offering-nurse-sign-on-bonuses.html)

“As lifeguards have become harder to recruit and housing costs have skyrocketed, town officials argue the outsize spending was necessary to keep the summer season alive.”

(“These 2 Jersey Shore towns couldn’t hire lifeguards, so they hiked pay to $20 an hour,” https://www.nj.com/cape-may-county/2021/05/these-2-jersey-shore-towns-couldnt-hire-lifeguards-so-they-hiked-pay-to-20-an-hour.html)

“Piqua-based baby-product company Evenflo is offering a $1,500 signing bonus. Hard Rock Casino Cincinnati is offering signing bonuses up to $4,000 for experienced table games dealers. Target has been advertising for jobs at its West Jefferson warehouse that start at $17.75 per hour….”

(“Desperate employers in Ohio luring workers with pay, perks and pizza

https://www.dispatch.com/story/business/2021/06/21/ohio-companies-wendys-evenflo-hard-rock-casino-cincinnati-worker-shortage/7691469002/)

“At Disney World, only about 33,000 of the more than 41,000 members of the Service Trades Council Union have returned to work, according to Matt Hollis, president of the union, per Bloomberg.”

(“Disney is offering $1,000 bonuses to recruits who sign up to become housekeepers and kitchen staff, amid the labor shortage,”

https://www.businessinsider.com/disney-struggles-find-workers-offering-sign-on-bonuses-labour-market-2021-6)

“Additional federal unemployment benefits provided during the pandemic are not the cause of the labor shortage, as fewer than 1,500 people in South Dakota received the extra payments.”

(“Worker shortage in South Dakota could raise wages but deter economic growth,” https://www.keloland.com/news/local-news/worker-shortage-in-south-dakota-could-raise-wages-but-deter-economic-growth/)

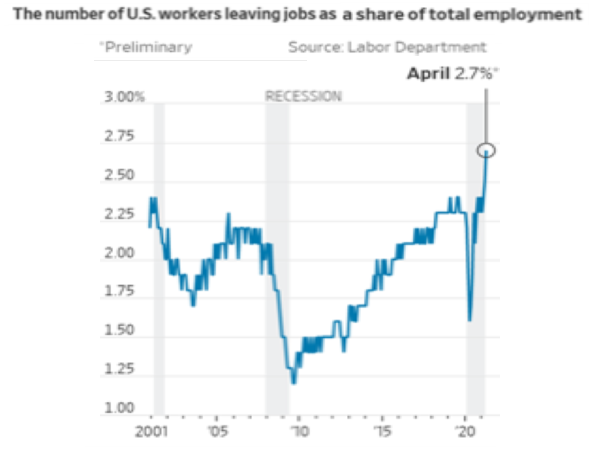

“A record 4 million people quit their jobs in April alone, according to the Labor Department.” (“As the Pandemic Recedes, Millions of Workers Are Saying ‘I Quit,’” https://www.npr.org/2021/06/24/1007914455/as-the-pandemic-recedes-millions-of-workers-are-saying-i-quit)

We’re in a robust labor force demand led recovery. Good news for businesses and investors if politicians get out of the way. We have a cash reserve in US ETF portfolio; we remain very overweight in the healthcare sector.

David R. Kotok

Chairman of the Board & Chief Investment Officer

Email | Bio

Links to other websites or electronic media controlled or offered by Third-Parties (non-affiliates of Cumberland Advisors) are provided only as a reference and courtesy to our users. Cumberland Advisors has no control over such websites, does not recommend or endorse any opinions, ideas, products, information, or content of such sites, and makes no warranties as to the accuracy, completeness, reliability or suitability of their content. Cumberland Advisors hereby disclaims liability for any information, materials, products or services posted or offered at any of the Third-Party websites. The Third-Party may have a privacy and/or security policy different from that of Cumberland Advisors. Therefore, please refer to the specific privacy and security policies of the Third-Party when accessing their websites.

Cumberland Advisors Market Commentaries offer insights and analysis on upcoming, important economic issues that potentially impact global financial markets. Our team shares their thinking on global economic developments, market news and other factors that often influence investment opportunities and strategies.