The failure of Silicon Valley Bank (SVB) along with Silvergate Bank and the Signature Bank of New York has created what is possibly an inflection point in the bond markets. We know the Federal Reserve has stepped in and backed depositors beyond the $250K limit on SVB and Signature Bank. That action was taken to prevent a cascading effect with corporate depositors not being able to meet payrolls, etc.

The effect on the fixed-income markets has been nothing short of astonishing. Treasury yields have been falling across the board since last Friday. Other high-grade bonds such as municipal bonds have seen yields fall, but not at the pace of Treasuries.

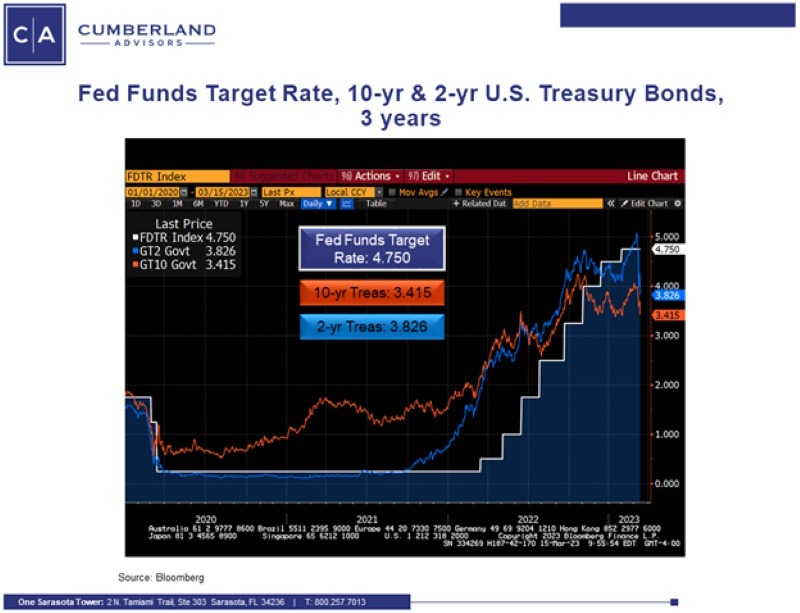

The chart below shows the fed funds target rate, the two-year US Treasury bond yield, and the ten-year US Treasury bond yield. As you can see, the dramatic drop in yields has brought the two-year Treasury bond yield from 25 basis points OVER the fed funds target rate to almost 90 basis points below the target rate.

We know that the furor was touched off by the mismatch of short-term deposits and lower-yielding longer-maturity government assets held by SVB. As tech firms needed to take deposits, the losses realized by the bank in selling their longer-term bond assets started a firestorm that resulted in a government takeover of the bank.

What does this mean going forward?

Combine the swift drop in rates in the last four days with a headline CPI number from Tuesday, March 14th, that was on target vs. expectations of 0.4% and a PPI monthly number on March 15th of -0.1% vs. expectations of +0.3%, along with retail sales for February falling 0.4%, and you have the ingredients for a possible Federal Reserve pause in the hiking of short rates. There is no question that the Fed wants to see the current turmoil in the market calm down before resuming any hiking program. Whether the Fed does raise rates will be data dependent, but all of the above amount to a brew of statistics signaling lower economic activity. This is an environment where we continue to be constructive on emphasizing intermediate to longer-term high-grade bonds in our Total Return strategy.

We will follow up with developments.

John R. Mousseau, CFA

President, Chief Executive Officer, & Director of Fixed Income

Email | Bio

Links to other websites or electronic media controlled or offered by Third-Parties (non-affiliates of Cumberland Advisors) are provided only as a reference and courtesy to our users. Cumberland Advisors has no control over such websites, does not recommend or endorse any opinions, ideas, products, information, or content of such sites, and makes no warranties as to the accuracy, completeness, reliability or suitability of their content. Cumberland Advisors hereby disclaims liability for any information, materials, products or services posted or offered at any of the Third-Party websites. The Third-Party may have a privacy and/or security policy different from that of Cumberland Advisors. Therefore, please refer to the specific privacy and security policies of the Third-Party when accessing their websites.

Cumberland Advisors Market Commentaries offer insights and analysis on upcoming, important economic issues that potentially impact global financial markets. Our team shares their thinking on global economic developments, market news and other factors that often influence investment opportunities and strategies.