As we finish the third quarter and round the turn for home in 2021, we are seeing a muni market which has shown remarkable resilience, with demand ongoing throughout the year and yield ratios to Treasuries remaining low as the market continues to expect a hike in the personal income tax rates, which will most likely rise to near 40% for incomes over $400,000.

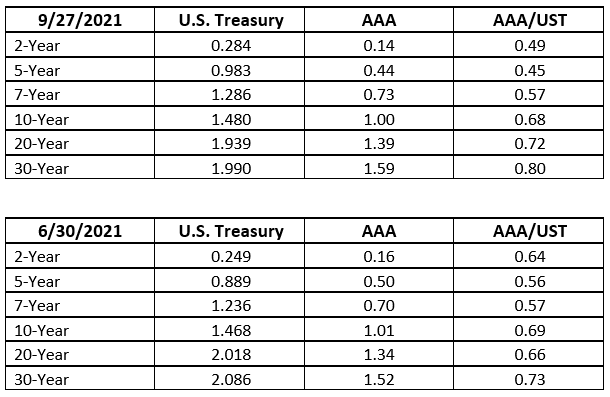

Below is a comparison AAA tax-free yields and the respective US Treasury yields. As you can see, the yield ratios are a touch cheaper than they were at the end of the second quarter but still rich by historical standards.

Source: Bloomberg

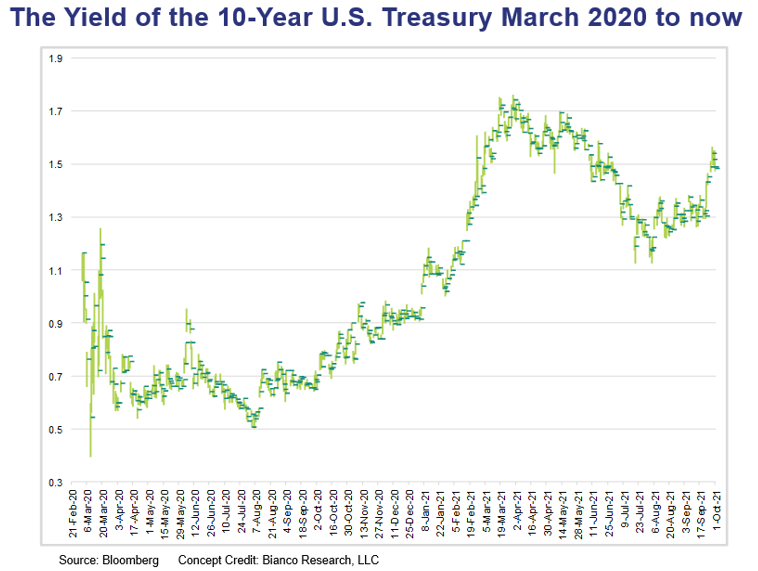

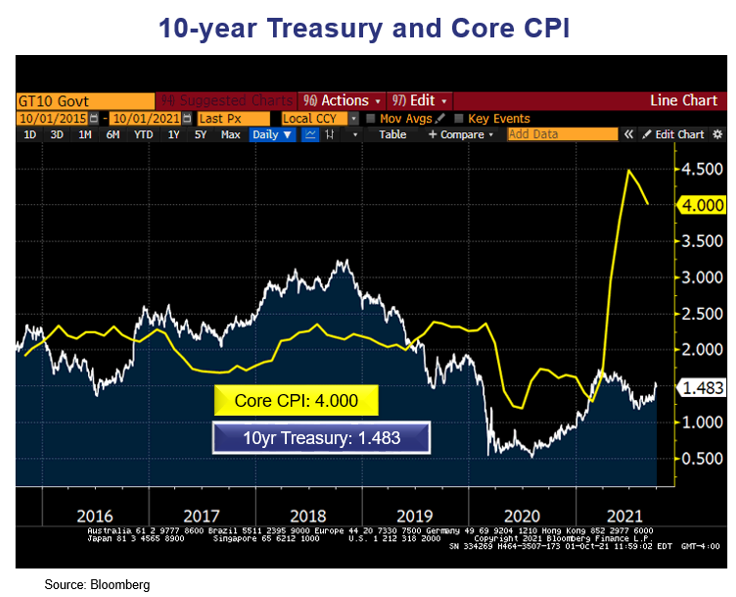

There are two other charts to reference.

One is the ten-year U.S. Treasury bond yield, which we use as a proxy for interest rates in general. The other is the difference between the ten-year bond yield and CORE inflation.

We can see that the first month of the quarter was marked by 10-year yields continuing to decline from the highs of March, which reached 1.75%. A lot of this move was in sympathy with the rise in caseloads of the Delta variant of Covid. Since early August we have seen a rise in the ten-year from the 1.20 range to the 1.50 range as we end the quarter. In our views, this reflects the peaking of the Delta variant, the Federal Reserve announcing plans to taper bond purchases, and the persistent higher levels of inflation that we are seeing.

Bond yields have moved up somewhat this month but are still a long way from trailing inflation. It is informative to note that when yields moved up in March, they provided a SLIGHTLY positive yield over inflation (REAL YIELD). That has been long gone as inflation has surged. The monthly inflation numbers are coming down off their highs of late spring/early summer, but we will be looking to see how the longer-term run rate of inflation settles in. There is no question that month-over-month inflation has surprised to the upside, and the market is wrestling with the Federal Reserve’s description of the inflation as transitory versus the market’s increasing assessment of the inflation as more persistent.

BABS, Etc.

The current efforts on Capitol Hill, centering around both the bipartisan infrastructure bill as well the possibility of another Build America Bonds program, speak toward more municipal supply, both tax-free and taxable. Please see our colleague Patty Healy’s piece on this: https://www.cumber.com/market-commentary/infrastructure-plans-muni-market-friendly-provisions.

Another issue which affects the muni market that is intertwined with the spending bill is the resumption of tax-free refundings. This would once again allow municipalities to issue tax-exempt debt to advance refund older, higher-coupon bonds to their first call date. The Tax Cuts and Jobs Act of 2017 eliminated this for municipalities. For most of 2020, beyond the peak of the pandemic, tax-free bond yields were close to taxable bond levels. That meant that municipalities could use taxable bonds for prefunding (this worked for higher-coupon tax-free bonds that were still outstanding). Now, tax free-municipal to taxable bond yield ratios are much lower, so a resumption of tax-free refunding would provide additional cost savings to municipal entities. We think this will get passed and the stated cost for this is a lot lower than estimated, in our opinion.

Also, the SALT provisions of the Tax Cuts and Jobs Act, which limited Federal tax deductions for local property taxes and state and local income taxes to $10,000, is being held hostage by several Northeastern members of Congress. They would like to see this cap removed completely and those taxes return to full deductibility. Politically we think this is a rough hurdle for the Democratic Party, as it will be portrayed as helping the wealthiest of taxpayers, though it helps plenty of middle-class taxpayers in the Northeast and California, where both property taxes and state income taxes are high.

And as we end the quarter, we would be remiss not to also include the market risk of changes at the Federal Reserve Bank. Two Federal Reserve Bank Presidents, Eric Rosengren of the Boston Federal Reserve Bank, and Robert Kaplan of the Dallas Federal Reserve Bank, have announced their retirements. In addition, there is speculation that Richard Clarida will be leaving as vice chairman of the Fed, and Fed Chairman Jay Powell has not yet been renominated by President Biden. Our point is that the Federal Reserve is losing a fair number of experienced officials, and we think the current lack of “bench strength” may be a source of consternation for the bond markets going into the fourth quarter.

John R. Mousseau, CFA

President, Chief Executive Officer, & Director of Fixed Income

Email | Bio

Links to other websites or electronic media controlled or offered by Third-Parties (non-affiliates of Cumberland Advisors) are provided only as a reference and courtesy to our users. Cumberland Advisors has no control over such websites, does not recommend or endorse any opinions, ideas, products, information, or content of such sites, and makes no warranties as to the accuracy, completeness, reliability or suitability of their content. Cumberland Advisors hereby disclaims liability for any information, materials, products or services posted or offered at any of the Third-Party websites. The Third-Party may have a privacy and/or security policy different from that of Cumberland Advisors. Therefore, please refer to the specific privacy and security policies of the Third-Party when accessing their websites.

Cumberland Advisors Market Commentaries offer insights and analysis on upcoming, important economic issues that potentially impact global financial markets. Our team shares their thinking on global economic developments, market news and other factors that often influence investment opportunities and strategies.