The increase in Delta infections put a damper on the return to normalcy in the third quarter. Areas that had seen an increase in economic activity, including transit systems and air travel, saw reductions. Healthcare systems were once again inundated with COVID patients, while the return to school was fraught with concerns about infection risks and politically divisive public health measures. As the fourth quarter begins, it appears that the Delta surge is abating, and more folks are getting vaccinated. However, pandemics generally take years to run their course, and we could yet see additional variants and spikes in infections, as well as the effects of Long COVID on the economy. We are nevertheless getting used to attending to our normal daily activities and visiting with loved ones, using precautions. In addition to the virus, global issues such as restrictions in China, developments in the Middle East, the energy transition, and supply chain disruptions may be with us for a while longer, putting a damper on growth while increasing prices and wages.

Strong investment performance

Investment returns, higher real estate values, wage growth, and stimulus funds have helped individuals maintain purchasing power and in turn have led to municipalities collecting strong income, capital gains, and sales tax revenue. In many cases results are much better than budgeted; and, combined with the stimulus funds that have yet to be spent, the windfall has led some governments to survey citizens on their preferences for how to spend the money!

Strong investment returns have improved the funded level of many pension plans and contributed to positive rating actions for some states and localities. Positive rating actions have been based not just on strong investment returns but also on better management and increased annual payments to assure that pension funding levels increase.

The substantial size of some university endowments and the strong growth they have experienced is good for university and college credit quality, but the endowments have also come into the crosshairs of Congress as a potential source of a wealth tax. We think a tax on endowments is not likely to happen, but the possibility is a concern.

Rising wealth and income levels for individuals also have Congress looking at increasing individual and corporate tax rates to pay for an expansive social infrastructure plan (“(Infrastructure Plans? Muni Market-Friendly Provisions? | Cumberland Advisors)). The fear that we will have higher taxes has contributed to good performance of municipal bonds (“Bonds Round the Corner Toward Home | Cumberland Advisors”.

State budgets — were taxes cut too much?

Strong revenue growth and stimulus funds resulted in performance by states in excess of 2021 budget expectations. This additional revenue allowed states to replenish reserves, improve pension funding, manage through the pandemic, and reduce taxes, among other actions. Most municipalities have a fiscal year end of June 30, so calendar Q3 is the first quarter of muni budget operations. Almost a third of states instituted tax rate reductions for budget year 2022, while five, including the already high tax states of NY and NJ, instituted a tax increase, according to a recent report by Fitch (“Fiscal 2022 State Tax Cuts May Complicate Budgets Longer-Term”). The link has an interactive chart towards the bottom where you can see the various actions taken by the states.

Fitch notes that US states reduced taxes to a greater extent than anticipated during this past budget season, with some of the biggest changes likely to necessitate difficult budget choices in the future.

In our Q1 credit commentary we noted that we are concerned about the unintended consequences of huge amounts of stimulus funding, which may take time to play out. The necessity of states balancing revenue and expenditures may be postponed; and when aid runs out, choices about spending priorities and raising revenues will need to be made. The thought that the federal government will continue to bail out individuals, businesses, and municipalities may entice some entities, especially political entities, to exercise less budgetary restraint.

Some states have accumulated healthy reserves, but others have not, and Fitch further notes that some states are now in a more vulnerable position should revenue growth slow and return to pre-pandemic patterns. Budget challenges, such as the rolling off of federal aid and a shift in consumer spending away from goods toward services (many of which are not taxed), are likely to curb state revenue growth over the medium term.

New York and New Jersey, already very-high-tax states, increased the income tax on the wealthiest individuals; and this increase could prompt more wealthier residents to move.

Another consideration for states is noted in a recent Moody’s report that dives into states’ need to repay funds that were borrowed from the federal government to cover unemployment needs. According to Moody’s, states owe $45 billion. On the high side, these loans are up to 20% of gross bonded debt for California and Texas. State unemployment funds are supported by payroll taxes on businesses. Moody’s notes that these taxes could put pressure on businesses just when they are trying to get back on their feet. At the same time, a number of states have used stimulus funds to pay down loans or replenish fund balances to reduce the burden on local businesses.

States need to manage a variety of constituents and the results of tax and spending decisions. Most municipalities learned from the financial crisis to prepare for outlier events by establishing strong reserves and cutting back spending. We hope that fiscal responsibility continues despite current and longer- term challenges emerging from the pandemic-induced recession.

State rating actions

Hawaii and Nevada, both states whose economies are dependent on tourism, were assigned improved outlooks during the quarter by Moody’s. New Jersey and Illinois both have long-standing issues with underfunded pensions, but both saw positive rating actions again this quarter. We’ll look at these moves in further detail and add comments on Puerto Rico.

The outlook on Nevada’s Aa1 rating was revised up to stable from negative, based on a rebounding domestic tourism industry that boosted sales and gaming taxes, Nevada’s two largest revenue sources, while significant federal aid helped the state manage through the crisis. Although Nevada drew down its rainy-day fund, reserves are budgeted to be rebuilt.

Hawaii’s outlook moved to positive from stable, reflecting a significant turnaround in the state’s economic and financial position. Restored travel from the US mainland has exceeded pre-pandemic levels and is driving strong tourist spending, although international tourism remains depressed. General fund revenue growth is budgeted at 7.9%, which is greater than in fiscal 2019, pre-pandemic. In turn, the state has continued its retiree healthcare prefunding effort, instead of deferring that investment to obtain budget savings, and has made substantial additional contributions to reserves.

Recent news on travel slowdowns caused by the Delta variant should likely reverse with reduced COVID infection levels in many places and folks readjusting their pandemic precautions. The lifting of the international travel ban will likely increase visitors to both Hawaii and Nevada as well as the rest of the US.

Meanwhile, Moody’s again acted on New Jersey’s A3 rating in July, assigning a positive outlook this quarter after a revision to stable from negative last quarter. This action reflects the state’s better-than-expected financial position and improved governance profile, which will enhance budget flexibility during the coronavirus recovery.

S&P changed its outlook to positive on New Jersey’s BBB rating, reflecting decisions made by the state on how to spend surplus revenues in fiscal years 2021 and 2022, which could position New Jersey to materially improve its long-term pension funding and other liabilities profile.

S&P upgraded the State of Illinois to BBB with a stable outlook, while just last quarter it assigned a positive outlook to the state’s BBB- rating. The upgrade reflects improved liquidity, demonstrated operational controls during the pandemic, and an improving economic condition.

Puerto Rico

There was big news on Puerto Rico developments this quarter. Puerto Rico is a commonwealth of the United States and has flirted with statehood a number of times. Essentially, the commonwealth issued a substantial amount of debt that could not be repaid because of four key factors: changes in incentives for certain businesses, costly natural disasters, an exodus of residents, and poor debt management. A specially catered, bankruptcy-type process was developed for the commonwealth. (States cannot go bankrupt and have tremendous resources, such that it is unlikely they would need to do so). The process in Puerto Rico has progressed slowly because of the diverging interests of the affected parties, including pensioners and bondholders. Other contributing factors include the large amount of debt; transparency, disclosure, and authorization issues; and the impacts of storms, earthquakes, and of course the pandemic. A plan has been released that employs a structure that has been used in sovereign debt restructurings such as Greece’s, where bondholders get securities or cash whose value is substantially below that of the original bonds. However, the securities allow for increases in payments to bondholders should revenues exceed certain levels. This provision allows the sovereign to have a debt load it can afford and manage while sharing the upside that may arise above-budget with bondholders. The plan has many moving parts to go with the different types of debt that were issued, although it appears close to approval there is still some descension.

Credit quality and default statistics

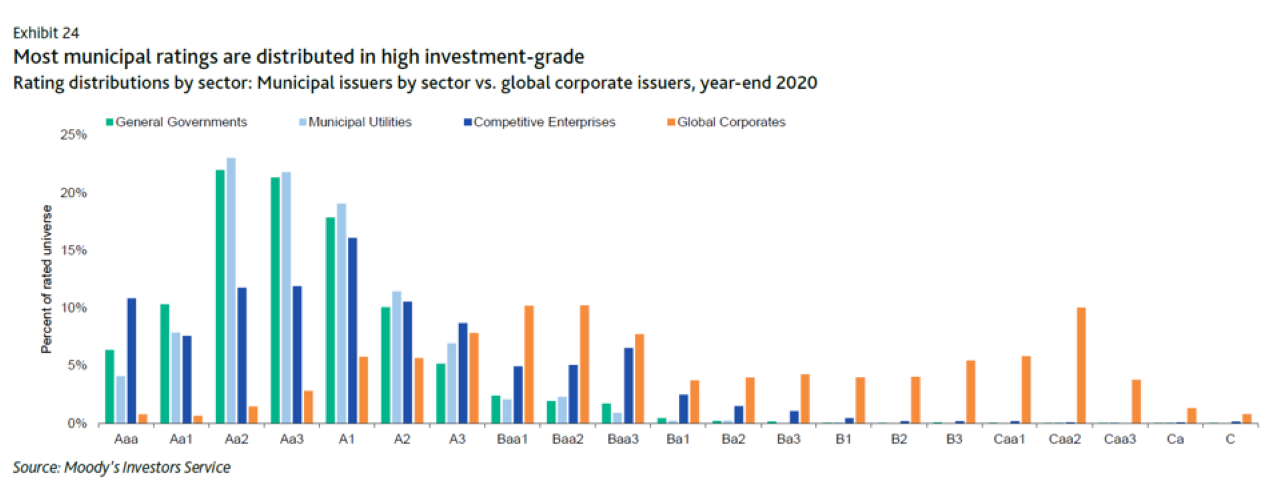

The municipal 10-year average default rate, as reported by Moody’s in their 2020 default study released in July, remains very low for all rated credits at 0.16%; and if you only consider investment-grade credits, the rate is even lower, at 0.10%. This figure compares favorably with the global corporate default rate of 10.55%. The disparity is reflected in ratings: The average municipal rating is AA, while the average corporate rating is BB+.

While ratings changes had been mostly positive for many years, the pandemic did result in more negative rating changes in 2020. S&P raised 214 muni ratings and downgraded 923. Thus downgrades sharply outpaced upgrades, but the actual percentage of downgraded ratings was not that far from the historical trend.

S&P further notes that stability has been a hallmark of US public finance ratings since 1986, and even more so when housing is excluded. At the AAA level, for example, 97.11% of ratings remain at AAA one year later, on average. Some ratings in the AA category shift down slightly in one year, but 94.46% remain in that category or move higher one year later. So, too, A, BBB, and BB ratings tend to move up more often than down within one year. Significant proportions of defaults don’t appear until the B and lower rating categories.

Both the Moody’s and S&P studies note that general-obligation bonds, other tax-backed bonds, and some utilities are generally less risky than municipal debt that carries more enterprise risk, such as local housing, higher education, healthcare, and transportation issues.

At Cumberland Advisors we continue our top-down approach to investing, looking at rates and other macro trends as well as state developments and financial operations to guide our analysis of individual credits. Our fixed-income accounts are invested mostly in high-quality munis with an average rating of AA. That includes our taxable accounts, which invest mostly in taxable muni bonds. It seems that credit quality has improved considerably since last year, so maybe upgrades will begin to outpace downgrades once again — however, that will depend on many variables, such as potentially slowing growth and/or supply chain disruptions, revenue collections above or below budget, and expense management, especially regarding pensions and other postemployment benefits.

Bond spreads, or the difference in yield between different-quality bonds and sectors, are very tight currently, since demand has been very strong and because rates are low in general; but they have widened out a bit as rates increase. Strong flows into mutual funds for the past 70 months have recently slowed from averaging over $1.2 billion for many weeks, to $408 million for the week ended September 29, to only $37 million net for the week ended October 6, 2021, according to Refinitiv Lipper US Fund Flows.

We use a barbell approach in our total-return investing, meaning that we hold both short-term and long-term bonds so that we can more easily adjust our duration (which measures sensitivity to changes in interest rates). The shorter bonds can be sold to take advantage of large outflows from mutual funds, which could reduce prices because the funds must sell bonds to honor redemptions into a market selloff.

Patricia Healy, CFA

Senior Vice President of Research & Portfolio Manager

Email | Bio

Links to other websites or electronic media controlled or offered by Third-Parties (non-affiliates of Cumberland Advisors) are provided only as a reference and courtesy to our users. Cumberland Advisors has no control over such websites, does not recommend or endorse any opinions, ideas, products, information, or content of such sites, and makes no warranties as to the accuracy, completeness, reliability or suitability of their content. Cumberland Advisors hereby disclaims liability for any information, materials, products or services posted or offered at any of the Third-Party websites. The Third-Party may have a privacy and/or security policy different from that of Cumberland Advisors. Therefore, please refer to the specific privacy and security policies of the Third-Party when accessing their websites.

Cumberland Advisors Market Commentaries offer insights and analysis on upcoming, important economic issues that potentially impact global financial markets. Our team shares their thinking on global economic developments, market news and other factors that often influence investment opportunities and strategies.